Question: This one's about bonds! Question 2: BBC has just issued a new annual coupon bond that has 5 years to maturity, a coupon rate of

This one's about bonds!

This one's about bonds!

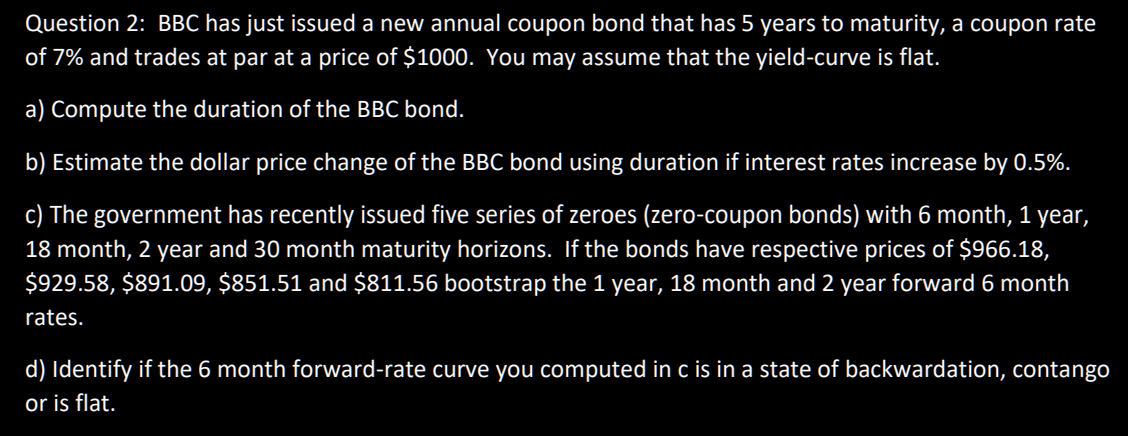

Question 2: BBC has just issued a new annual coupon bond that has 5 years to maturity, a coupon rate of 7% and trades at par at a price of $1000. You may assume that the yield-curve is flat. a) Compute the duration of the BBC bond. b) Estimate the dollar price change of the BBC bond using duration if interest rates increase by 0.5%. c) The government has recently issued five series of zeroes (zero-coupon bonds) with 6 month, 1 year, 18 month, 2 year and 30 month maturity horizons. If the bonds have respective prices of $966.18, $929.58, $891.09, $851.51 and $811.56 bootstrap the 1 year, 18 month and 2 year forward 6 month rates. d) Identify if the 6 month forward-rate curve you computed in c is in a state of backwardation, contango or is flat. Question 2: BBC has just issued a new annual coupon bond that has 5 years to maturity, a coupon rate of 7% and trades at par at a price of $1000. You may assume that the yield-curve is flat. a) Compute the duration of the BBC bond. b) Estimate the dollar price change of the BBC bond using duration if interest rates increase by 0.5%. c) The government has recently issued five series of zeroes (zero-coupon bonds) with 6 month, 1 year, 18 month, 2 year and 30 month maturity horizons. If the bonds have respective prices of $966.18, $929.58, $891.09, $851.51 and $811.56 bootstrap the 1 year, 18 month and 2 year forward 6 month rates. d) Identify if the 6 month forward-rate curve you computed in c is in a state of backwardation, contango or is flat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts