Question: This problem relates to optimizing a financial portfolio. A bank has $650,000 in assets to allocate among investments in bonds, home mortgages, car loans, and

This problem relates to optimizing a financial portfolio.

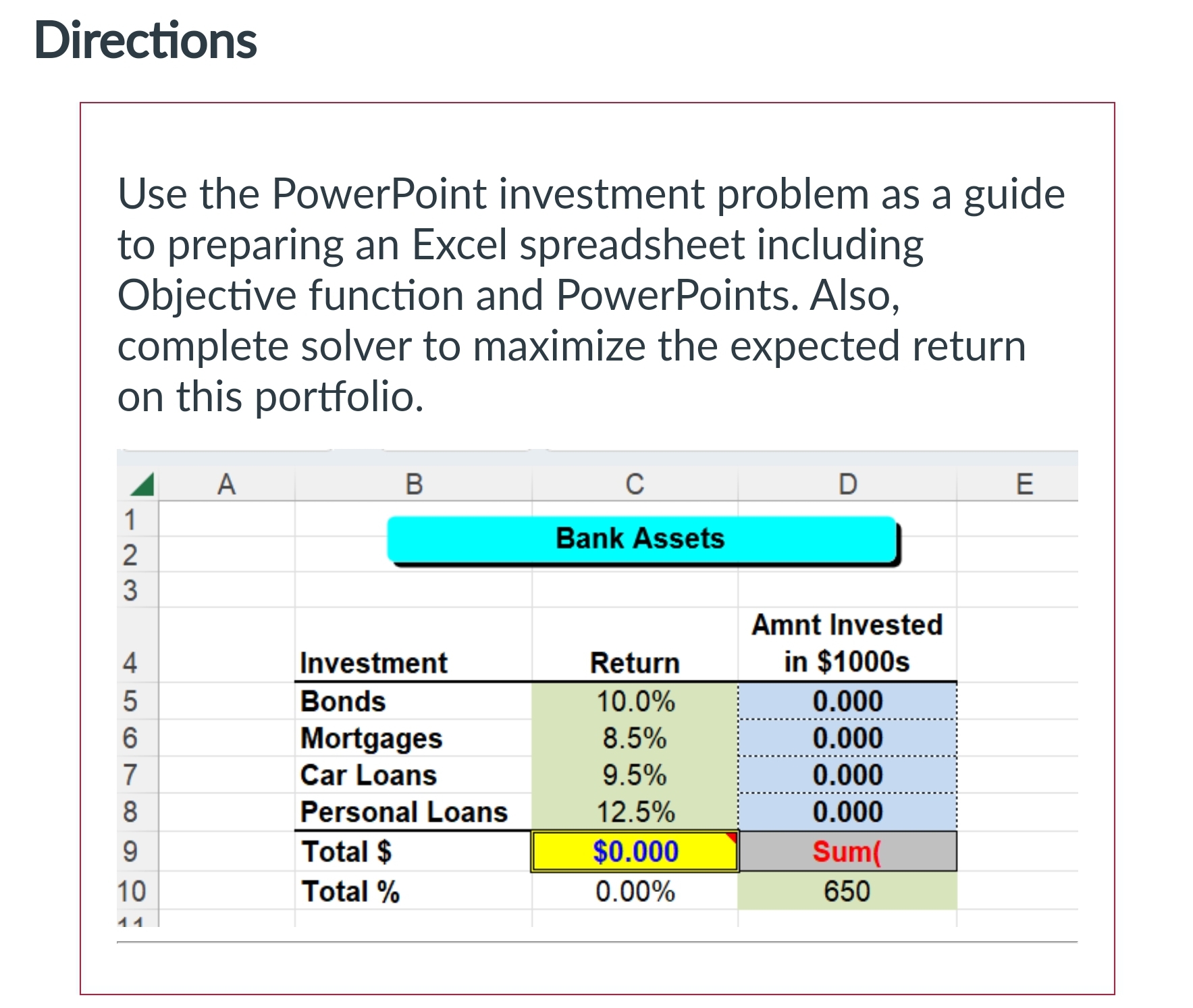

A bank has $650,000 in assets to allocate among investments in bonds, home mortgages, car loans, and personal loans. Bonds are expected to produce a return of 10%, mortgages 8.5%, car loans 9.5%, and personal loans 12.5%. The bank wants to restrict personal loans to no more than 25% of the total portfolio. The bank wants to ensure that more money is invested in mortgages than in personal loans. The bank also wants to invest more in bonds than in personal loans.

Use the PowerPoint investment problem as a guide to preparing an Excel spreadsheet including Objective function and PowerPoints. Also, complete solver to maximize the expected return on this portfolio.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts