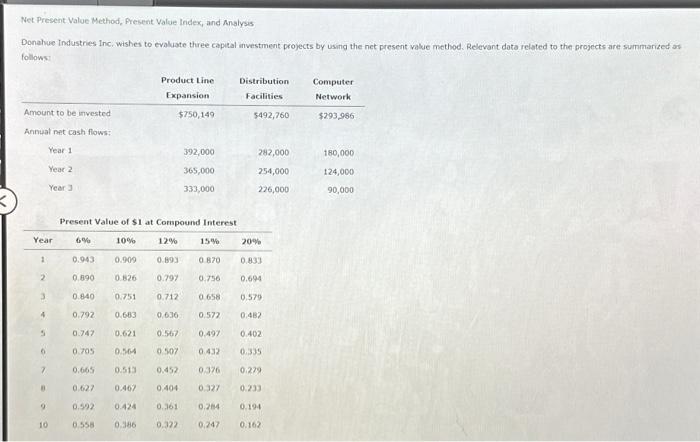

Question: this Net Present Value Method, Present Valve Index, and Analysis Donahue Industries Inc. wishes to evaluate three capital investment projects by using the net present

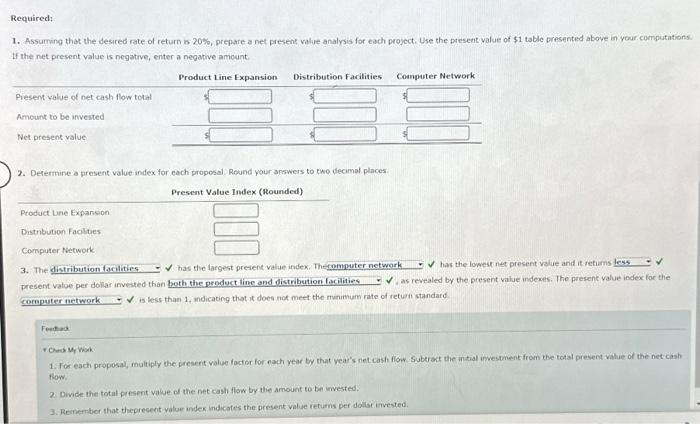

Net Present Value Method, Present Valve Index, and Analysis Donahue Industries Inc. wishes to evaluate three capital investment projects by using the net present value method. Relevant data related to the projects are surnmarized as follows Present Value of \$1 at Compound Interest 1. Assuming that the desared rate of return is 20%, prepare a net present value analysis for each project. Use the present value of $1 table presented above in your computations If the net present value is negative, enter a negative amount. 2. Determine a present value index for each proposal. Round your answers to two decimal places. 3. The : has the largest present value index. Thecomputer network has the lowest net present value and it retiums present value per dollar invested than both the product line and distribution. , as revealed by the present value indexes. The present value index lor the is less than 1 , ndicating thet it does not meet the mumum rate of return standard. Fentod roust whok: 1. For each proposal, multiply the present value factor for each year by that vear's net cash flow suberact the intial investment from the total present value of the net cash fow: 2. Divide the total present value of the net cash flow by the amount to ber invested. 3. Remernber that thepresent valur index indicates the present value returns per dollsi invested. Cones WY Wos flow 2. Bivele the total present value of the net cas, flow by the amount to be invected 1. Aemember that thepresent value index andicates the peesent value returns per dolar mpested

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts