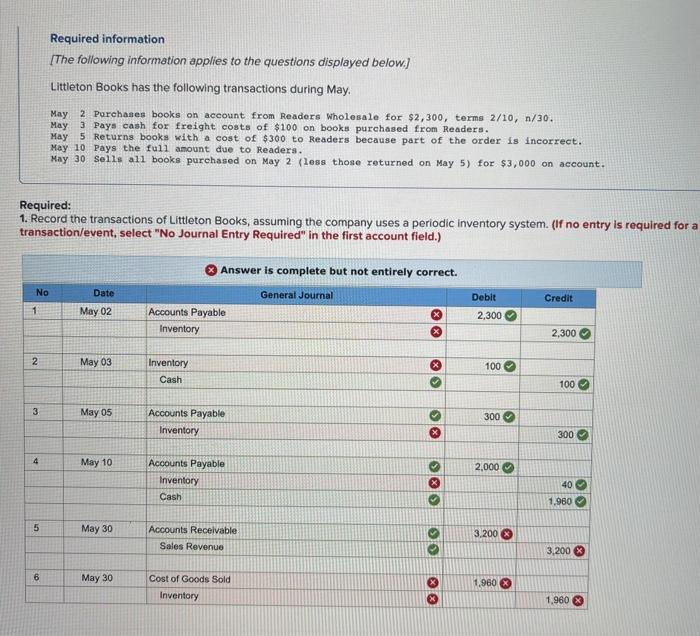

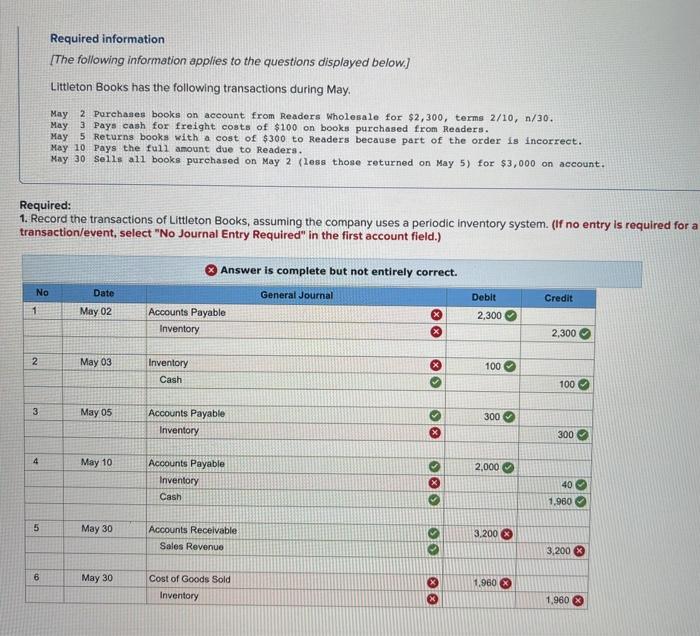

Question: , this problem has two parts. Required information [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May.

![applies to the questions displayed below.] Littleton Books has the following transactions](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717b349c6d96_4736717b349515a6.jpg)

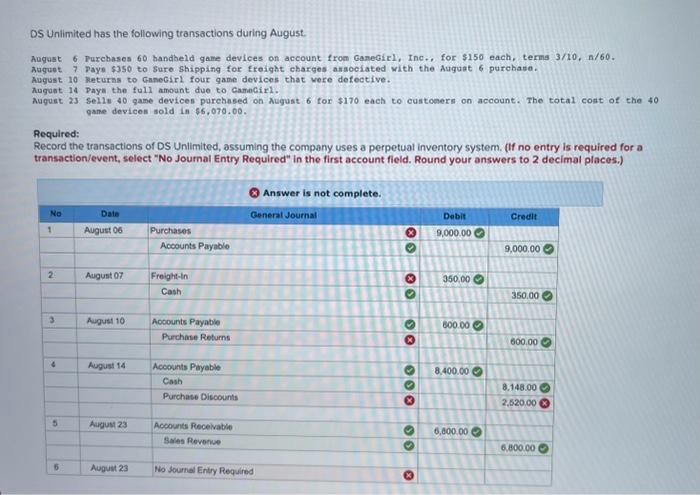

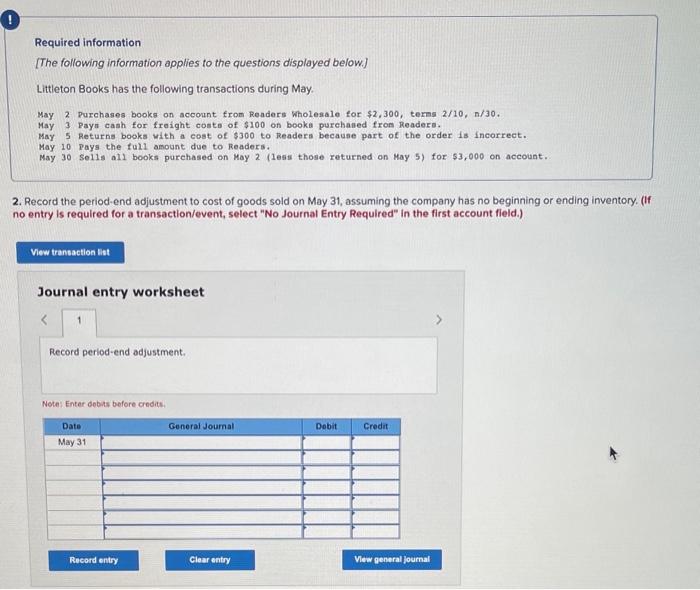

Required information [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May. May 2 Purchases books on account from Readers Wholesale for $2,300, terms 2/10,n/30. May 3 pays cash for freight costs of $100 on books purchased from Readers. May 5 Returns books with a cost of $300 to Readers because part of the order is incorrect. May 10 Pays the fu11 anount due to Readers. May 30 Sells a11 books purchased on May 2 (less those returned on May 5) for $3,000 on account. Required: 1. Record the transactions of Littleton Books, assuming the company uses a periodic inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required information [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May. May 2 Purchases books on account from Readers Wholesale for $2,300, terms 2/10,n/30. May 3 Payn cash for fraight coste of $100 on booke purchaned fron Readers. May 5 Returns books with a cost of $300 to Readers because part of the order is fncorrect. May 10 Pays the full amount due to Readers. May 10 solls all books purchased on May 2 (1ess those returned on May 5) for $3,000 on account. 2. Record the period-end adjustment to cost of goods sold on May 31, assuming the company has no beginning or ending inventory. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account fleid.) Journal entry worksheet Record period-end adjustment. Note: Enter dobass before credits. DS Unlimited has the following transactions during August. August 6 Turchases 60 handheld game devices on account from Gamebirl, Inc., for $150 each, terms 3/10, n/60. Auguet 7 paye $350 to sure shipping for freight eharges ansoeiated with the Auguat 6 purchase. August 10 Returas to Ganecirl four game devices that vere defeetive. Augant 14 Daya the full amount due to Camecirl. August 23 Sells 40 game devicen parchased on August 6 for $170 each to eustoners on account. The total cost of the 40 game devicen sold in 5.6,070.00. Required: Record the transactions of DS Unlimited, assuming the company uses a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to 2 decimal places.) Required information [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May. May 2 Purchases books on account from Readers Wholesale for $2,300, terms 2/10,n/30. May 3 pays cash for freight costs of $100 on books purchased from Readers. May 5 Returns books with a cost of $300 to Readers because part of the order is incorrect. May 10 Pays the fu11 anount due to Readers. May 30 Sells a11 books purchased on May 2 (less those returned on May 5) for $3,000 on account. Required: 1. Record the transactions of Littleton Books, assuming the company uses a periodic inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required information [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May. May 2 Purchases books on account from Readers Wholesale for $2,300, terns 2/10,n/30. May 3 Payn cash for freight costs of $100 on booke purchaned fron Readera. May 5 Returns books with a cost of $300 to Readers because part of the order is incorrect. May 10 Pays the full amount due to Readers. May 30 sells all books purchased on May 2 (1esis those returned on May 5) for $3,000 on account. 2. Record the period-end adjustment to cost of goods sold on May 31, assuming the company has no beginning or ending inventory. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account fleld.) Journal entry worksheet Record period-end adjustment. Note: Enter debass before credite

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts