Question: this one Question 2 (25 min, 20 points) Your firm is considering three projects as follows: Initial Investment First-Year Cash Flow Growth Rate 4.0% Project

this one

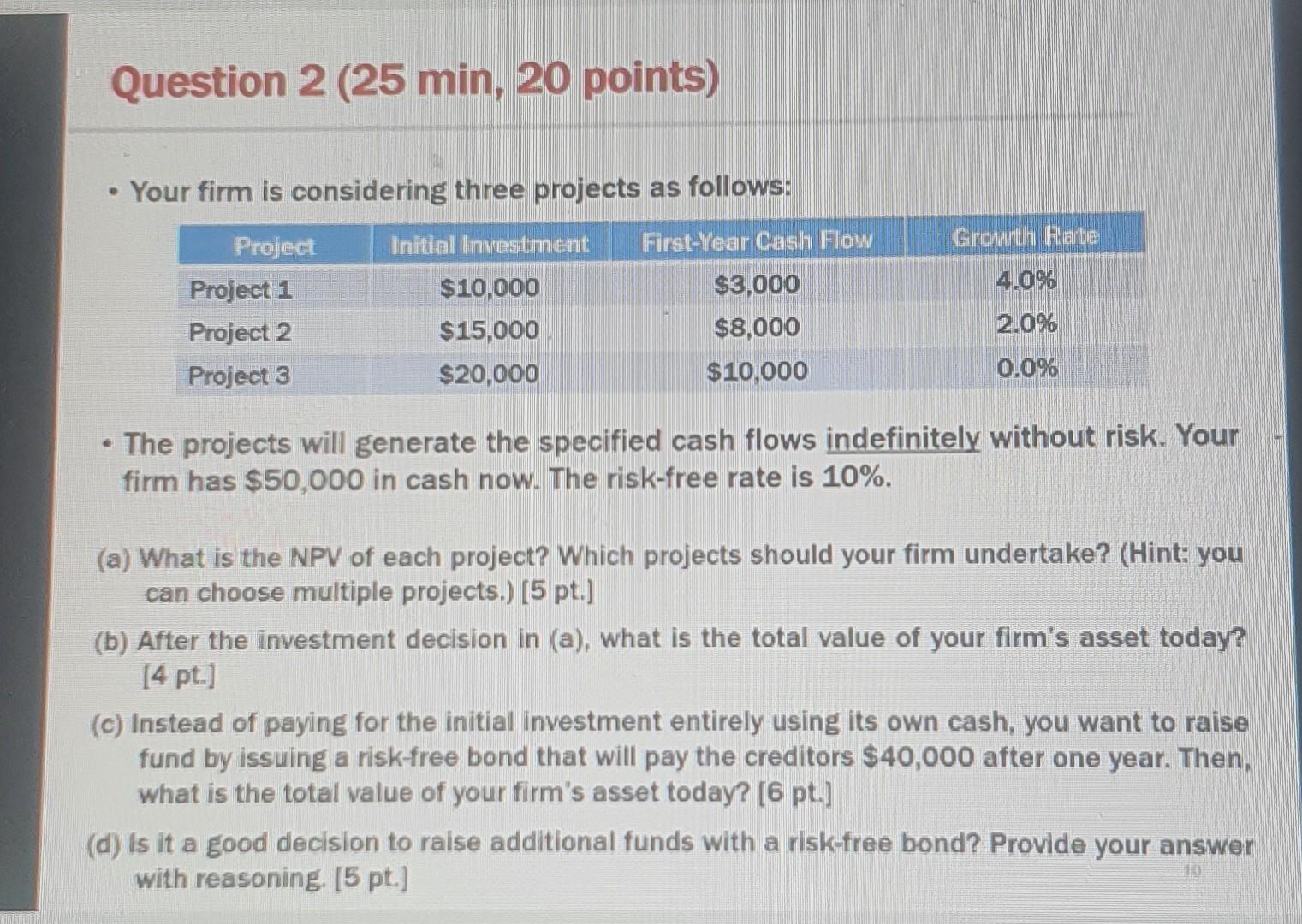

Question 2 (25 min, 20 points) Your firm is considering three projects as follows: Initial Investment First-Year Cash Flow Growth Rate 4.0% Project Project 1 Project 2 Project 3 $10,000 $15,000 $3,000 $8,000 $10.000 2.0% $20,000 0.0% e The projects will generate the specified cash flows indefinitely without risk. Your firm has $50,000 in cash now. The risk-free rate is 10%. (a) What is the NPV of each project? Which projects should your firm undertake? (Hint: you can choose multiple projects.) (5 pt.) (6) After the investment decision in (a), what is the total value of your firm's asset today? [4 pt.) (c) Instead of paying for the initial investment entirely using its own cash, you want to raise fund by issuing a risk-free bond that will pay the creditors $40,000 after one year. Then, what is the total value of your firm's asset today? [6 pt.) (d) Is it a good decision to raise additional funds with a risk-free bond? Provide your answer with reasoning. [5 pt.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts