Question: this problem has multiple parts , the first steps is to write the journal entries , there are 11 in totatal for that part ,

after the order entry do question 2, 3-a , 3-b and 4

after the order entry do question 2, 3-a , 3-b and 4

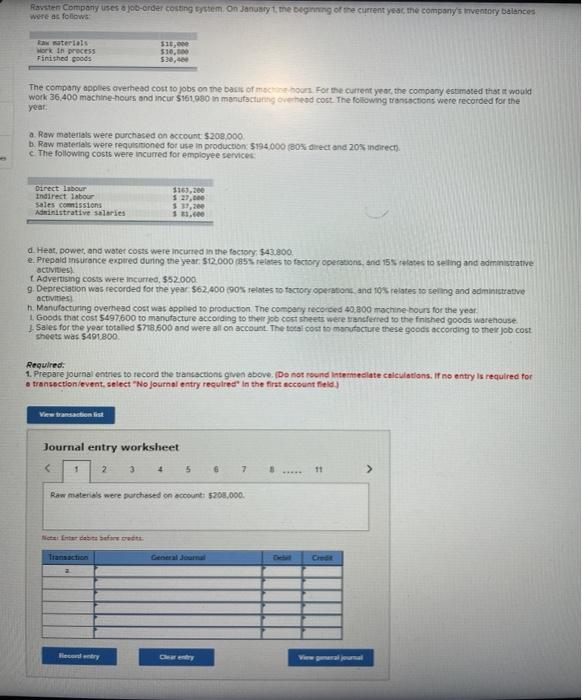

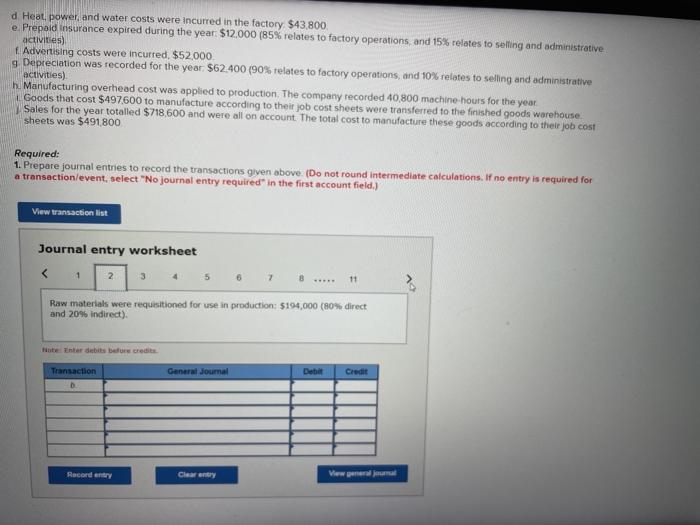

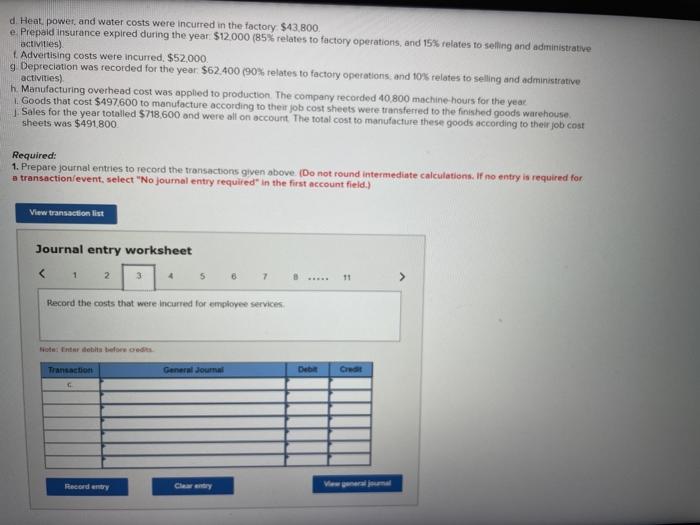

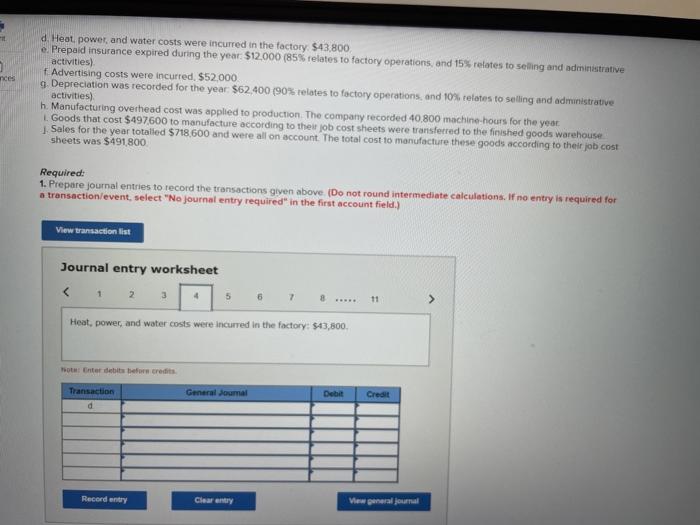

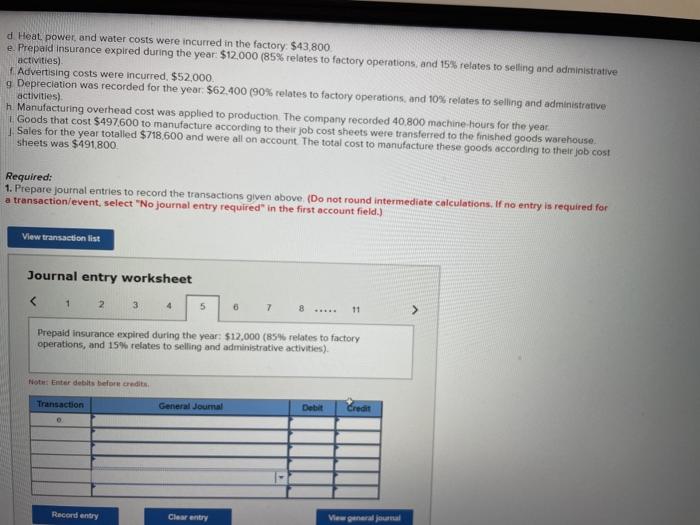

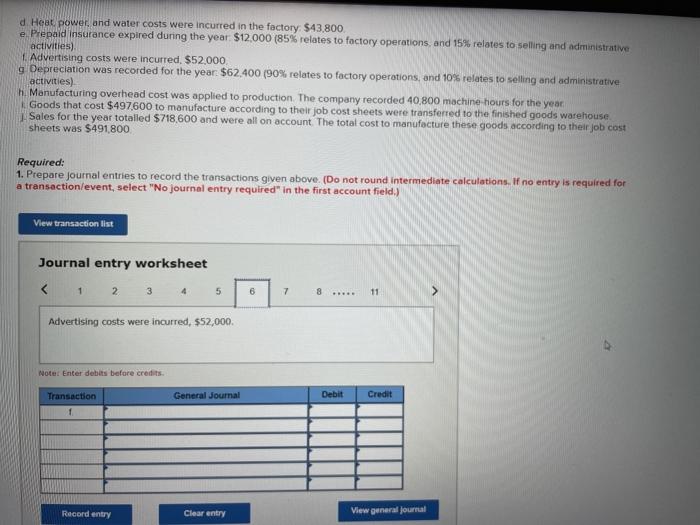

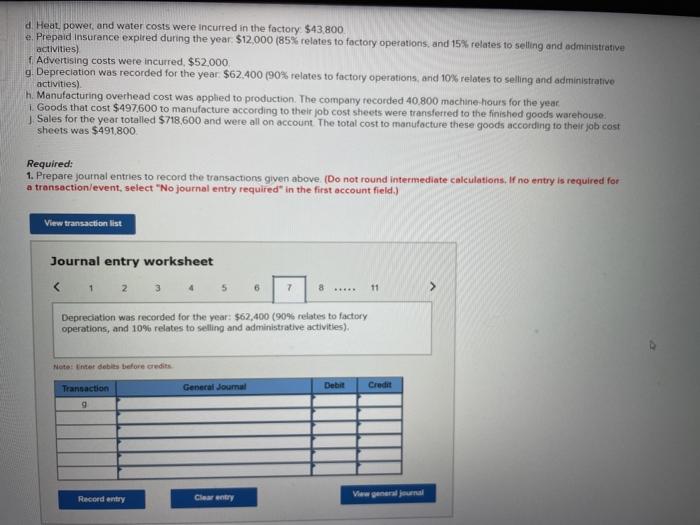

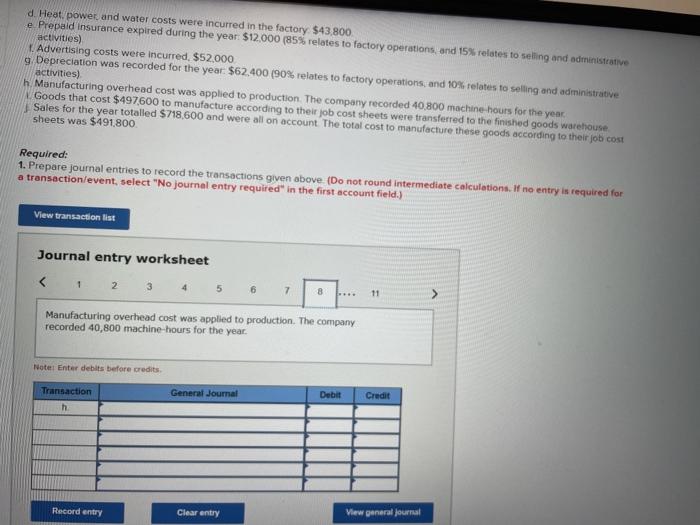

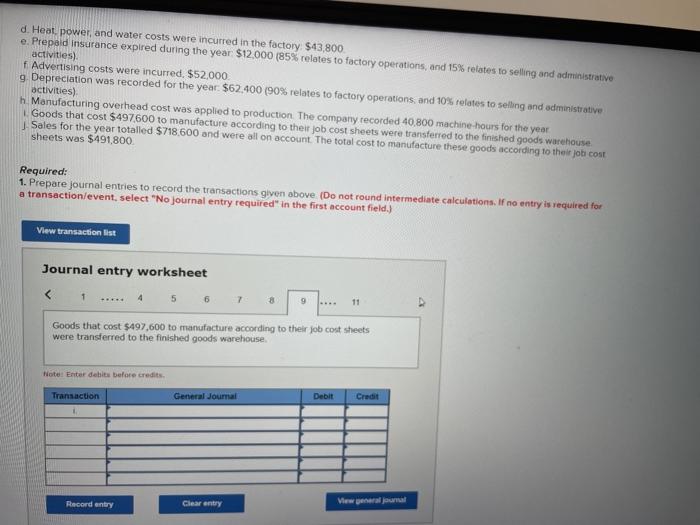

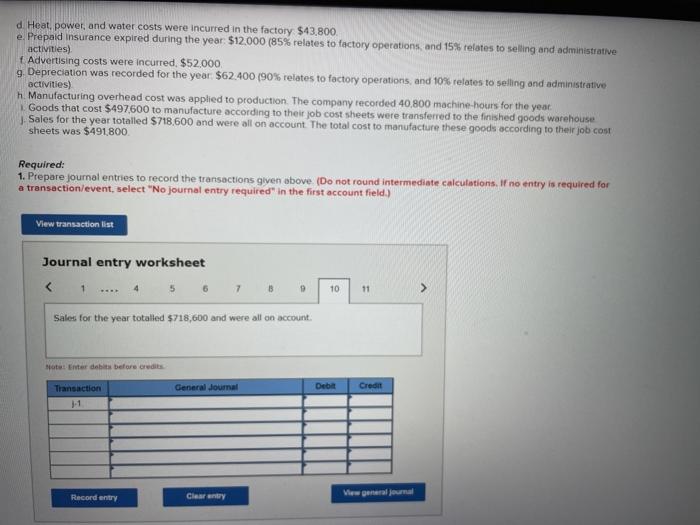

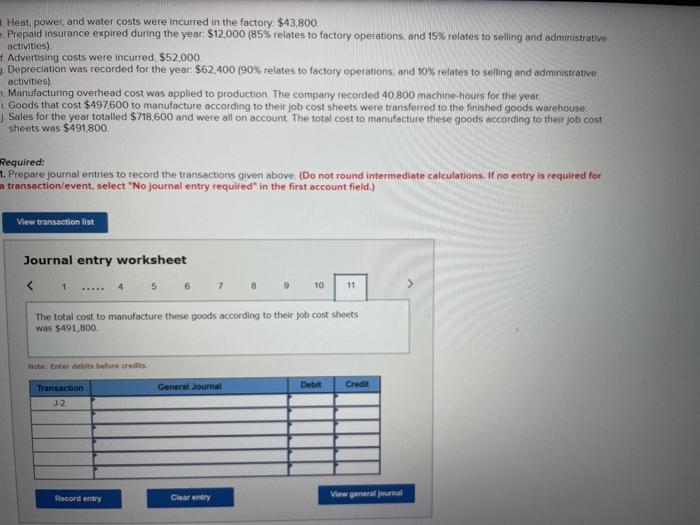

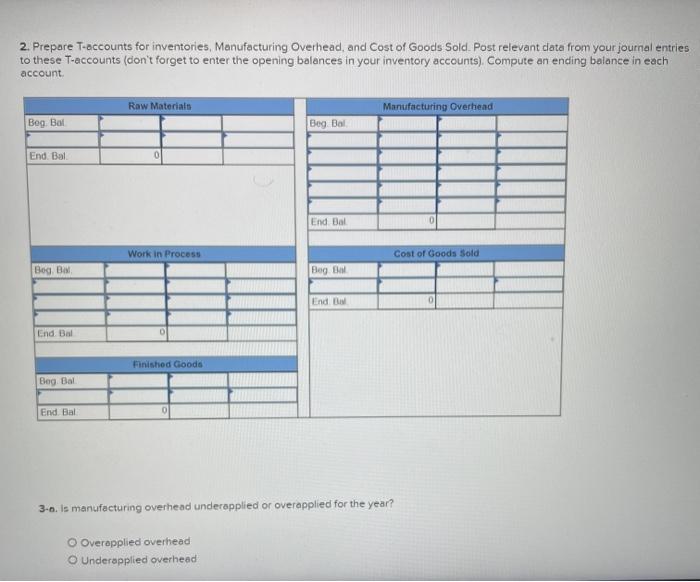

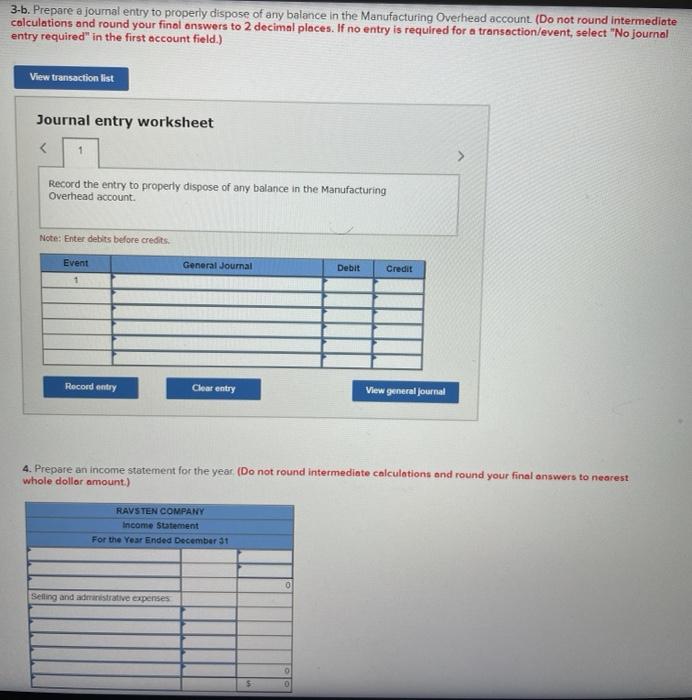

Ravsten Company uses a co-order costing system on Januarytme beginning of the current year, the company's inventory balances we as follows work in process Finished goods $10, $10,000 The company applies overhead cost to jobs on me base of coors. For the current year, the company estimated that it would work 36.400 machine-hours and incur $161.980 in manufacturing overhead cost. The following transactions were recorded for the year a Raw materials were purchased on account $200.000 D. Raw materials were requisitioned for use in production 5194.000 (Bos direct and 20% indirect The following costs were incurred for employee services Direct labour Indirect labou Sales comissions Administrative salaries $160,200 $ 27,000 $ 17,200 $ 3.600 d. Heat, power, and water costs were incurred in the factory $43.800 e. Prepaid insurance expired during the year $12.000 685 relates to factory operations, and 15 relates to selling and administrative activities) Advertising costs were incurred, $52.000 9 Depreciation was recorded for the year $62.400 1905 relates to factory operations and 10 relates to selling and administrative activities n Manufacturing overead cost was applied to production The company recorded 40.800 machine bours for the year. 1. Goods that cost 5497600 to manufacture according to their cost sheets were transferred to the finished goods warehouse Sales for the year totaled 5718,600 and were all on account. The total costo manufacture these goods according to their job cost sheets was $491800 Required: 1. Prepare journal entries to record the transactions given above. Do not round Intermediate calculations. If no entry is required for transaction levent, select "No journal entry required in the first account field.) View transaction ist Journal entry worksheet 1 2 3 5 6 7 . 11 > Raw materials were purchased on account: $200,000 Nicat det er et Transaction General Journal Heady d Heat, power, and water costs were incurred in the factory $43,800 e Prepaid insurance expired during the year $12.000 (85% relates to factory operations, and 15% relates to selling and administrative activities) Advertising costs were incurred $52,000 9 Depreciation was recorded for the year. $62.400 (90% relates to factory operations, and 10% relates to selling and administrative activities) h. Manufacturing overhead cost was applied to production. The company recorded 40,800 machine-hours for the year L Goods that cost $497600 to manufacture according to their job cost sheets were transferred to the finished goods warehouse y Sales for the year totalled $718,600 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $491 800 Required: 1. Prepare journal entries to record the transactions given above. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 6 11 Raw materials were requisitioned for use in production: $194,000 (80% direct and 20% indirect). inte Enter debits before credits General Journal Det Credit Transaction D Record Clearn d Heat power and water costs were incurred in the factory $43.800. e Prepaid insurance expired during the year $12.000 (85% relates to factory operations, and 15% relates to selling and administrative activities) Advertising costs were incurred. $52,000 9 Depreciation was recorded for the year $62.400 (90% relates to factory operations and 10% relates to selling and administrative activities) h. Manufacturing overhead cost was applied to production. The company recorded 40.800 machine hours for the year Goods that cost $497600 to manufacture according to their job cost sheets were transferred to the finished goods warehouse Sales for the year totalled $718,600 and were all on account the total cost to manufacture these goods according to their job cost sheets was $491 800 Required: 1. Prepare journal entries to record the transactions given above (Do not round intermediate calculations. If no entsy is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Heat, power and water costs were incurred in the factory: $43,800 Not: Enter debit before credits Transaction General Jumal Det Credit Record entry Clear entry View general Journal d Heat power and water costs were incurred in the factory $43,800 e. Prepaid insurance expired during the year $12.000 (85% relates to factory operations, and 15% relates to selling and administrative activities) Advertising costs were incurred. $52,000. 9 Depreciation was recorded for the year: $62.400 (90% relates to factory operations, and 10% relates to selling and administrative activities) h Manufacturing overhead cost was applied to production. The company recorded 40 800 machine hours for the year. Goods that cost $497,600 to manufacture according to their job cost sheets were transferred to the finished goods warehouse Sales for the year totalled $718,600 and were all on account the total cost to manufacture these goods according to their job cost sheets was $491,800 Required: 1. Prepare journal entries to record the transactions given above (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 2 3 1 5 6 7 11 Prepaid Insurance expired during the year: $12,000 (85% relates to factory operations, and 15% relates to selling and administrative activities) Note: Enter debts before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal d. Heat power and water costs were incurred in the factory $43.800 e Prepaid insurance expired during the year $12.000 (85% relates to factory operations and 15% relates to selling and administrative activities) Advertising costs were incurred $52,000 Depreciation was recorded for the year $62.400 (90% relates to factory operations, and 10% relates to selling and administrative activities) hManufacturing overhead cost was applied to production. The company recorded 40,800 machine hours for the year Goods that cost $497,600 to manufacture according to their job cost sheets were transferred to the finished goods warehouse Sales for the year totalled $718,600 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $491,800 Required: 1. Prepare journal entries to record the transactions given above. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 5 6 7 8 11 Advertising costs were incurred, $52,000. Note: Enter debits before credits Transaction General Journal Debit Credit 1 Record entry Clear entry View general Journal d. Heat power and water costs were incurred in the factory $43,800 e. Prepaid Insurance expired during the year $12,000 (85% relates to factory operations, and 15% relates to selling and administrative activities) Advertising costs were incurred, $52,000, g. Depreciation was recorded for the year. $62.400 (90% relates to factory operations, and 10% relates to selling and administrative activities) h. Manufacturing overhead cost was applied to production. The company recorded 40.800 machine hours for the year. Goods that cost $497600 to manufacture according to their job cost sheets were transferred to the finished goods warehouse Sales for the year totalled $718,600 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $491,800 Required: 1. Prepare journal entries to record the transactions given above. (Do not round intermediate calculations, If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 6 7 11 > Depreciation was recorded for the year: $62,400 (90% relates to factory operations, and 10% relates to selling and administrative activities) Note: inter debes before credits Transaction General Journal Debit Credit Record entry Cle View general d. Heat power and water costs were incurred in the factory $43,800 e Prepaid Insurance expired during the year: $12,000 (85% relates to factory operations, and 15% relates to selling and administrative activities) Advertising costs were incurred, $52,000 9 Depreciation was recorded for the year $62,400 (90% relates to factory operations, and 10% relates to selling and administrative activities) h Manufacturing overhead cost was applied to production. The company recorded 40,800 machine hours for the year Goods that cost $497,600 to manufacture according to their job cost sheets were transferred to the finished goods warehouse Sales for the year totalled $718,600 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $491.800 Required: 1. Prepare journal entries to record the transactions given above (Do not round intermediate calculations. I no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Sales for the year totalled $718,600 and were all on account: Not Enter debits before credits Transaction General Journal Debe Credit Record entry Clear Heat power and water costs were incurred in the factory $43,800 Prepaid insurance expired during the year $12,000 (85% relates to factory operations, and 15% relates to selling and administrative activities) Advertising costs were incurred, $52,000 Depreciation was recorded for the year: $62.400 (90% relates to factory operations, and 10% relates to selling and administrative activities) Manufacturing overhead cost was applied to production The company recorded 40,800 machine hours for the year Goods that cost $497.600 to manufacture according to their job cost sheets were transferred to the finished goods warehouse Sales for the year totalled $718,600 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $491 800 Required: 1. Prepare journal entries to record the transactions given above (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 5 6 7 7 8 9 10 11 The total cost to manufacture these goods according to their job cost sheets was $491,800 totunter debit before credits General Journal Debit Credit Transaction J2 Record entry Clear entry View general journal 2. Prepare T-accounts for inventories, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don't forget to enter the opening balances in your inventory accounts) Compute an ending balance in each account Raw Materials Manufacturing Overhead Bog Bot Beg Bal End Bal End Bal Work in Process Cost of Goods Sold Beg B Beg End End Bal Finished Goods Beg Bal End Bal 3-o. Is manufacturing overhead underapplied or overapplied for the year? O Overapplied overhead Underapplied overhead 3-b. Prepare a journal entry to properly dispose of any balance in the Manufacturing Overhead account (Do not round Intermediate calculations and round your final answers to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts