Question: This project is devoted to figuring out how much we need to have in retirement, how much we will need to save to meet that

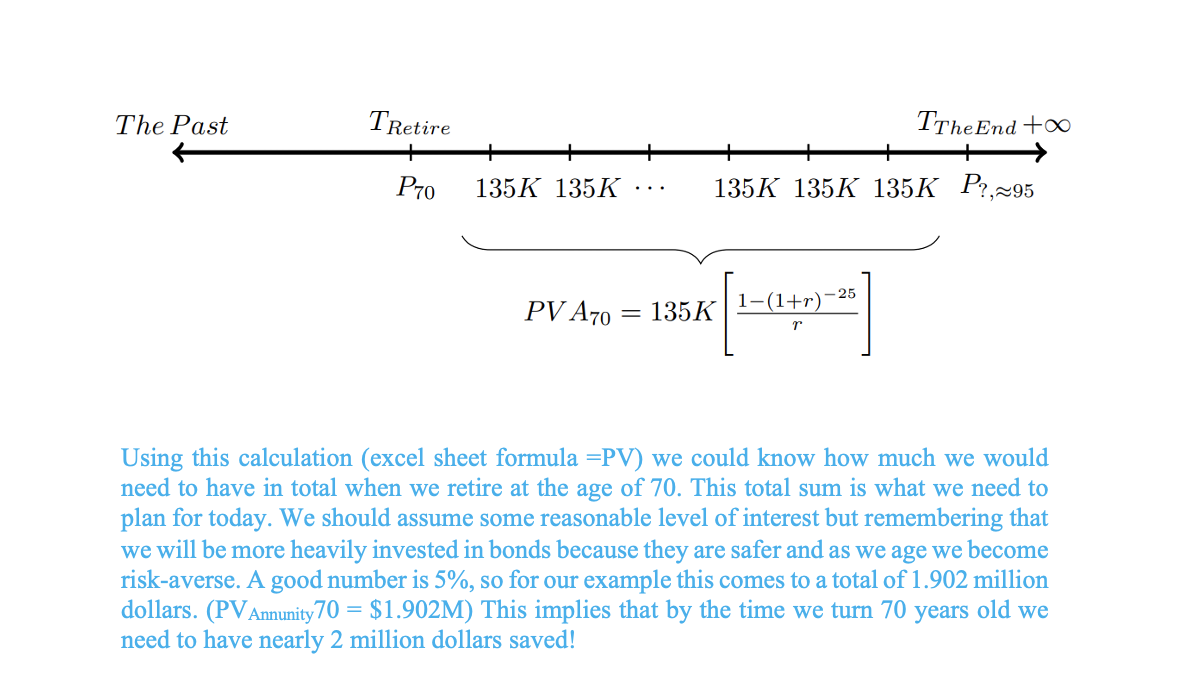

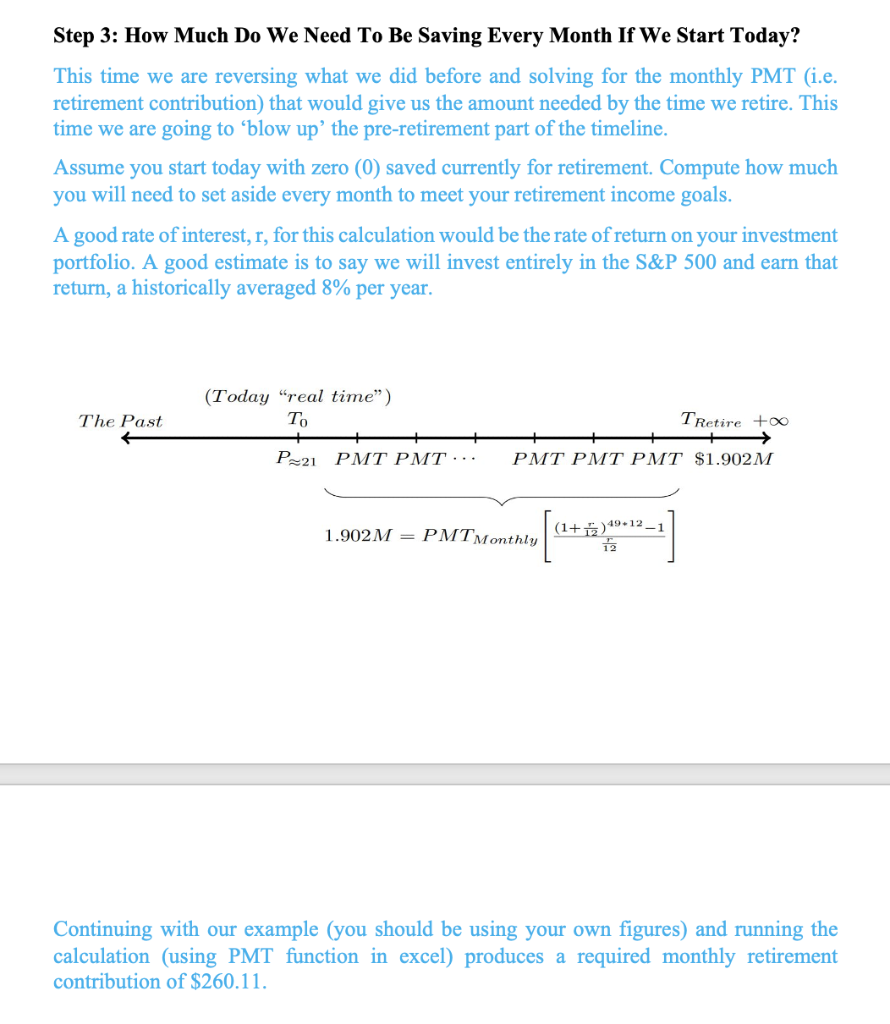

This project is devoted to figuring out how much we need to have in retirement, how much we will need to save to meet that goal and developing our own starter portfolio to begin investing First Part---How Much Do We Really Need Step 1: Adjust Income for Inflation The first step we took was to figure out based on our income at (approximately 21 years old, use your true age), and figure out how much that would be at age 70. This allows us to use the P70 as an annual income during retirement. Let's assume the number comes to P70=$135,000 per year. (Today "real time") TO The Past Tretire TThe End too P21 P70 P2,95 P21(1 + r) 49 Step 2: Figure Out Total Need at the Beginning of Retirement Supposing our retirement income is P70 = $135,000, i.e. based on our income today that is equivalent to one-hundred and thirty-five thousand dollars when we retire. Assuming our annual income doesn't grow during the entire period of our retirement. Also, assume you will pass-away at 95 years old for this exercise. how much would we need to have put away when we retire at 70? To see how this looks lets blow up' the retirement section of our timeline. In reality we are going to take the present value of an annuity, because there will be equal annual payment produced from our retirement account to pay our bills from the time we turn 70 until we perish at 95. A total of 25 years. The question is, how much is this 25 years worth of annual cash flows worth to us (not today!) but when we would retire? ( i.e. at 70) The Past TRetire TTheEnd too P70 135K 135K 135K 135K 135K P2,29 295 PV A70 135K -25 1-(1+r) / Using this calculation (excel sheet formula =PV) we could know how much we would need to have in total when we retire at the age of 70. This total sum is what we need to plan for today. We should assume some reasonable level of interest but remembering that we will be more heavily invested in bonds because they are safer and as we age we become risk-averse. A good number is 5%, so for our example this comes to a total of 1.902 million dollars. (PV Annunity70 = $1.902M) This implies that by the time we turn 70 years old we need to have nearly 2 million dollars saved! = Step 3: How Much Do We Need To Be Saving Every Month If We Start Today? This time we are reversing what we did before and solving for the monthly PMT (i.e. retirement contribution) that would give us the amount needed by the time we retire. This time we are going to blow up' the pre-retirement part of the timeline. Assume you start today with zero (7) saved currently for retirement. Compute how much you will need to set aside every month to meet your retirement income goals. A good rate of interest, r, for this calculation would be the rate of return on your investment portfolio. A good estimate is to say we will invest entirely in the S&P 500 and earn that return, a historically averaged 8% per year. (Today "real time") The Past TRetire too P_21 PMT PMT... PMT PMT PMT $1.902M 1.902M = PMTMonthly (1+0)49-12-1 1 Continuing with our example (you should be using your own figures) and running the calculation (using PMT function in excel) produces a required monthly retirement contribution of $260.11. This project is devoted to figuring out how much we need to have in retirement, how much we will need to save to meet that goal and developing our own starter portfolio to begin investing First Part---How Much Do We Really Need Step 1: Adjust Income for Inflation The first step we took was to figure out based on our income at (approximately 21 years old, use your true age), and figure out how much that would be at age 70. This allows us to use the P70 as an annual income during retirement. Let's assume the number comes to P70=$135,000 per year. (Today "real time") TO The Past Tretire TThe End too P21 P70 P2,95 P21(1 + r) 49 Step 2: Figure Out Total Need at the Beginning of Retirement Supposing our retirement income is P70 = $135,000, i.e. based on our income today that is equivalent to one-hundred and thirty-five thousand dollars when we retire. Assuming our annual income doesn't grow during the entire period of our retirement. Also, assume you will pass-away at 95 years old for this exercise. how much would we need to have put away when we retire at 70? To see how this looks lets blow up' the retirement section of our timeline. In reality we are going to take the present value of an annuity, because there will be equal annual payment produced from our retirement account to pay our bills from the time we turn 70 until we perish at 95. A total of 25 years. The question is, how much is this 25 years worth of annual cash flows worth to us (not today!) but when we would retire? ( i.e. at 70) The Past TRetire TTheEnd too P70 135K 135K 135K 135K 135K P2,29 295 PV A70 135K -25 1-(1+r) / Using this calculation (excel sheet formula =PV) we could know how much we would need to have in total when we retire at the age of 70. This total sum is what we need to plan for today. We should assume some reasonable level of interest but remembering that we will be more heavily invested in bonds because they are safer and as we age we become risk-averse. A good number is 5%, so for our example this comes to a total of 1.902 million dollars. (PV Annunity70 = $1.902M) This implies that by the time we turn 70 years old we need to have nearly 2 million dollars saved! = Step 3: How Much Do We Need To Be Saving Every Month If We Start Today? This time we are reversing what we did before and solving for the monthly PMT (i.e. retirement contribution) that would give us the amount needed by the time we retire. This time we are going to blow up' the pre-retirement part of the timeline. Assume you start today with zero (7) saved currently for retirement. Compute how much you will need to set aside every month to meet your retirement income goals. A good rate of interest, r, for this calculation would be the rate of return on your investment portfolio. A good estimate is to say we will invest entirely in the S&P 500 and earn that return, a historically averaged 8% per year. (Today "real time") The Past TRetire too P_21 PMT PMT... PMT PMT PMT $1.902M 1.902M = PMTMonthly (1+0)49-12-1 1 Continuing with our example (you should be using your own figures) and running the calculation (using PMT function in excel) produces a required monthly retirement contribution of $260.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts