Question: This question: 2 point(s) possible (Calculating operating cash flows) The Heritage Farm Implement Company is considering an investment which is expected to generate revenue

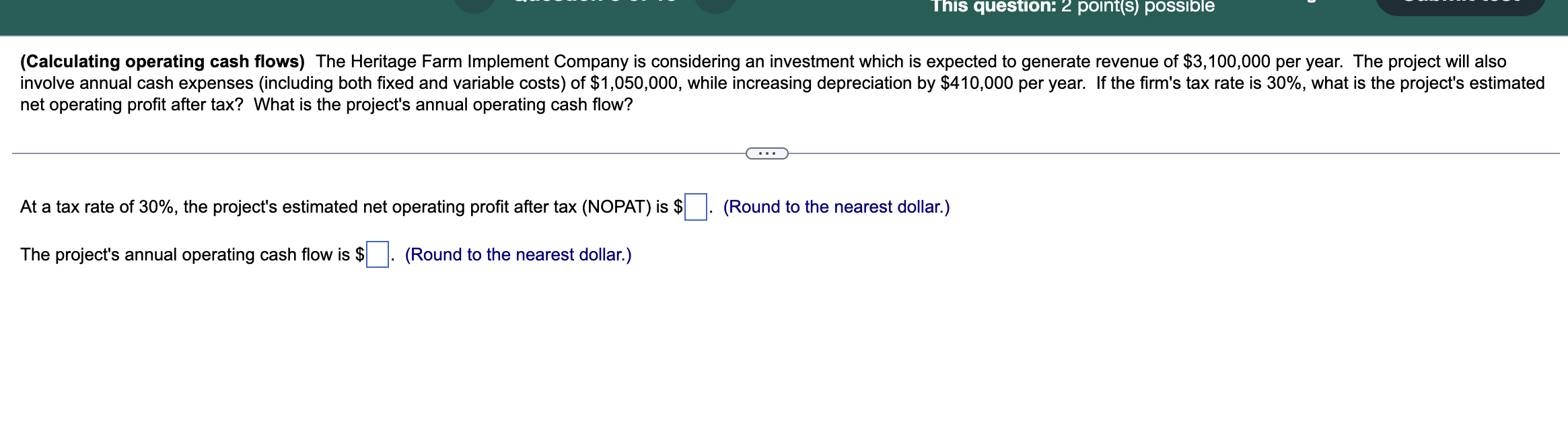

This question: 2 point(s) possible (Calculating operating cash flows) The Heritage Farm Implement Company is considering an investment which is expected to generate revenue of $3,100,000 per year. The project will also involve annual cash expenses (including both fixed and variable costs) of $1,050,000, while increasing depreciation by $410,000 per year. If the firm's tax rate is 30%, what is the project's estimated net operating profit after tax? What is the project's annual operating cash flow? At a tax rate of 30%, the project's estimated net operating profit after tax (NOPAT) is $ The project's annual operating cash flow is $ . (Round to the nearest dollar.) (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts