Question: This problem involves the Black-Scholes European option pricing formulas. Consider what happens to the call option price Ce(s, t) in the limit as t +T

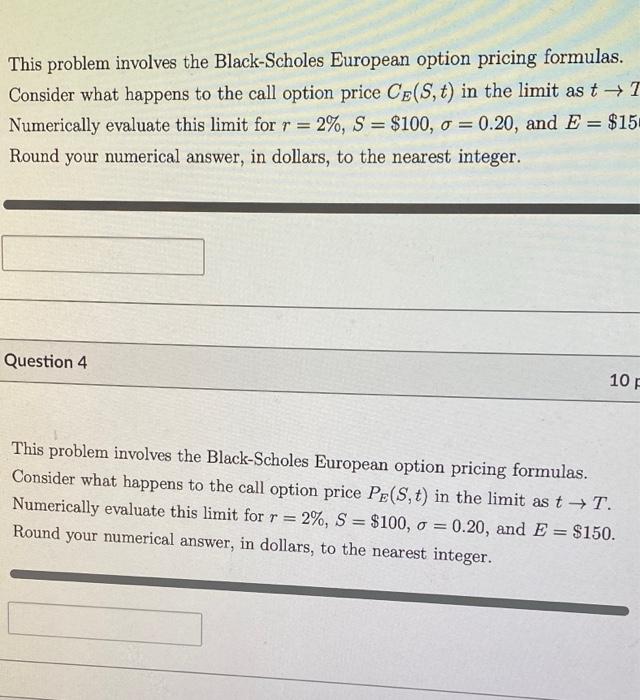

This problem involves the Black-Scholes European option pricing formulas. Consider what happens to the call option price Ce(s, t) in the limit as t +T Numerically evaluate this limit for r = 2%, S = $100, 0 = 0.20, and E = $15 Round your numerical answer, in dollars, to the nearest integer. Question 4 10 F This problem involves the Black-Scholes European option pricing formulas. Consider what happens to the call option price PE(S,t) in the limit as t+T. Numerically evaluate this limit for r = 2%, S = $100, 0 = 0.20, and E= $150. Round your numerical answer, in dollars, to the nearest integer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts