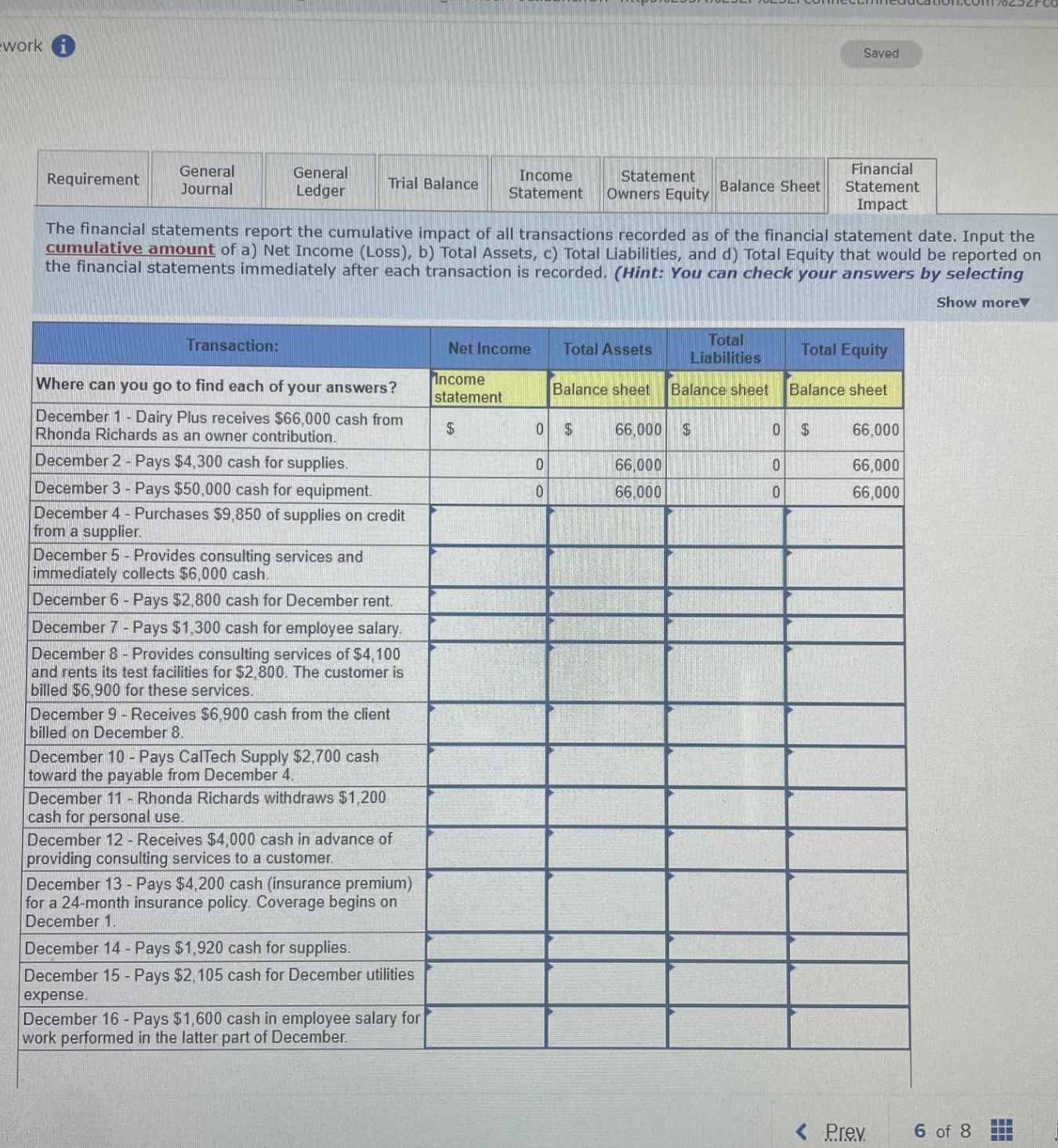

Question: This problem is based on the transactions for the Dairy Plus Company in your text. Prepare journal entries for each transaction and identify the financial

This problem is based on the transactions for the Dairy Plus Company in your text. Prepare journal entries for each transaction and identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal entries recorded.

December On December Rhonda Richards forms a consulting business, named Dairy Plus. Dairy Plus receives $ cash from Rhonda Richards as an owner contribution.

December Dairy Plus pays $ cash for supplies. The company's policy is to record all prepaid expenses in asset accounts.

December Dairy Plus pays $ cash for equipment.

December Dairy Plus purchases $ of supplies on credit from a supplier, CalTech Supply.

December Dairy Plus provides consulting services and immediately collects $ cash.

December Dairy Plus pays $ cash for December rent.

December Dairy Plus pays $ cash for employee salary.

December Dairy Plus provides consulting services of $ and rents its test facilities for $ The customer is billed $ for these services.

December Dairy Plus receives $ cash from the client billed on December

December Dairy Plus pays CalTech Supply $ cash as partial payment for its December $ purchase of supplies.

December Rhonda Richards withdraws $ cash from Dairy Plus for personal use.

December Dairy Plus receives $ cash in advance of providing consulting services to a customer. The company's policy is to record fees collected in advance in a balance sheet account.

December Dairy Plus pays $ cash insurance premium for a month insurance policy. Coverage begins on December The company's policy is to record all prepaid expenses in a balance sheet account.

December Dairy Plus pays $ cash for supplies.

December Dairy Plus pays $ cash for December utilities expense.

December Dairy Plus pays $ cash in employee salary for work performed in the latter part of December.

Need help with the completion of this form specifically. Not sure how to Please do not use the previous answers given as they are all wrong!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock