Question: This problem is a simpler version of what we will discuss in class on 9/13 regarding the possible disconnection between YTM and the amount of

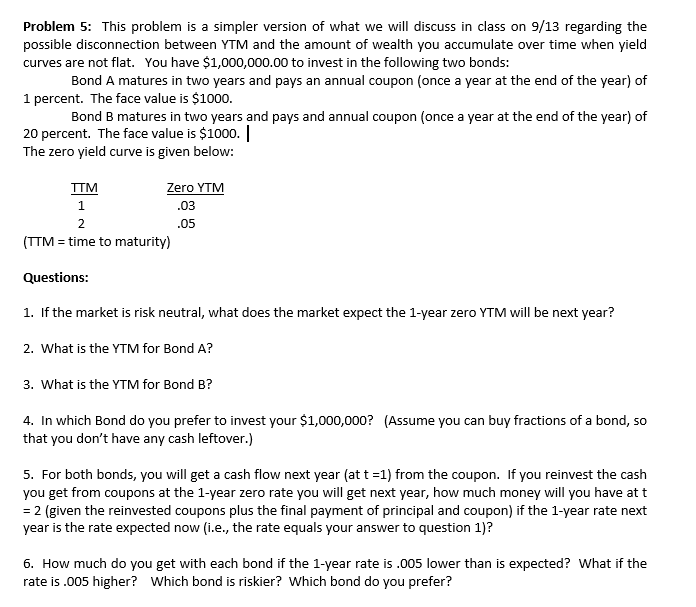

This problem is a simpler version of what we will discuss in class on 9/13 regarding the possible disconnection between YTM and the amount of wealth you accumulate over time when yield curves are not flat. You have $1,000,000.00 to invest in the following two bonds: Bond A matures in two years and pays an annual coupon (once a year at the end of the year) of 1 percent. The face value is $1000. Bond B matures in two years and pays and annual coupon (once a year at the end of the year) of 20 percent. The face value is $1000. | The zero yield curve is given below: (TIM = time to maturity) If the market is risk neutral, what does the market expect the 1-year zero YTM will be next year? What is the YTM for Bond A? What is the YTM for Bond B? In which Bond do you prefer to invest your $1,000,000? (Assume you can buy fractions of a bond, so that you don't have any cash leftover.) For both bonds, you will get a cash flow next year (at t =1) from the coupon. If you reinvest the cash you get from coupons at the 1-year zero rate you will get next year, how much money will you have at t = 2 (given the reinvested coupons plus the final payment of principal and coupon) if the 1-year rate next year is the rate expected now (i.e., the rate equals your answer to question 1)? How much do you get with each bond if the 1-year rate is .005 lower than is expected? What if the rate is .005 higher? Which bond is riskier? Which bond do you prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts