Question: This project consists of (1) a video and (2) an amortization schedule that you and your group create documenting your work in response to the

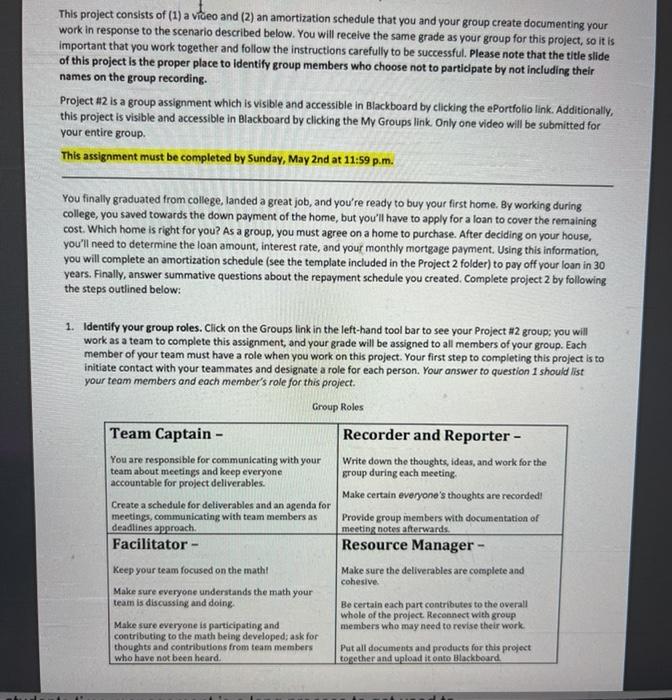

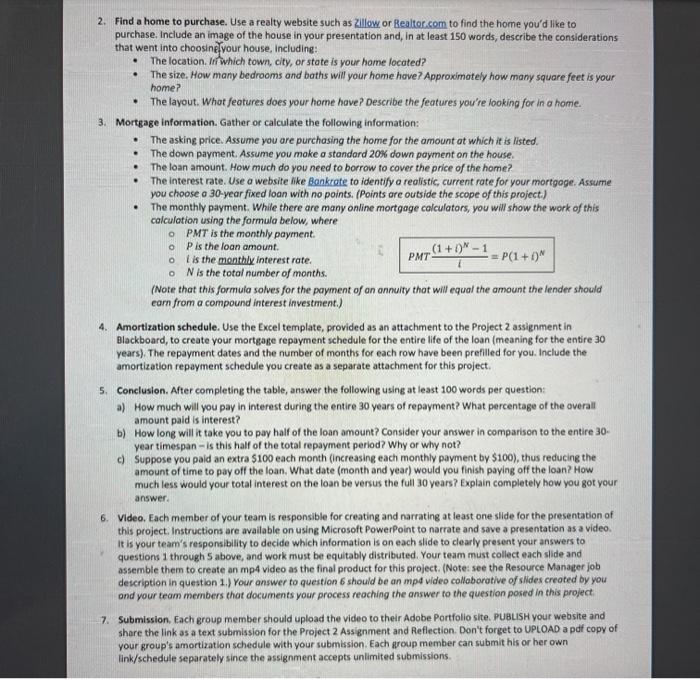

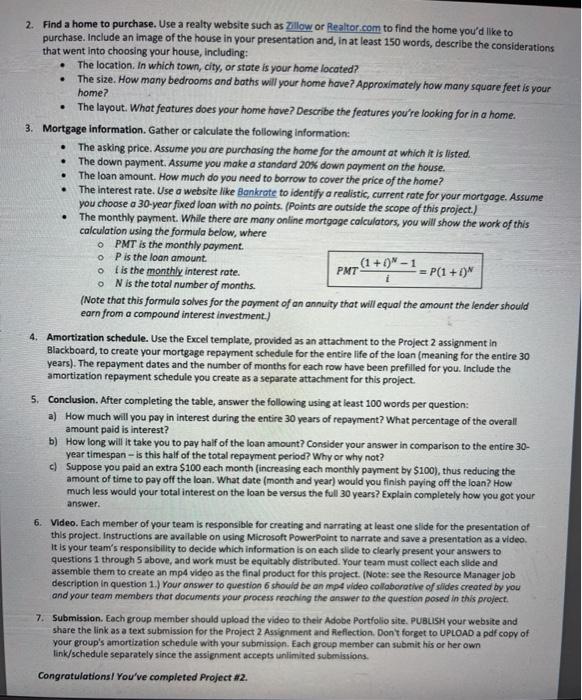

This project consists of (1) a video and (2) an amortization schedule that you and your group create documenting your work in response to the scenario described below. You will receive the same grade as your group for this project, so it is important that you work together and follow the instructions carefully to be successful. Please note that the title slide of this project is the proper place to identify group members who choose not to participate by not including their names on the group recording. Project #2 is a group assignment which is visible and accessible in Blackboard by clicking the ePortfolio link. Additionally, this project is visible and accessible in Blackboard by clicking the My Groups link Only one video will be submitted for your entire group This assignment must be completed by Sunday, May 2nd at 11:59 p.m. You finally graduated from college, landed a great job, and you're ready to buy your first home. By working during college, you saved towards the down payment of the home, but you'll have to apply for a loan to cover the remaining cost. Which home is right for you? As a group, you must agree on a home to purchase. After deciding on your house, you'll need to determine the loan amount, interest rate, and your monthly mortgage payment. Using this information, you will complete an amortization schedule (see the template included in the Project 2 folder) to pay off your loan in 30 years. Finally, answer summative questions about the repayment schedule you created. Complete project 2 by following the steps outlined below: 1. Identify your group roles. Click on the Groups link in the left-hand tool bar to see your Project #2 group: you will work as a team to complete this assignment, and your grade will be assigned to all members of your group. Each member of your team must have a role when you work on this project. Your first step to completing this project is to initiate contact with your teammates and designate a role for each person. Your answer to question I should list your team members and each member's role for this project. Group Roles Team Captain - You are responsible for communicating with your team about meetings and keep everyone accountable for project deliverables. Create a schedule for deliverables and an agenda for meetings, communicating with team members as deadlines approach Facilitator - Recorder and Reporter - Write down the thoughts, ideas, and work for the group during each meeting Make certain everyone's thoughts are recorded! Provide group members with documentation of meeting notes afterwards. Resource Manager - Make sure the deliverables are complete and cohesive Keep your team focused on the math! Make sure everyone understands the math your team is discussing and doing Make sure everyone is participating and contributing to the math being developed, ask for thoughts and contributions from team members who have not been heard. Be certain each part contributes to the overall whole of the project. Reconnect with group members who may need to revise their work Put all documents and products for this project together and upload it onto Blackboard . . . . . . . o 2. Find a home to purchase. Use a realty website such as Zillow or Realtor.com to find the home you'd like to purchase. Include an image of the house in your presentation and, in at least 150 words, describe the considerations that went into choosine your house, Including: The location. If which town, city, or state is your home located? The size. How many bedrooms and baths will your home have? Approximately how many square feet is your home? The layout. What features does your home have? Describe the features you're looking for in a home. 3. Mortgage Information. Gather or calculate the following information: The asking price. Assume you are purchasing the home for the amount at which it is listed The down payment. Assume you make a standard 20% down payment on the house, The loan amount. How much do you need to borrow to cover the price of the home? The interest rate. Use a website like Bankrote to identify a realistic current rate for your mortgage. Assume you choose a 30-year fixed loan with no points. (Points are outside the scope of this project) The monthly payment. While there are many online mortgage calculators, you will show the work of this calculation using the formula below, where O PMT is the monthly payment. OP is the loan amount. (1+O" o is the monthly interest rate. PMT = P(1+0) N is the total number of months. (Note that this formula solves for the payment of an annuity that will equal the amount the lender should earn from a compound interest investment.) 4. Amortization schedule. Use the Excel template, provided as an attachment to the Project 2 assignment in Blackboard, to create your mortgage repayment schedule for the entire life of the loan (meaning for the entire 30 years). The repayment dates and the number of months for each row have been prefilled for you. Include the amortization repayment schedule you create as a separate attachment for this project. 5. Conclusion. After completing the table, answer the following using at least 100 words per question: a) How much will you pay in interest during the entire 30 years of repayment? What percentage of the overall amount paid is interest? b) How long will it take you to pay half of the loan amount? Consider your answer in comparison to the entire 30- year timespan is this half of the total repayment period? Why or why not? c) Suppose you paid an extra $100 each month (increasing each monthly payment by $100), thus reducing the amount of time to pay off the loan, What date (month and year) would you finish paying off the loan? How much less would your total interest on the loan be versus the full 30 years? Explain completely how you got your answer 6. Video, Each member of your team is responsible for creating and narrating at least one side for the presentation of this project. Instructions are available on using Microsoft PowerPoint to narrate and save a presentation as a video it is your team's responsibility to decide which information is on each slide to clearly present your answers to questions through 5 above, and work must be equitably distributed. Your team must collect each slide and assemble them to create an mp4 video as the final product for this project. (Note: see the Resource Manager job description in question 1.) Your answer to question 6 should be an mp4 video collaborative of slides created by you and your team members that documents your process reoching the answer to the question posed in this project 7. Submission. Each group member should upload the video to their Adobe Portfolio site. PUBLISH your website and share the link as a text submission for the Project 2 Assignment and Reflection. Don't forget to UPLOAD a pdf copy of your group's amortization schedule with your submission. Each group member can submit his or her own link/schedule separately since the assignment accepts unlimited submissions . . . . O 2. Find a home to purchase. Use a realty website such as Zillow or Realtor.com to find the home you'd like to purchase. Include an image of the house in your presentation and, in at least 150 words, describe the considerations that went into choosing your house, including: The location in which town, city, or state is your home located? The size. How many bedrooms and baths will your home have? Approximately how many square feet is your home? The layout. What features does your home have? Describe the features you're looking for in a home. 3. Mortgage Information. Gather or calculate the following information: The asking price. Assume you are purchasing the home for the amount at which it is listed. The down payment. Assume you make a standard 20% down payment on the house. The loan amount. How much do you need to borrow to cover the price of the home? The Interest rate. Use a website like Bankrate to identify a realistic, current rate for your mortgage. Assume you choose a 30-year fixed loan with no points. (Points are outside the scope of this project.) The monthly payment. While there are many online mortgage calculators, you will show the work of this calculation using the formula below, where PMT is the monthly payment. o P is the loan amount (1 + 0-1 o is the monthly interest rate. PMT = P(1 +O N is the total number of months. (Note that this formula solves for the payment of an annuity that will equal the amount the lender should earn from a compound interest investment.) 4. Amortization schedule. Use the Excel template, provided as an attachment to the Project 2 assignment in Blackboard, to create your mortgage repayment schedule for the entire life of the loan (meaning for the entire 30 years). The repayment dates and the number of months for each row have been prefilled for you. Include the amortization repayment schedule you create as a separate attachment for this project. 5. Conclusion. After completing the table, answer the following using at least 100 words per question: a) How much will you pay in interest during the entire 30 years of repayment? What percentage of the overall amount paid is interest? b) How long will it take you to pay half of the loan amount? Consider your answer in comparison to the entire 30- year timespan - is this half of the total repayment period? Why or why not? c) Suppose you paid an extra $100 each month (increasing each monthly payment by $100), thus reducing the amount of time to pay off the loan. What date (month and year) would you finish paying off the loan? How much less would your total interest on the loan be versus the full 30 years? Explain completely how you got your answer. 6. Video. Each member of your team is responsible for creating and narrating at least one side for the presentation of this project. Instructions are available on using Microsoft PowerPoint to narrate and save a presentation as a video It is your team's responsibility to decide which information is on each side to clearly present your answers to questions 1 through 5 above, and work must be equitably distributed. Your team must collect each slide and assemble them to create an mp4 Video as the final product for this project. (Note: see the Resource Manager job description in question 1.) Your answer to question should be an mp4 video collaborative of slides created by you and your team members that documents your process reaching the answer to the question posed in this project 7. Submission. Each group member should upload the video to their Adobe Portfolio site. PUBLISH your website and share the link as a text submission for the Project 2 Assignment and Reflection. Don't forget to UPLOAD a pdf copy of your group's amortization schedule with your submission. Each group member can submit his or her own link/schedule separately since the assignment accepts unlimited submissions. Congratulations! You've completed Project #2. This project consists of (1) a video and (2) an amortization schedule that you and your group create documenting your work in response to the scenario described below. You will receive the same grade as your group for this project, so it is important that you work together and follow the instructions carefully to be successful. Please note that the title slide of this project is the proper place to identify group members who choose not to participate by not including their names on the group recording. Project #2 is a group assignment which is visible and accessible in Blackboard by clicking the ePortfolio link. Additionally, this project is visible and accessible in Blackboard by clicking the My Groups link Only one video will be submitted for your entire group This assignment must be completed by Sunday, May 2nd at 11:59 p.m. You finally graduated from college, landed a great job, and you're ready to buy your first home. By working during college, you saved towards the down payment of the home, but you'll have to apply for a loan to cover the remaining cost. Which home is right for you? As a group, you must agree on a home to purchase. After deciding on your house, you'll need to determine the loan amount, interest rate, and your monthly mortgage payment. Using this information, you will complete an amortization schedule (see the template included in the Project 2 folder) to pay off your loan in 30 years. Finally, answer summative questions about the repayment schedule you created. Complete project 2 by following the steps outlined below: 1. Identify your group roles. Click on the Groups link in the left-hand tool bar to see your Project #2 group: you will work as a team to complete this assignment, and your grade will be assigned to all members of your group. Each member of your team must have a role when you work on this project. Your first step to completing this project is to initiate contact with your teammates and designate a role for each person. Your answer to question I should list your team members and each member's role for this project. Group Roles Team Captain - You are responsible for communicating with your team about meetings and keep everyone accountable for project deliverables. Create a schedule for deliverables and an agenda for meetings, communicating with team members as deadlines approach Facilitator - Recorder and Reporter - Write down the thoughts, ideas, and work for the group during each meeting Make certain everyone's thoughts are recorded! Provide group members with documentation of meeting notes afterwards. Resource Manager - Make sure the deliverables are complete and cohesive Keep your team focused on the math! Make sure everyone understands the math your team is discussing and doing Make sure everyone is participating and contributing to the math being developed, ask for thoughts and contributions from team members who have not been heard. Be certain each part contributes to the overall whole of the project. Reconnect with group members who may need to revise their work Put all documents and products for this project together and upload it onto Blackboard . . . . . . . o 2. Find a home to purchase. Use a realty website such as Zillow or Realtor.com to find the home you'd like to purchase. Include an image of the house in your presentation and, in at least 150 words, describe the considerations that went into choosine your house, Including: The location. If which town, city, or state is your home located? The size. How many bedrooms and baths will your home have? Approximately how many square feet is your home? The layout. What features does your home have? Describe the features you're looking for in a home. 3. Mortgage Information. Gather or calculate the following information: The asking price. Assume you are purchasing the home for the amount at which it is listed The down payment. Assume you make a standard 20% down payment on the house, The loan amount. How much do you need to borrow to cover the price of the home? The interest rate. Use a website like Bankrote to identify a realistic current rate for your mortgage. Assume you choose a 30-year fixed loan with no points. (Points are outside the scope of this project) The monthly payment. While there are many online mortgage calculators, you will show the work of this calculation using the formula below, where O PMT is the monthly payment. OP is the loan amount. (1+O" o is the monthly interest rate. PMT = P(1+0) N is the total number of months. (Note that this formula solves for the payment of an annuity that will equal the amount the lender should earn from a compound interest investment.) 4. Amortization schedule. Use the Excel template, provided as an attachment to the Project 2 assignment in Blackboard, to create your mortgage repayment schedule for the entire life of the loan (meaning for the entire 30 years). The repayment dates and the number of months for each row have been prefilled for you. Include the amortization repayment schedule you create as a separate attachment for this project. 5. Conclusion. After completing the table, answer the following using at least 100 words per question: a) How much will you pay in interest during the entire 30 years of repayment? What percentage of the overall amount paid is interest? b) How long will it take you to pay half of the loan amount? Consider your answer in comparison to the entire 30- year timespan is this half of the total repayment period? Why or why not? c) Suppose you paid an extra $100 each month (increasing each monthly payment by $100), thus reducing the amount of time to pay off the loan, What date (month and year) would you finish paying off the loan? How much less would your total interest on the loan be versus the full 30 years? Explain completely how you got your answer 6. Video, Each member of your team is responsible for creating and narrating at least one side for the presentation of this project. Instructions are available on using Microsoft PowerPoint to narrate and save a presentation as a video it is your team's responsibility to decide which information is on each slide to clearly present your answers to questions through 5 above, and work must be equitably distributed. Your team must collect each slide and assemble them to create an mp4 video as the final product for this project. (Note: see the Resource Manager job description in question 1.) Your answer to question 6 should be an mp4 video collaborative of slides created by you and your team members that documents your process reoching the answer to the question posed in this project 7. Submission. Each group member should upload the video to their Adobe Portfolio site. PUBLISH your website and share the link as a text submission for the Project 2 Assignment and Reflection. Don't forget to UPLOAD a pdf copy of your group's amortization schedule with your submission. Each group member can submit his or her own link/schedule separately since the assignment accepts unlimited submissions . . . . O 2. Find a home to purchase. Use a realty website such as Zillow or Realtor.com to find the home you'd like to purchase. Include an image of the house in your presentation and, in at least 150 words, describe the considerations that went into choosing your house, including: The location in which town, city, or state is your home located? The size. How many bedrooms and baths will your home have? Approximately how many square feet is your home? The layout. What features does your home have? Describe the features you're looking for in a home. 3. Mortgage Information. Gather or calculate the following information: The asking price. Assume you are purchasing the home for the amount at which it is listed. The down payment. Assume you make a standard 20% down payment on the house. The loan amount. How much do you need to borrow to cover the price of the home? The Interest rate. Use a website like Bankrate to identify a realistic, current rate for your mortgage. Assume you choose a 30-year fixed loan with no points. (Points are outside the scope of this project.) The monthly payment. While there are many online mortgage calculators, you will show the work of this calculation using the formula below, where PMT is the monthly payment. o P is the loan amount (1 + 0-1 o is the monthly interest rate. PMT = P(1 +O N is the total number of months. (Note that this formula solves for the payment of an annuity that will equal the amount the lender should earn from a compound interest investment.) 4. Amortization schedule. Use the Excel template, provided as an attachment to the Project 2 assignment in Blackboard, to create your mortgage repayment schedule for the entire life of the loan (meaning for the entire 30 years). The repayment dates and the number of months for each row have been prefilled for you. Include the amortization repayment schedule you create as a separate attachment for this project. 5. Conclusion. After completing the table, answer the following using at least 100 words per question: a) How much will you pay in interest during the entire 30 years of repayment? What percentage of the overall amount paid is interest? b) How long will it take you to pay half of the loan amount? Consider your answer in comparison to the entire 30- year timespan - is this half of the total repayment period? Why or why not? c) Suppose you paid an extra $100 each month (increasing each monthly payment by $100), thus reducing the amount of time to pay off the loan. What date (month and year) would you finish paying off the loan? How much less would your total interest on the loan be versus the full 30 years? Explain completely how you got your answer. 6. Video. Each member of your team is responsible for creating and narrating at least one side for the presentation of this project. Instructions are available on using Microsoft PowerPoint to narrate and save a presentation as a video It is your team's responsibility to decide which information is on each side to clearly present your answers to questions 1 through 5 above, and work must be equitably distributed. Your team must collect each slide and assemble them to create an mp4 Video as the final product for this project. (Note: see the Resource Manager job description in question 1.) Your answer to question should be an mp4 video collaborative of slides created by you and your team members that documents your process reaching the answer to the question posed in this project 7. Submission. Each group member should upload the video to their Adobe Portfolio site. PUBLISH your website and share the link as a text submission for the Project 2 Assignment and Reflection. Don't forget to UPLOAD a pdf copy of your group's amortization schedule with your submission. Each group member can submit his or her own link/schedule separately since the assignment accepts unlimited submissions. Congratulations! You've completed Project #2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts