Question: This one shows the other options from the dropdown menu The Central Valley Company is a manufacturing firm that produces and sells a single product.

This one shows the other options from the dropdown menu

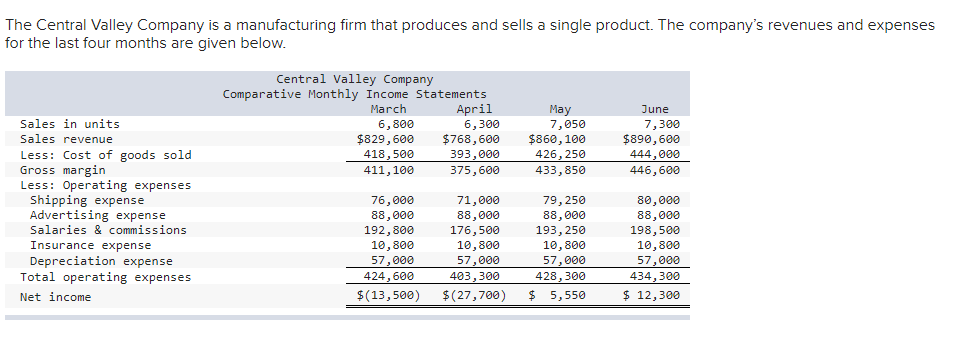

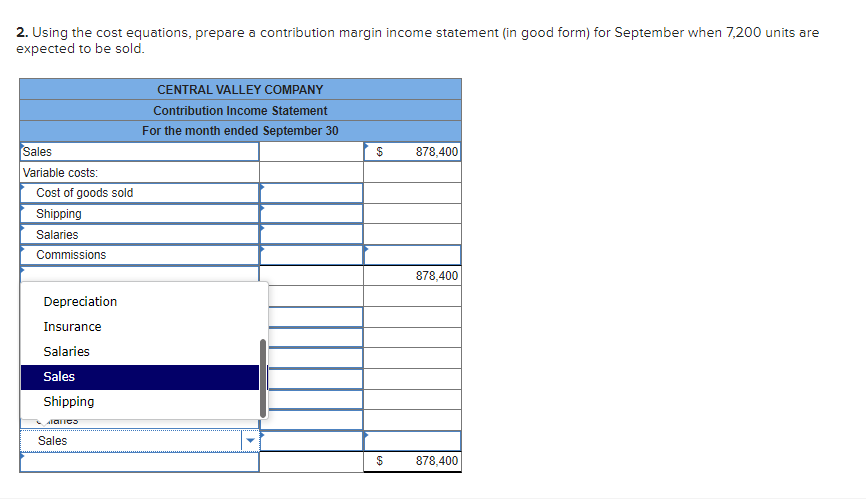

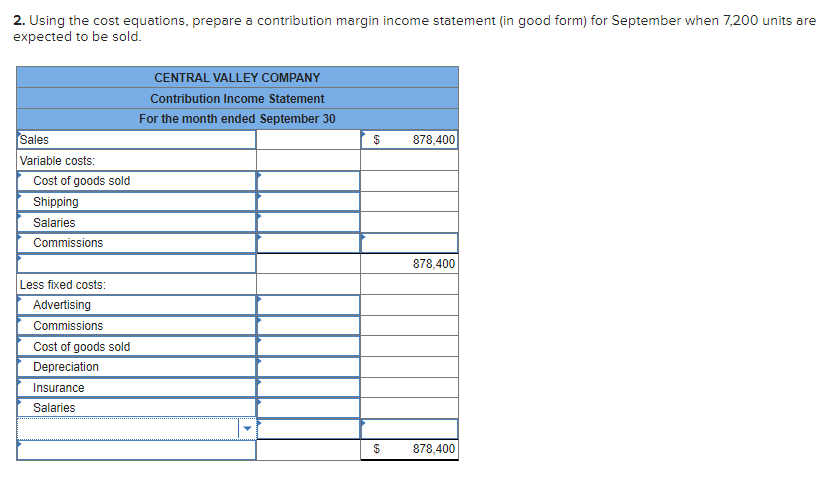

The Central Valley Company is a manufacturing firm that produces and sells a single product. The company's revenues and expenses for the last four months are given below. Central Valley Company Comparative Monthly Income Statements March April 6,800 6,300 $829,600 $768,600 418,500 393,000 411,100 375,600 May 7,050 $860, 100 426, 250 433,850 June 7,300 $890,600 444,000 446,600 Sales in units Sales revenue Less: Cost of goods sold Gross margin Less: Operating expenses Shipping expense Advertising expense Salaries & commissions Insurance expense Depreciation expense Total operating expenses Net income 76,000 88,000 192,800 10,800 57,000 424,600 $(13,500) 71,000 88,000 176,500 10,800 57,000 403,300 $(27,700) 79,250 88,000 193,250 10,800 57,000 428,300 $ 5,550 80,000 88,000 198,500 10,800 57,000 434,300 $ 12,300 2. Using the cost equations, prepare a contribution margin income statement (in good form) for September when 7,200 units are expected to be sold. CENTRAL VALLEY COMPANY Contribution Income Statement For the month ended September 30 $ 878,400 Sales Variable costs: Cost of goods sold Shipping Salaries Commissions 878,400 Depreciation Insurance Salaries Sales Shipping AGNES Sales $ 878,400 2. Using the cost equations, prepare a contribution margin income statement (in good form) for September when 7,200 units are expected to be sold. CENTRAL VALLEY COMPANY Contribution Income Statement For the month ended September 30 $ 878,400 Sales Variable costs: Cost of goods sold Shipping Salaries Commissions 878,400 Less fixed costs: Advertising Commissions Cost of goods sold Depreciation Insurance Salaries $ 878,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts