Question: This problem continues the Canyon Canoe Company situation from Chapter F:2. You will need to use the unadjusted trial balance and posted T-accounts that you

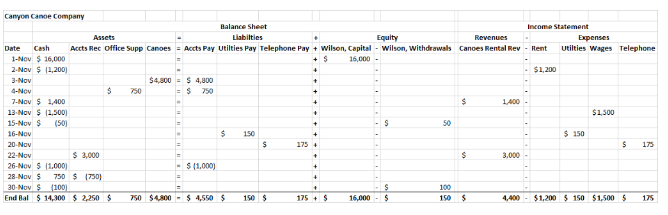

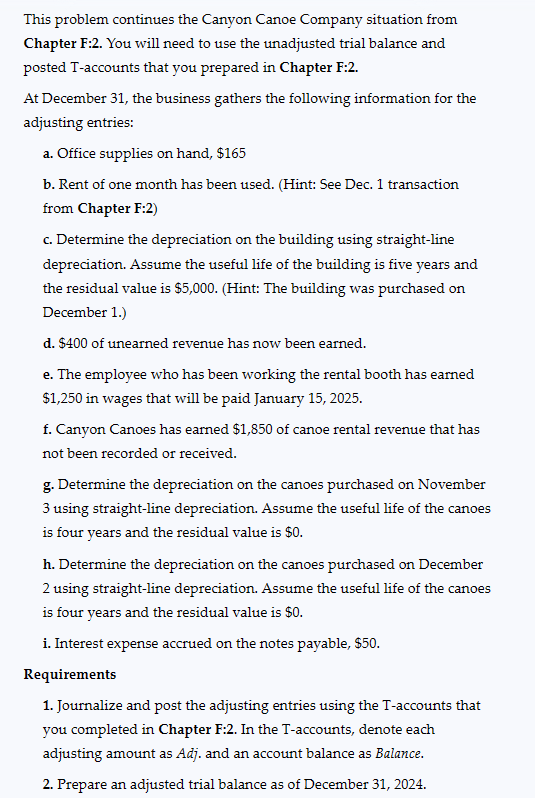

This problem continues the Canyon Canoe Company situation from Chapter F:2. You will need to use the unadjusted trial balance and posted T-accounts that you prepared in Chapter F:2. At December 31, the business gathers the following information for the adjusting entries: a. Office supplies on hand, $165 b. Rent of one month has been used. (Hint: See Dec. 1 transaction from Chapter F:2 ) c. Determine the depreciation on the building using straight-line depreciation. Assume the useful life of the building is five years and the residual value is $5,000. (Hint: The building was purchased on December 1.) d. $400 of unearned revenue has now been earned. e. The employee who has been working the rental booth has earned $1,250 in wages that will be paid January 15,2025. f. Canyon Canoes has earned $1,850 of canoe rental revenue that has not been recorded or received. g. Determine the depreciation on the canoes purchased on November 3 using straight-line depreciation. Assume the useful life of the canoes is four years and the residual value is $0. h. Determine the depreciation on the canoes purchased on December 2 using straight-line depreciation. Assume the useful life of the canoes is four years and the residual value is $0. i. Interest expense accrued on the notes payable, $50. Requirements 1. Journalize and post the adjusting entries using the T-accounts that you completed in Chapter F:2. In the T-accounts, denote each adjusting amount as Adj. and an account balance as Balance. 2. Prepare an adjusted trial balance as of December 31, 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts