Question: This problem must be solved on an EXCEL SHEET and explained in a WORD document. Please help, Thank you in advance. Understanding Accumulation. Every month

This problem must be solved on an EXCEL SHEET and explained in a WORD document. Please help, Thank you in advance.

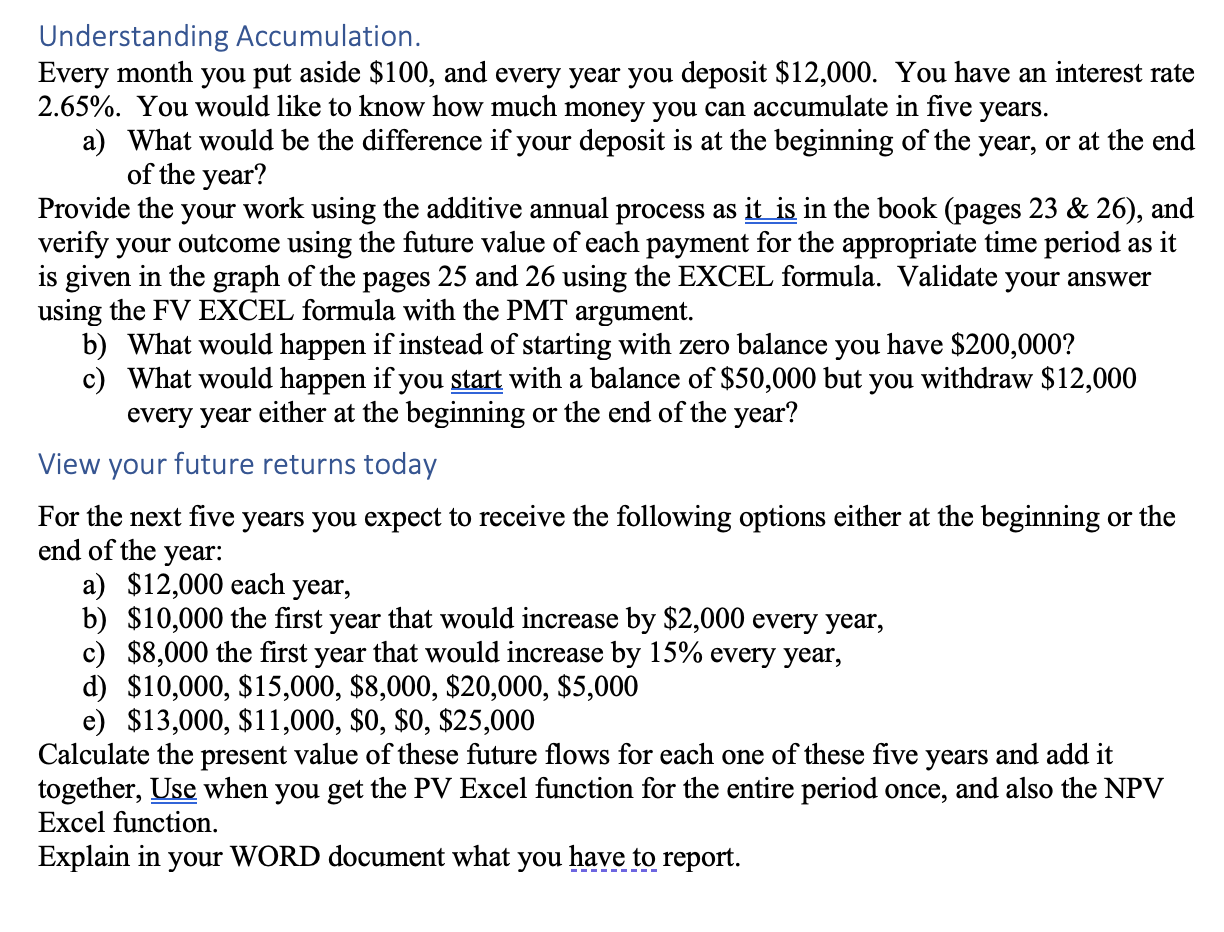

Understanding Accumulation. Every month you put aside $100, and every year you deposit $12,000. You have an interest rate 2.65%. You would like to know how much money you can accumulate in five years. a) What would be the difference if your deposit is at the beginning of the year, or at the end of the year? Provide the your work using the additive annual process as it is in the book (pages 23 & 26), and verify your outcome using the future value of each payment for the appropriate time period as it is given in the graph of the pages 25 and 26 using the EXCEL formula. Validate your answer using the FV EXCEL formula with the PMT argument. b) What would happen if instead of starting with zero balance you have $200,000? c) What would happen if you start with a balance of $50,000 but you withdraw $12,000 every year either at the beginning or the end of the year? View your future returns today For the next five years you expect to receive the following options either at the beginning or the end of the year: a) $12,000 each year, b) $10,000 the first year that would increase by $2,000 every year, c) $8,000 the first year that would increase by 15% every year, d) $10,000, $15,000, $8,000, $20,000, $5,000 e) $13,000, $11,000, $0, $0, $25,000 Calculate the present value of these future flows for each one of these five years and add it together, Use when you get the PV Excel function for the entire period once, and also the NPV Excel function. Explain in your WORD document what you have to report. Understanding Accumulation. Every month you put aside $100, and every year you deposit $12,000. You have an interest rate 2.65%. You would like to know how much money you can accumulate in five years. a) What would be the difference if your deposit is at the beginning of the year, or at the end of the year? Provide the your work using the additive annual process as it is in the book (pages 23 & 26), and verify your outcome using the future value of each payment for the appropriate time period as it is given in the graph of the pages 25 and 26 using the EXCEL formula. Validate your answer using the FV EXCEL formula with the PMT argument. b) What would happen if instead of starting with zero balance you have $200,000? c) What would happen if you start with a balance of $50,000 but you withdraw $12,000 every year either at the beginning or the end of the year? View your future returns today For the next five years you expect to receive the following options either at the beginning or the end of the year: a) $12,000 each year, b) $10,000 the first year that would increase by $2,000 every year, c) $8,000 the first year that would increase by 15% every year, d) $10,000, $15,000, $8,000, $20,000, $5,000 e) $13,000, $11,000, $0, $0, $25,000 Calculate the present value of these future flows for each one of these five years and add it together, Use when you get the PV Excel function for the entire period once, and also the NPV Excel function. Explain in your WORD document what you have to report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts