Question: This my project I'm trying to use the Macys com on yahoo finance to gather all the requested information, but I have a hard time

This my project I'm trying to use the Macys com on yahoo finance to gather all the requested information, but I have a hard time finding it.

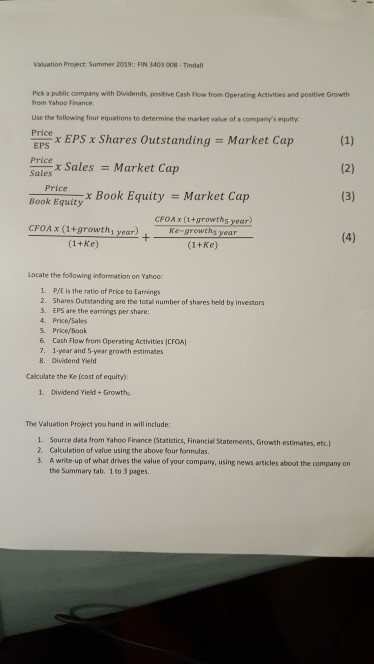

Valuation Project: Summer 2019: FIN 3403 O08-Tindall Pick a public company with Dividends, positive Cash Flow from Operating Activities and positive Growth from Yahoo Finance. Use the following four equations to determine the market value of a company's equity Price x EPS x Shares Outstanding EPS Market Cap (1) Price x Sales Sales Market Cap (2) Price x Book Equity Market Cap (3) Book Equity CFOAX (1+growths year? Ke CFOAx (1+growth, year) ths vear (4) (1+Ke) (1+Ke) Locate the following information on Yahoo 1. P/E is the ratio of Price to Earnings 2. Shares Outstanding are the total number of shares held by investors 3. EPS are the earnings per share: 4. Price/Sales S. Price/Book 6. Cash Flow from Operating Activities (CFOA 7. 1year and 5-year growth estimates 8. Dividend Yield Calculate the Ke (cost of equity) 1. Dividend Yield + Growths. The Valuation Project you hand in will include: 1. Source data from Yahoo Finance (Statistics, Financial Statements, Growth estimates, etc.J 2. Calculation of value using the above four formulas. 3. A write-up of what drives the value of your company, using news articles about the compamy on the Summary tab. 1 to 3 pages. Valuation Project: Summer 2019: FIN 3403 O08-Tindall Pick a public company with Dividends, positive Cash Flow from Operating Activities and positive Growth from Yahoo Finance. Use the following four equations to determine the market value of a company's equity Price x EPS x Shares Outstanding EPS Market Cap (1) Price x Sales Sales Market Cap (2) Price x Book Equity Market Cap (3) Book Equity CFOAX (1+growths year? Ke CFOAx (1+growth, year) ths vear (4) (1+Ke) (1+Ke) Locate the following information on Yahoo 1. P/E is the ratio of Price to Earnings 2. Shares Outstanding are the total number of shares held by investors 3. EPS are the earnings per share: 4. Price/Sales S. Price/Book 6. Cash Flow from Operating Activities (CFOA 7. 1year and 5-year growth estimates 8. Dividend Yield Calculate the Ke (cost of equity) 1. Dividend Yield + Growths. The Valuation Project you hand in will include: 1. Source data from Yahoo Finance (Statistics, Financial Statements, Growth estimates, etc.J 2. Calculation of value using the above four formulas. 3. A write-up of what drives the value of your company, using news articles about the compamy on the Summary tab. 1 to 3 pages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts