Question: This problem is worth 25 points. Given the following information, show whether covered interest arbitrage possible for U.S. investors. Also, what is the dollar profit

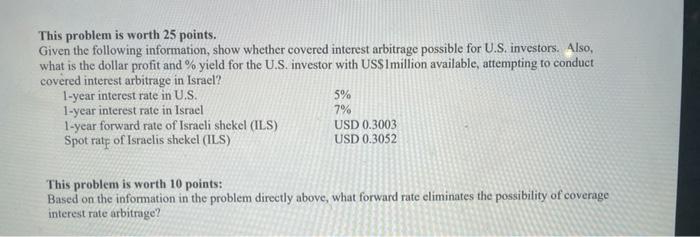

This problem is worth 25 points. Given the following information, show whether covered interest arbitrage possible for U.S. investors. Also, what is the dollar profit and % yield for the U.S. investor with US$1 million available, attempting to conduct covered interest arbitrage in Israel? 1-year interest rate in U.S. 5% 1-year interest rate in Israel 7% 1-year forward rate of Israeli shekel (ILS) USD 0.3003 Spot rate of Israelis shekel (ILS) USD 0.3052 This problem is worth 10 points: Based on the information in the problem directly above, what forward rate eliminates the possibility of coverage interest rate arbitrage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts