Question: This project is a continuation of Projects 1 & 2, JaJos Consulting and Sales Inc. A time machine has taken us 2 years into the

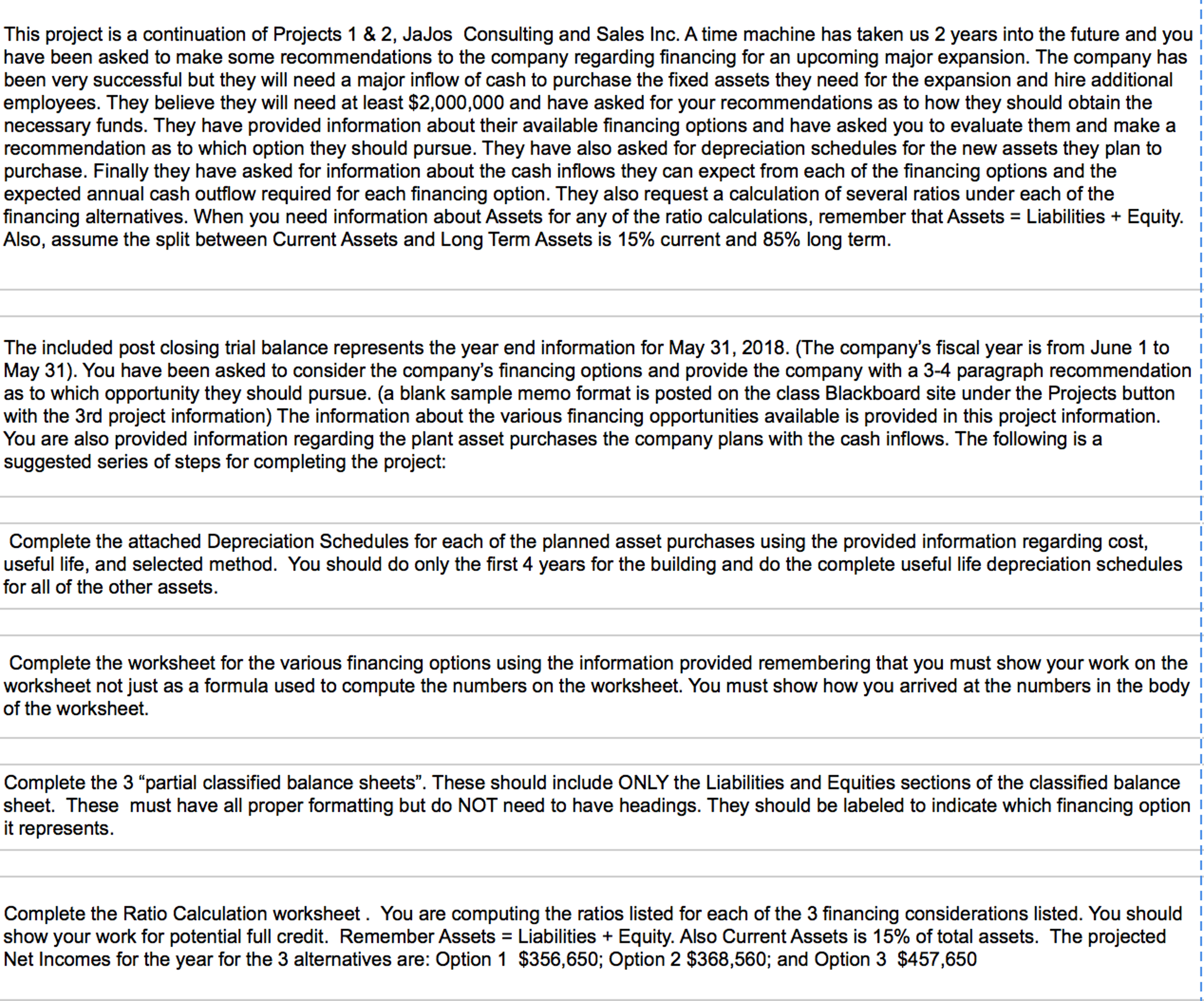

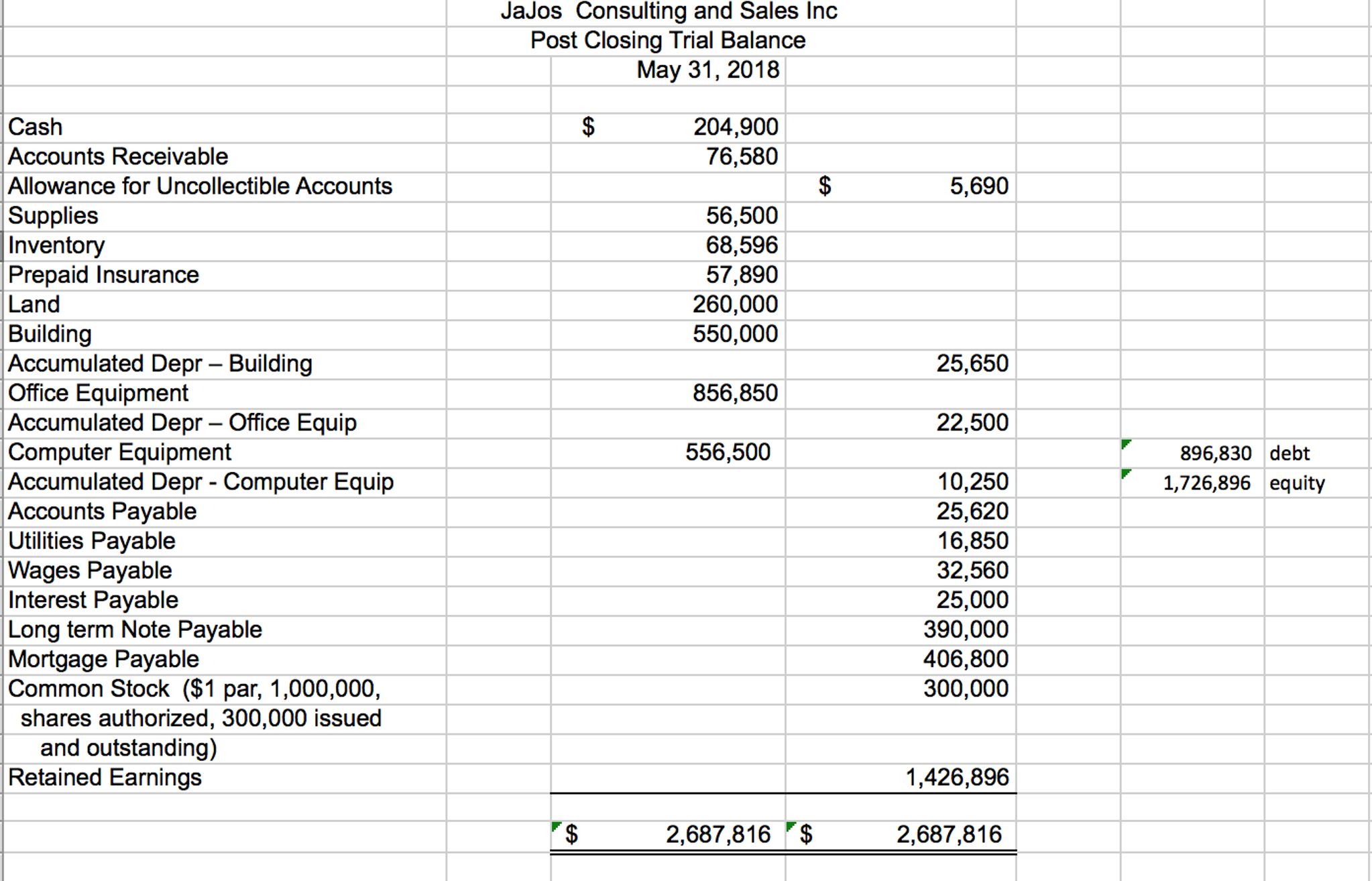

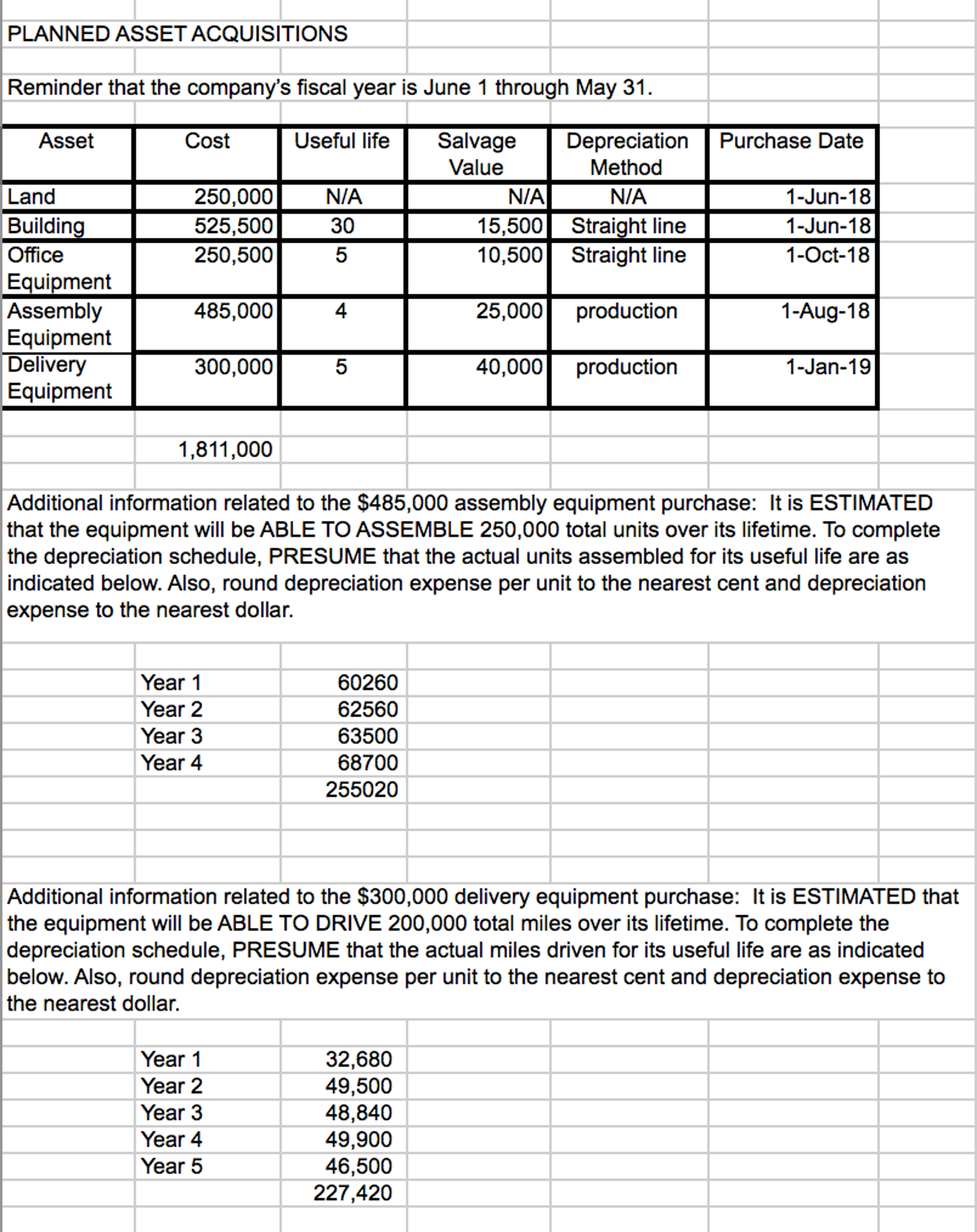

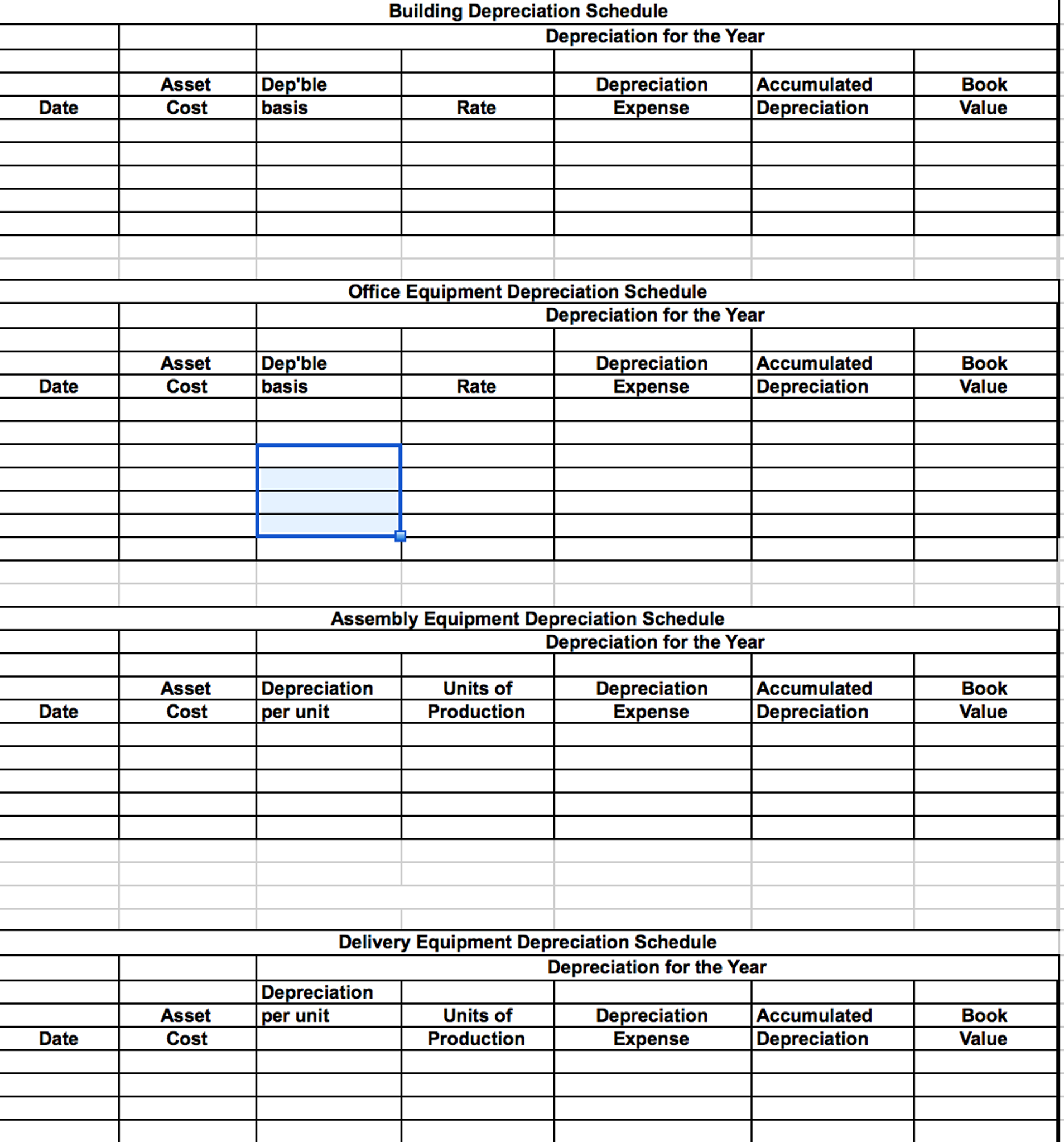

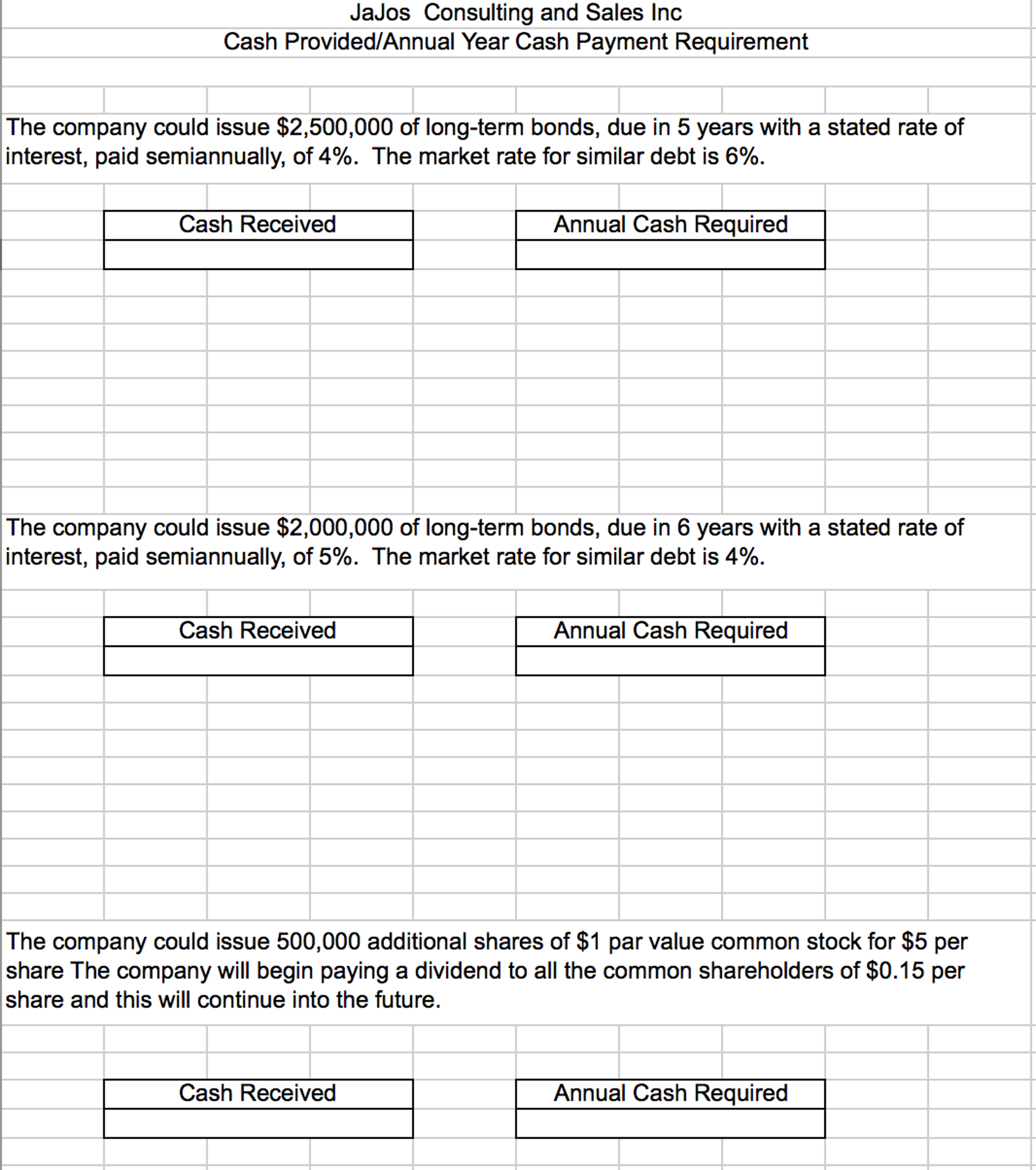

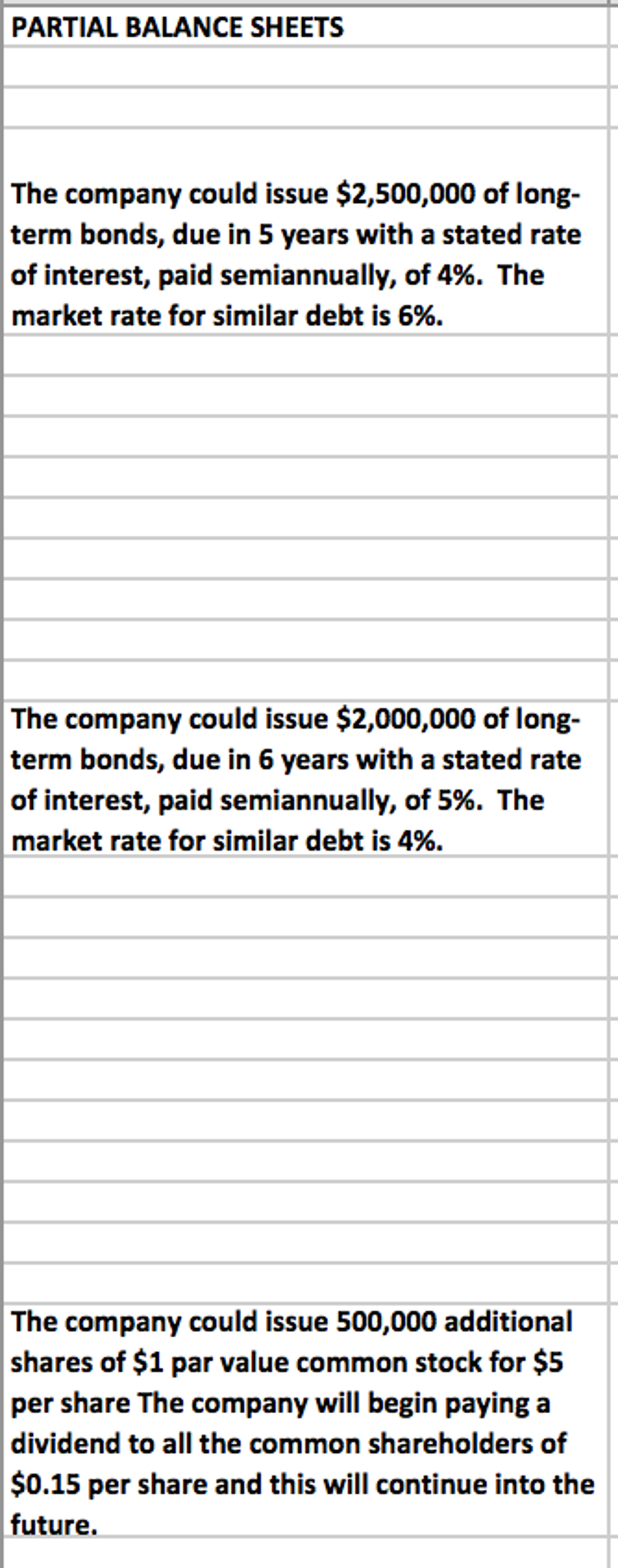

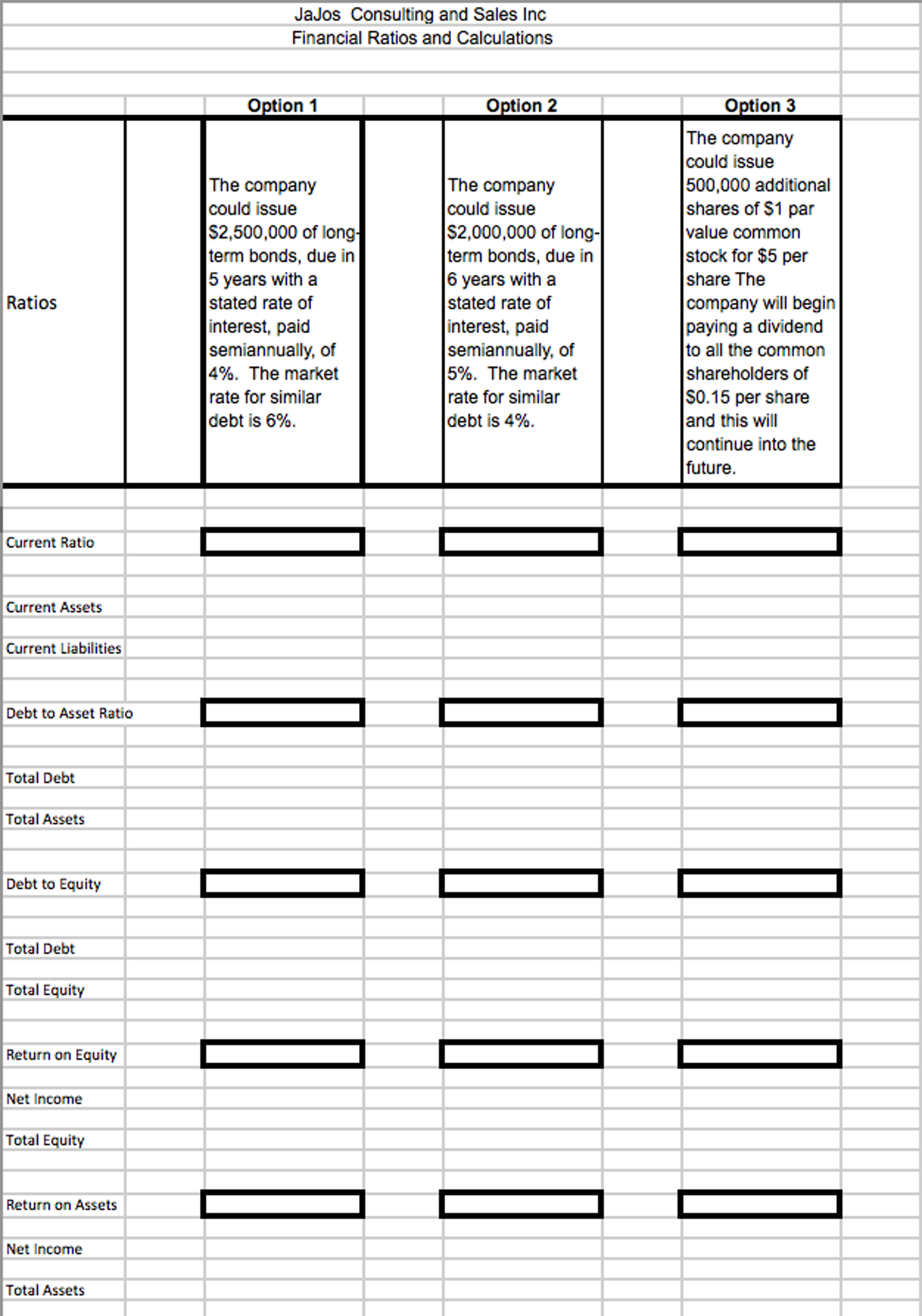

This project is a continuation of Projects 1 & 2, JaJos Consulting and Sales Inc. A time machine has taken us 2 years into the future and you have been asked to make some recommendations to the company regarding financing for an upcoming major expansion. The company has l been very successful but they will need a major inflow of cash to purchase the fixed assets they need for the expansion and hire additional employees. They believe they will need at least $2,000,000 and have asked for your recommendations as to how they should obtain the necessary funds. They have provided information about their available financing options and have asked you to evaluate them and make a recommendation as to which option they should pursue. They have also asked for depreciation schedules for the new assets they plan to purchase. Finally they have asked for information about the cash inflows they can expect from each of the financing options and the expected annual cash outflow required for each financing option. They also request a calculation of several ratios under each of the financing alternatives. When you need information about Assets for any of the ratio calculations, remember that Assets Liabilities Equity Also, assume the split between Current Assets and Long Term Assets is 15% current and 85% long term The included post closing trial balance represents the year end information for May 31, 2018. (The company's fiscal year is from June 1 to May 31). You have been asked to consider the company's financing options and provide the company with a 3-4 paragraph recommendation as to which opportunity they should pursue. (a blank sample memo format is posted on the class Blackboard site under the Projects button with the 3rd project information) The information about the various financing opportunities available is provided in this project information You are also provided information regarding the plant asset purchases the company plans with the cash inflows. The following is a suggested series of steps for completing the projec Complete the attached Depreciation Schedules for each of the planned asset purchases using the provided information regarding cost useful life, and selected method. You should do only the first 4 years for the building and do the complete useful life depreciation schedules for all of the other assets Complete the worksheet for the various financing options using the information provided remembering that you must show your work on the worksheet not just as a formula used to compute the numbers on the worksheet. You must show how you arrived at the numbers in the body of the worksheet Complete the 3 "partial classified balance sheets". These should include ONLY the Liabilities and Equities sections of the classified balance sheet. These must have all proper formatting but do NOT need to have headings. They should be labeled to indicate which financing option represents Complete the Ratio Calculation worksheet. You are computing the ratios listed for each of the 3 financing considerations listed. You should show your work for potential full credit. Remember Assets Liabilities Equity. Also Current Assets is 15% of total assets. The projected Net Incomes for the year for the 3 alternatives are: Option 1 $356,650; Option 2 $368,560; and Option 3 $457,650

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts