Question: This project has two problems centered around finance - one question about the mathematical explosion of compound interest and the other about the stock

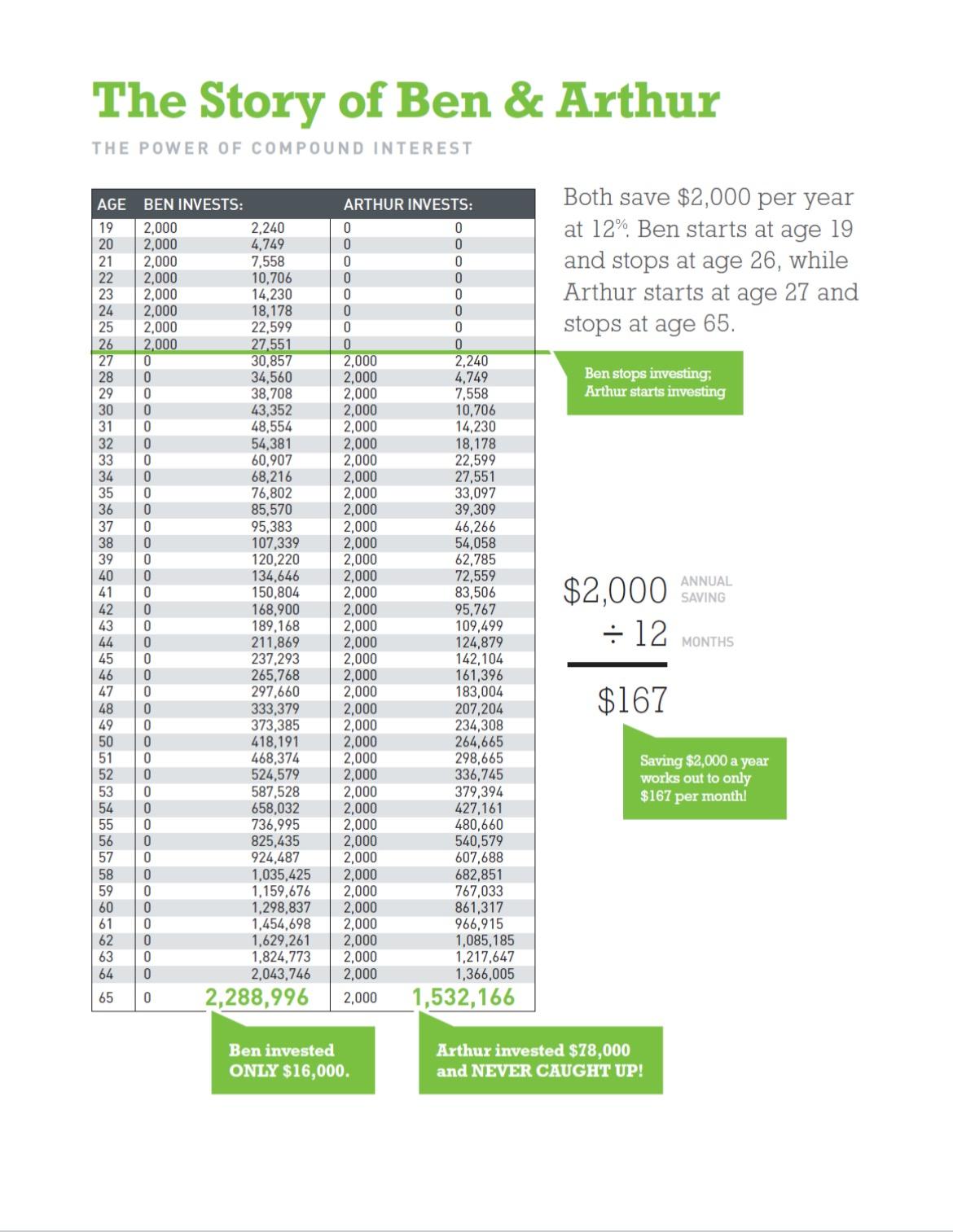

This project has two problems centered around finance - one question about the mathematical explosion of compound interest and the other about the stock market. Enjoy! Problem 1 To get started, please watch this short video. The table that Dave talks about in the video is featured below. 1. Write a few sentences summarizing and explaining what Dave was talking about. Why is compound interest so important? Why is time so important? 2. Let's use mathematics to see why time is so important when it comes to saving for retirement. Suppose you have $10,000 to invest in a mutual fund that averages a 12% annual return. a) After 5 years, what is the value of the fund? Explain or show your work. b) After 10 years, what is the value of the fund? Explain or show your work. c) After 20 years, what is the value of the fund? Explain or show your work. d) It looks like time doubles in parts b) and c) from 10 to 20 years. Does the account value also double? If not, why not? The Story of Ben & Arthur THE POWER OF COMPOUND INTEREST AGE BEN INVESTS: 19 2,000 20 2,000 21 2,000 22 2,000 23 2,000 24 2,000 25 2,000 2,000 26 27 28 29 30 31 32 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 59 60 61 62 63 64 65 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Dood 0 0 0 oooooooooooooooooooo 0 0 0 0 0 0 0 2,240 4,749 7,558 10,706 14,230 18,178 22,599 27,551 30,857 34,560 38,708 43,352 48,554 54,381 60,907 68,216 76,802 85,570 95,383 107,339 120,220 134,646 150,804 168,900 189,168 211,869 237,293 265,768 297,660 333,379 373,385 418,191 468,374 524,579 587,528 658,032 736,995 825,435 924,487 ARTHUR INVESTS: 0 0 0 0 0 0 0 0 0 0 0 0 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 1,035,425 2,000 1,159,676 2,000 1,298,837 2,000 1,454,698 2,000 1,629,261 2,000 1,824,773 2,000 2,043,746 2,000 2,288,996 2,000 Ben invested ONLY $16,000. 0 0 0 0 2,240 4,749 7,558 10,706 14,230 18,178 22,599 27,551 33,097 39,309 46,266 54,058 62,785 72,559 83,506 95,767 109,499 124,879 142,104 161,396 183,004 207,204 234,308 264,665 298,665 336,745 379,394 427,161 480,660 540,579 607,688 682,851 767,033 861,317 966,915 1,085,185 1,217,647 1,366,005 1,532,166 Both save $2,000 per year at 12% Ben starts at age 19 and stops at age 26, while Arthur starts at age 27 and stops at age 65. Ben stops investing, Arthur starts investing ANNUAL SAVING 12 MONTHS $2,000 $167 Saving $2,000 a year works out to only $167 per month! Arthur invested $78,000 and NEVER CAUGHT UP!

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts