Question: This project will run for six years and will require an initial investment of $17,500,000 for new equipment. At the end of the six years,

This project will run for six years and will require an initial investment of $17,500,000 for new equipment. At the end of the six years, this equipment can be sold for $600,000. The initial working capital required will be Inventory of $400,000,000, Accounts Receivable of $1,000,000 and Accounts Payable of $3,000,000. You have contacted CRA and determined that the asset class for this equipment is Class 6 which has a CCA rate of 10%. You also confirm that the companys tax rate is 34%. The company forecasts that they can sell their new products at a price of $250, and that the variable cost of each unit sold is $140. The required rate of return for this project is 30% You have been asked to calculate the NPV and IRR of this project.

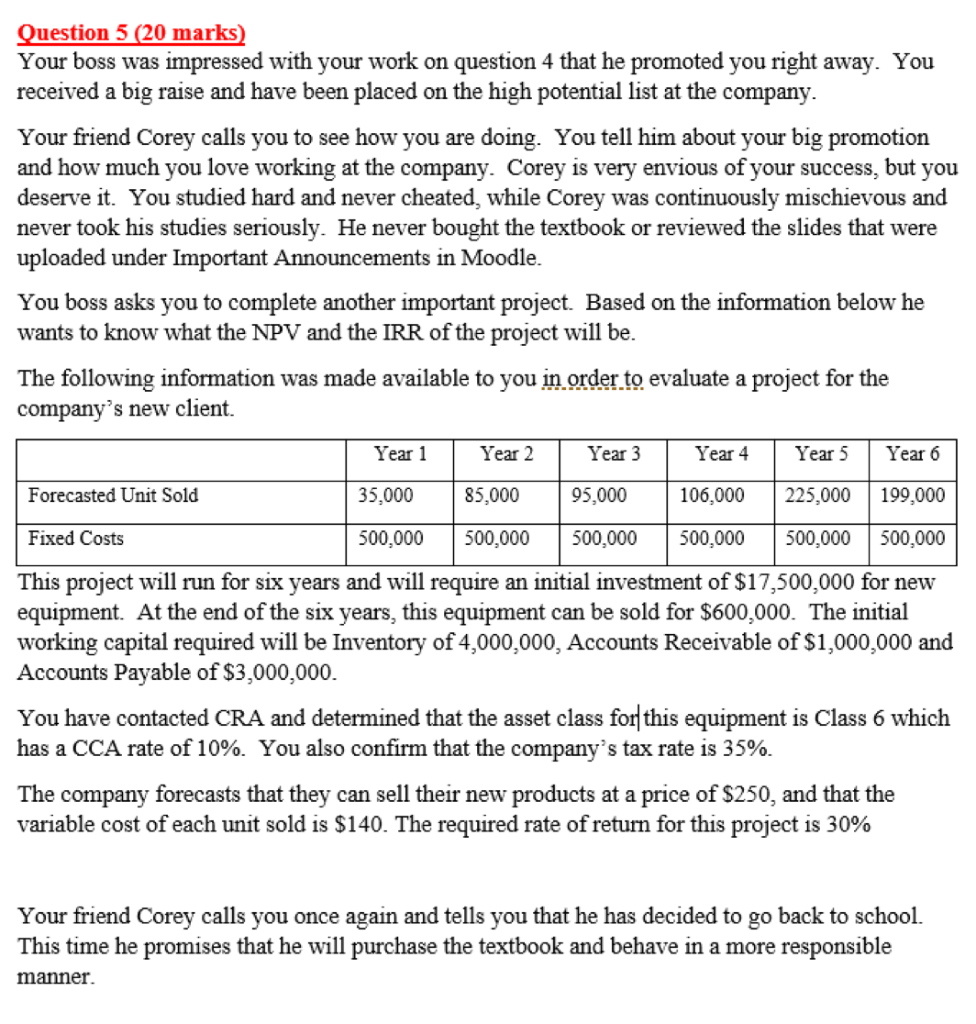

Question 5 (20 marks) Your boss was impressed with your work on question 4 that he promoted you right away. You received a big raise and have been placed on the high potential list at the company. Your friend Corey calls you to see how you are doing. You tell him about your big promotion and how much you love working at the company. Corey is very envious of your success, but you deserve it. You studied hard and never cheated, while Corey was continuously mischievous and never took his studies seriously. He never bought the textbook or reviewed the slides that were uploaded under Important Announcements in Moodle. You boss asks you to complete another important project. Based on the information below he wants to know what the NPV and the IRR of the project will be. The following information was made available to you in order to evaluate a project for the company's new client. Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Forecasted Unit Sold 35,000 85,000 95,000 106,000 225,000 199,000 Fixed Costs 500,000 500,000 500,000 500,000 500,000 500,000 This project will run for six years and will require an initial investment of $17,500,000 for new equipment. At the end of the six years, this equipment can be sold for $600,000. The initial working capital required will be Inventory of 4,000,000, Accounts Receivable of $1,000,000 and Accounts Payable of $3,000,000. You have contacted CRA and determined that the asset class for this equipment is Class 6 which has a CCA rate of 10%. You also confirm that the company's tax rate is 35%. The company forecasts that they can sell their new products at a price of $250, and that the variable cost of each unit sold is $140. The required rate of return for this project is 30% Your friend Corey calls you once again and tells you that he has decided to go back to school. This time he promises that he will purchase the textbook and behave in a more responsible manner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts