Question: this problem is not like the one already posted on chegg , this is a new one with new questions i want answers to all

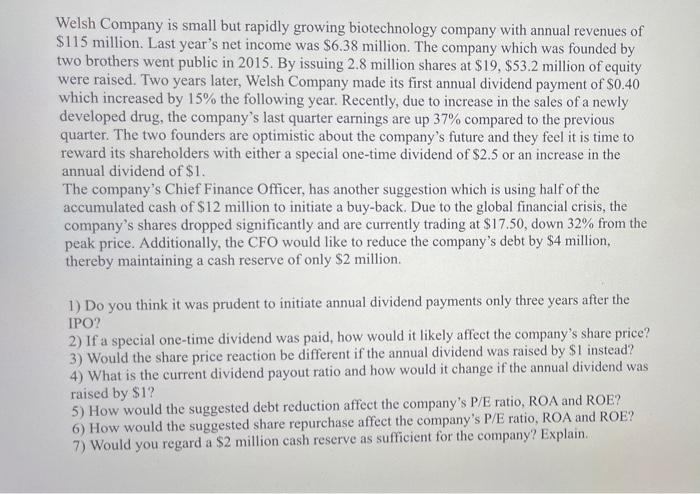

Welsh Company is small but rapidly growing biotechnology company with annual revenues of $115 million. Last year's net income was $6.38 million. The company which was founded by two brothers went public in 2015. By issuing 2.8 million shares at $19, $53.2 million of equity were raised. Two years later, Welsh Company made its first annual dividend payment of $0.40 which increased by 15% the following year. Recently, due to increase in the sales of a newly developed drug, the company's last quarter earnings are up 37% compared to the previous quarter. The two founders are optimistic about the company's future and they feel it is time to reward its shareholders with either a special one-time dividend of $2.5 or an increase in the annual dividend of $1. The company's Chief Finance Officer, has another suggestion which is using half of the accumulated cash of $12 million to initiate a buy-back. Due to the global financial crisis, the company's shares dropped significantly and are currently trading at $17.50, down 32% from the peak price. Additionally, the CFO would like to reduce the company's debt by $4 million, thereby maintaining a cash reserve of only $2 million. 1) Do you think it was prudent to initiate annual dividend payments only three years after the IPO? 2) If a special one-time dividend was paid, how would it likely affect the company's share price? 3) Would the share price reaction be different if the annual dividend was raised by $1 instead? 4) What is the current dividend payout ratio and how would it change if the annual dividend was raised by $1? 5) How would the suggested debt reduction affect the company's P/E ratio, ROA and ROE? 6) How would the suggested share repurchase affect the company's P/E ratio, ROA and ROE? 7) Would you regard a $2 million cash reserve as sufficient for the company? Explain. Welsh Company is small but rapidly growing biotechnology company with annual revenues of $115 million. Last year's net income was $6.38 million. The company which was founded by two brothers went public in 2015. By issuing 2.8 million shares at $19, $53.2 million of equity were raised. Two years later, Welsh Company made its first annual dividend payment of $0.40 which increased by 15% the following year. Recently, due to increase in the sales of a newly developed drug, the company's last quarter earnings are up 37% compared to the previous quarter. The two founders are optimistic about the company's future and they feel it is time to reward its shareholders with either a special one-time dividend of $2.5 or an increase in the annual dividend of $1. The company's Chief Finance Officer, has another suggestion which is using half of the accumulated cash of $12 million to initiate a buy-back. Due to the global financial crisis, the company's shares dropped significantly and are currently trading at $17.50, down 32% from the peak price. Additionally, the CFO would like to reduce the company's debt by $4 million, thereby maintaining a cash reserve of only $2 million. 1) Do you think it was prudent to initiate annual dividend payments only three years after the IPO? 2) If a special one-time dividend was paid, how would it likely affect the company's share price? 3) Would the share price reaction be different if the annual dividend was raised by $1 instead? 4) What is the current dividend payout ratio and how would it change if the annual dividend was raised by $1? 5) How would the suggested debt reduction affect the company's P/E ratio, ROA and ROE? 6) How would the suggested share repurchase affect the company's P/E ratio, ROA and ROE? 7) Would you regard a $2 million cash reserve as sufficient for the company? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts