Question: This new project will make avocado chips. It will cost $25,000,000 today for a new building and machines. We would invest in NWC equivalent of

This new project will make avocado chips. It will cost $25,000,000 today for a new building and machines. We would invest in NWC equivalent of 10% of capital expenditure cost today. We know that this project will bring in sales of $14,000,000 in the first year, growing at a rate of 25% for the first 2 years and growing at a rate of 12% for the next 4 years. We employ a MACRS 7-year depreciation scale for all CAPEX. In year-end 3, we will have to purchase $9,000,000 in new machines. Net working capital account will be 25% of sales for each year. Costs of goods sold will be 50% of sales until we get the new machines at which they will drop to 38% of sales. After year 6, we are quitting the entire project and liquidating all, we can sell the original machines for $4million and the new machines for $4million. This project is in line with a new product division that has similar risk levels to existing operations.

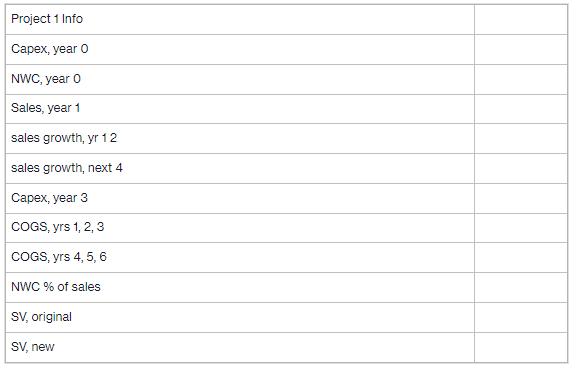

Input all information onto the table:

Project 1 Info Capex, year NWC, year 0 Sales, year 1 sales growth, yr 12 sales growth, next 4 Capex, year 3 COGS, yrs 1, 2, 3 COGS, yrs 4, 5, 6 NWC % of sales SV, original SV, new

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Sure Ive organized the information you provided into a table The table includes the project details ... View full answer

Get step-by-step solutions from verified subject matter experts