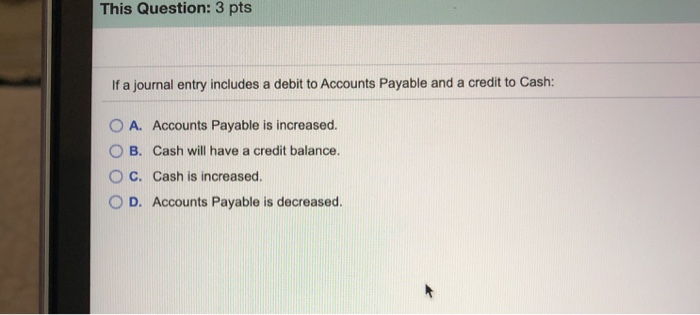

Question: This Question: 3 pts If a journal entry includes a debit to Accounts Payable and a credit to Cash: A. Accounts Payable is increased. B.

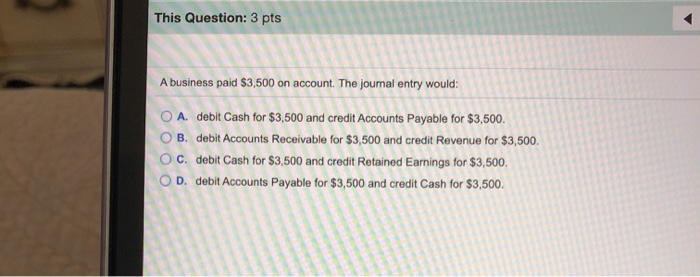

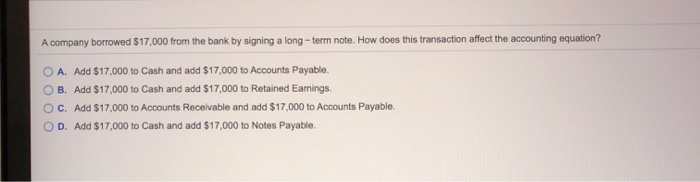

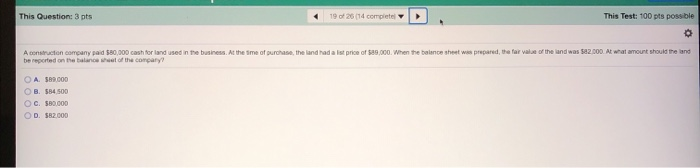

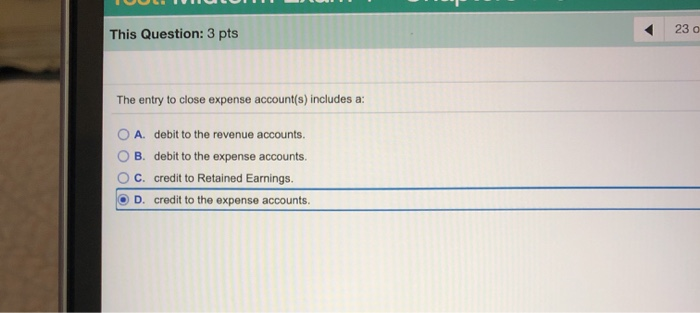

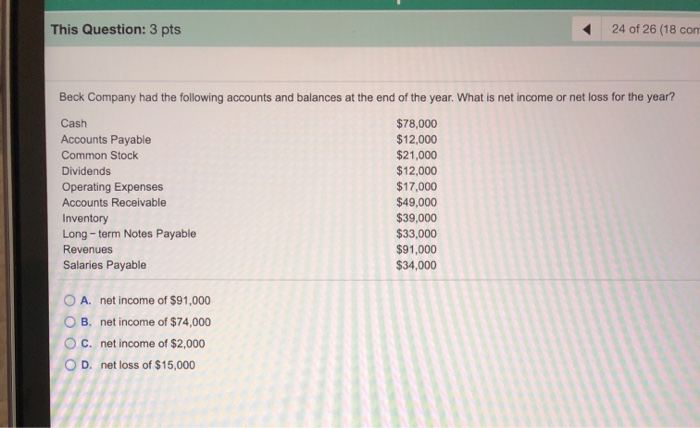

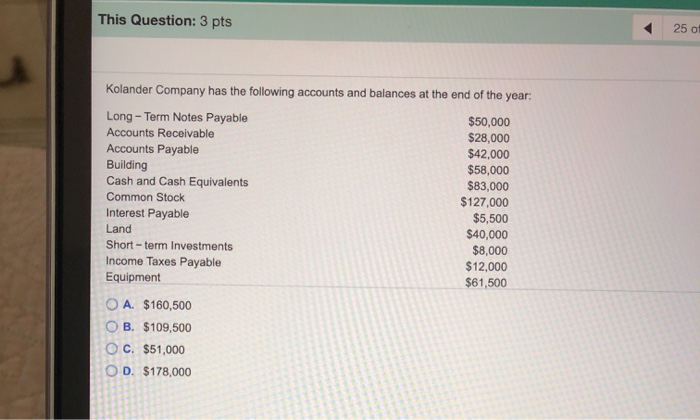

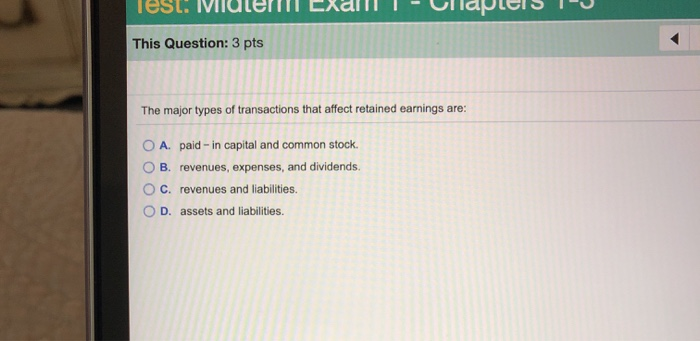

This Question: 3 pts If a journal entry includes a debit to Accounts Payable and a credit to Cash: A. Accounts Payable is increased. B. Cash will have a credit balance. C. Cash is increased. D. Accounts Payable is decreased. This Question: 3 pts A business paid $3,500 on account. The journal entry would: A. debit Cash for $3,500 and credit Accounts Payable for $3,500. OB. debit Accounts Receivable for $3,500 and credit Revenue for $3,500. OC. debit Cash for $3,500 and credit Retained Earnings for $3,500 OD. debit Accounts Payable for $3,500 and credit Cash for $3,500. A company borrowed $17,000 from the bank by signing a long-term note. How does this transaction affect the accounting equation? A. Add $17,000 to Cash and add $17,000 to Accounts Payable. OB. Add $17,000 to Cash and add $17,000 to Retained Earnings. C. Add $17,000 to Accounts Receivable and add $17,000 to Accounts Payable. OD. Add $17,000 to Cash and add $17,000 to Notes Payable. This Question: 3 pts 19 of 26 (14 complete This Test: 100 pts possible A construction company paid $80,000 cash for land used in the business. At the time of purchase, the land had a ist price of 589,000. When the balance sheet was prepared, the far value of the land was $22.000. At what amount should the land be reported on the balance of the company A 50.000 OB. 584 500 C. 500.000 OD. 582.000 This Question: 3 pts 230 The entry to close expense account(s) includes a: OO A. debit to the revenue accounts. B. debit to the expense accounts. C. credit to Retained Earnings. D. credit to the expense accounts. This Question: 3 pts 24 of 26 (18 con Beck Company had the following accounts and balances at the end of the year. What is net income or net loss for the year? Cash $78,000 Accounts Payable $12,000 Common Stock $21,000 Dividends $12,000 Operating Expenses $17,000 Accounts Receivable $49,000 Inventory $39,000 Long-term Notes Payable $33,000 Revenues $91,000 Salaries Payable $34,000 O A. net income of $91,000 O B. net income of $74,000 OC. net income of $2,000 OD. net loss of $15,000 This Question: 3 pts 25 of Kolander Company has the following accounts and balances at the end of the year. Long-Term Notes Payable $50,000 Accounts Receivable $28,000 Accounts Payable $42.000 Building $58,000 Cash and Cash Equivalents $83,000 Common Stock $127.000 Interest Payable $5,500 Land $40,000 Short-term Investments $8,000 Income Taxes Payable $12,000 Equipment $61,500 O A $160,500 OB. $109,500 OC. $51,000 OD. $178,000 Test: This Question: 3 pts The major types of transactions that affect retained earnings are: OO A. paid - in capital and common stock. B. revenues, expenses, and dividends. C. revenues and liabilities. D. assets and liabilities. O