Question: THIS PROBLEM HAS 3 QUESTIONS. EACH QUESTION HAS 4 POSSIBLE ANSWERS. THERE IS A DROPDOWN MENU FOR EACH QUESTION. Calculate the price of a bond

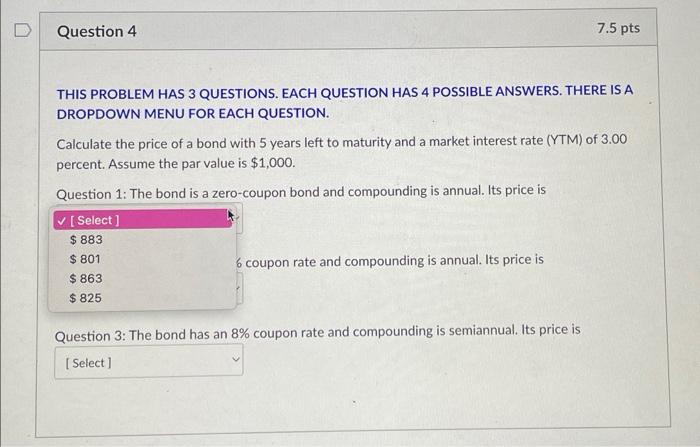

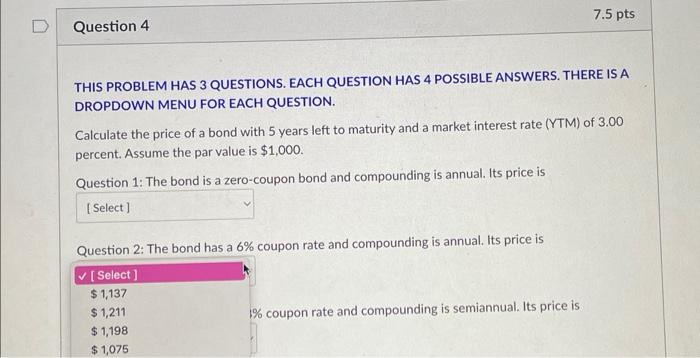

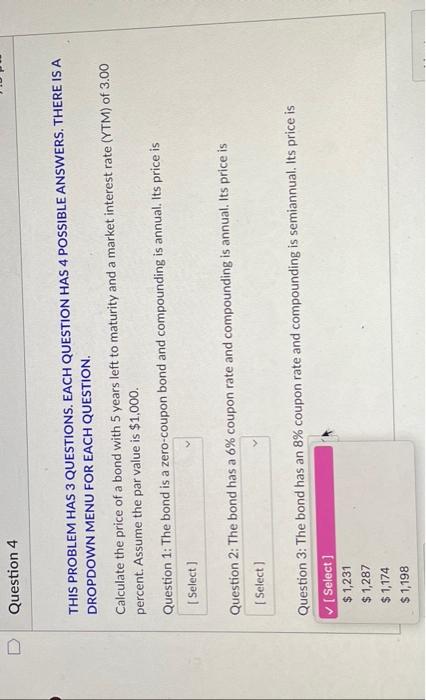

THIS PROBLEM HAS 3 QUESTIONS. EACH QUESTION HAS 4 POSSIBLE ANSWERS. THERE IS A DROPDOWN MENU FOR EACH QUESTION. Calculate the price of a bond with 5 years left to maturity and a market interest rate (YTM) of 3.00 percent. Assume the par value is $1,000. Question 1: The bond is a zero-coupon bond and compounding is annual. Its price is coupon rate and compounding is annual. Its price is Question 3: The bond has an 8% coupon rate and compounding is semiannual. Its price is THIS PROBLEM HAS 3 QUESTIONS. EACH QUESTION HAS 4 POSSIBLE ANSWERS. THERE IS A DROPDOWN MENU FOR EACH QUESTION. Calculate the price of a bond with 5 years left to maturity and a market interest rate (YTM) of 3.00 percent. Assume the par value is $1,000. Ouestion 1: The bond is a zero-coupon bond and compounding is annual. Its price is Question 2: The bond has a 6% coupon rate and compounding is annual. Its price is % coupon rate and compounding is semiannual. Its price is THIS PROBLEM HAS 3 QUESTIONS. EACH QUESTION HAS 4 POSSIBLE ANSWERS. THERE IS A DROPDOWN MENU FOR EACH QUESTION. Calculate the price of a bond with 5 years left to maturity and a market interest rate (YTM) of 3.00 percent. Assume the par value is $1,000. Question 1: The bond is a zero-coupon bond and compounding is annual. Its price is Question 2: The bond has a 6% coupon rate and compounding is annual. Its price is Question 3: The bond has an 8% coupon rate and compounding is semiannual. Its price is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts