Question: This question: 8 point(s) possible The face value is $98,000, the stated rate is 10%, and the term of the bond is eight years. The

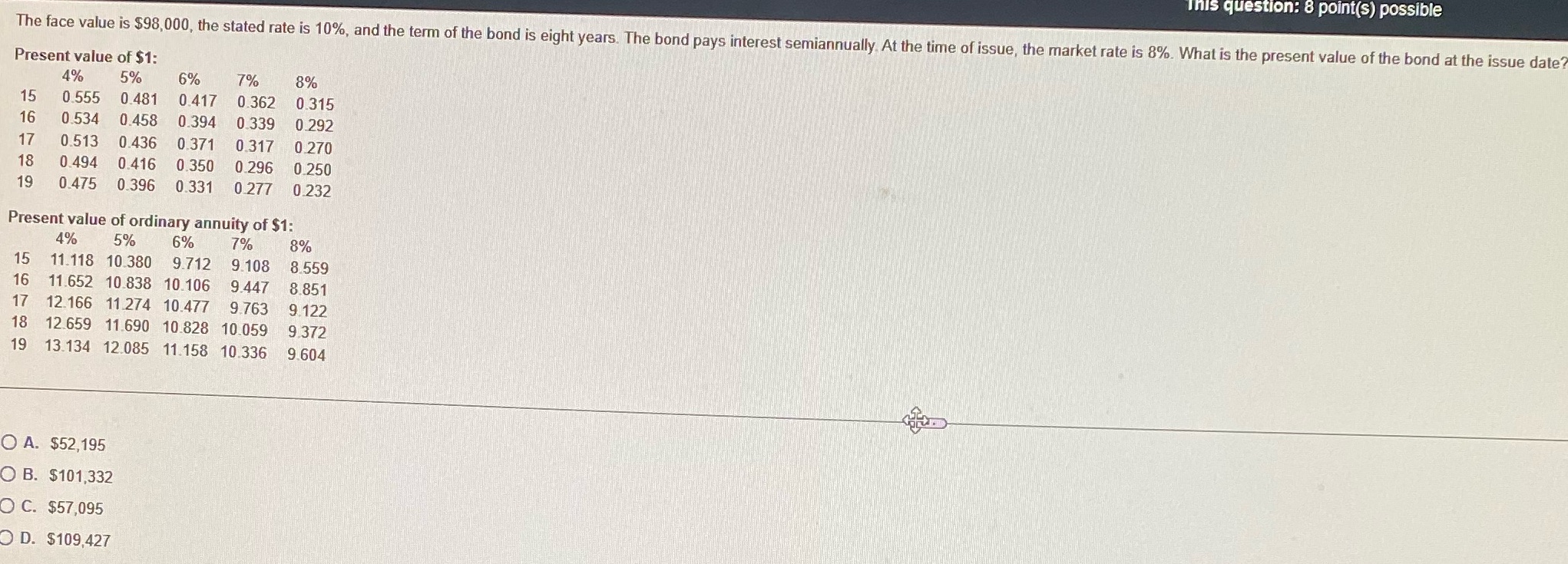

This question: 8 point(s) possible The face value is $98,000, the stated rate is 10%, and the term of the bond is eight years. The bond pays interest semiannually. At the time of issue, the market rate is 8%. What is the present value of the bond at the issue date? Present value of $1: 4% 5% 6% 7% 8% 15 0.555 0.481 0.417 0.362 0.315 16 0.534 0.458 0.394 0.339 0.292 17 0.513 0.436 0.371 0.317 0.270 18 0.494 0.416 0.350 0.296 0.250 19 0.475 0.396 0.331 0.277 0.232 Present value of ordinary annuity of $1: 4% 5% 6% 7% 8% 15 11 118 10 380 9.712 9.108 8 559 16 11.652 10 838 10.106 9.447 8.851 17 12 166 11 274 10.477 9.763 9.122 18 12 659 11.690 10.828 10.059 9.372 9 13 134 12.085 11.158 10.336 9.604 O A. $52, 195 O B. $101,332 O C. $57,095 O D. $109,427

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts