Question: This problem includes a pre- assignment (offline) before you work now with the online test. You have received material and Excel- spreadsheet with hints to

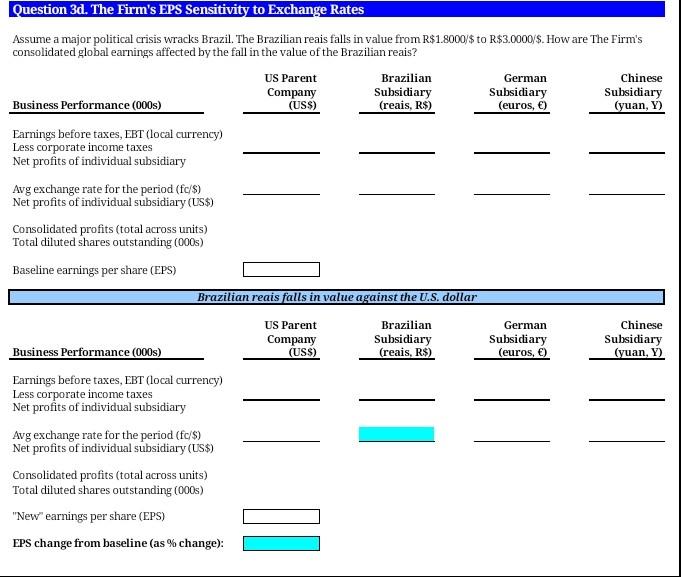

This problem includes a pre- assignment (offline) before you work now with the online test. You have received material and Excel- spreadsheet with hints to solve the problem. Here in the online form, please indicate your final answers (the end results for the questions) very briefly. Questions 3 a-e are based on a U.S.-based multinational manufacturing firm (The Firm) with wholly owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. From itslearning you can find separate material on the background facts of the firm, as well as an Excel-worksheet (with hints on how to solve the problems). Question 3d. The Firm's EPS Sensitivity to Exchange Rates Assume a major political crisis wracks Brazil. The Brazilian reais falls in value from R$1.8000/$ to R$3.0000/$. How are The Firm's consolidated global earnings affected by the fall in the value of the Brazilian reais? US Parent Brazilian German Chinese Company Subsidiary Subsidiary Subsidiary Business Performance (000) (USS) (reais, R$) (euros, ) (yuan, Y) Earnings before taxes, EBT (local currency) Less corporate income taxes Net profits of individual subsidiary Avg exchange rate for the period (fc/8) Net profits of individual subsidiary (US$) Consolidated profits (total across units) Total diluted shares outstanding (000s) Baseline earnings per share (EPS) Brazilian reais falls in value against the U.S. dollar US Parent Company (USS) Brazilian Subsidiary (reais, R$) German Subsidiary (euros, ) Chinese Subsidiary (yuan, Y) Business Performance (000s) Earnings before taxes, EBT (local currency) Less corporate income taxes Net profits of individual subsidiary Avg exchange rate for the period (fo/8) Net profits of individual subsidiary (US$) Consolidated profits (total across units) Total diluted shares outstanding (000s) "New" earnings per share (EPS) EPS change from baseline (as % change): TO This problem includes a pre- assignment (offline) before you work now with the online test. You have received material and Excel- spreadsheet with hints to solve the problem. Here in the online form, please indicate your final answers (the end results for the questions) very briefly. Questions 3 a-e are based on a U.S.-based multinational manufacturing firm (The Firm) with wholly owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. From itslearning you can find separate material on the background facts of the firm, as well as an Excel-worksheet (with hints on how to solve the problems). Question 3d. The Firm's EPS Sensitivity to Exchange Rates Assume a major political crisis wracks Brazil. The Brazilian reais falls in value from R$1.8000/$ to R$3.0000/$. How are The Firm's consolidated global earnings affected by the fall in the value of the Brazilian reais? US Parent Brazilian German Chinese Company Subsidiary Subsidiary Subsidiary Business Performance (000) (USS) (reais, R$) (euros, ) (yuan, Y) Earnings before taxes, EBT (local currency) Less corporate income taxes Net profits of individual subsidiary Avg exchange rate for the period (fc/8) Net profits of individual subsidiary (US$) Consolidated profits (total across units) Total diluted shares outstanding (000s) Baseline earnings per share (EPS) Brazilian reais falls in value against the U.S. dollar US Parent Company (USS) Brazilian Subsidiary (reais, R$) German Subsidiary (euros, ) Chinese Subsidiary (yuan, Y) Business Performance (000s) Earnings before taxes, EBT (local currency) Less corporate income taxes Net profits of individual subsidiary Avg exchange rate for the period (fo/8) Net profits of individual subsidiary (US$) Consolidated profits (total across units) Total diluted shares outstanding (000s) "New" earnings per share (EPS) EPS change from baseline (as % change): TO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts