Question: This question and numbers for the below question format Best Fender uses a standard cost system and provide the following information: (Click the icon to

This question and numbers for the below question format

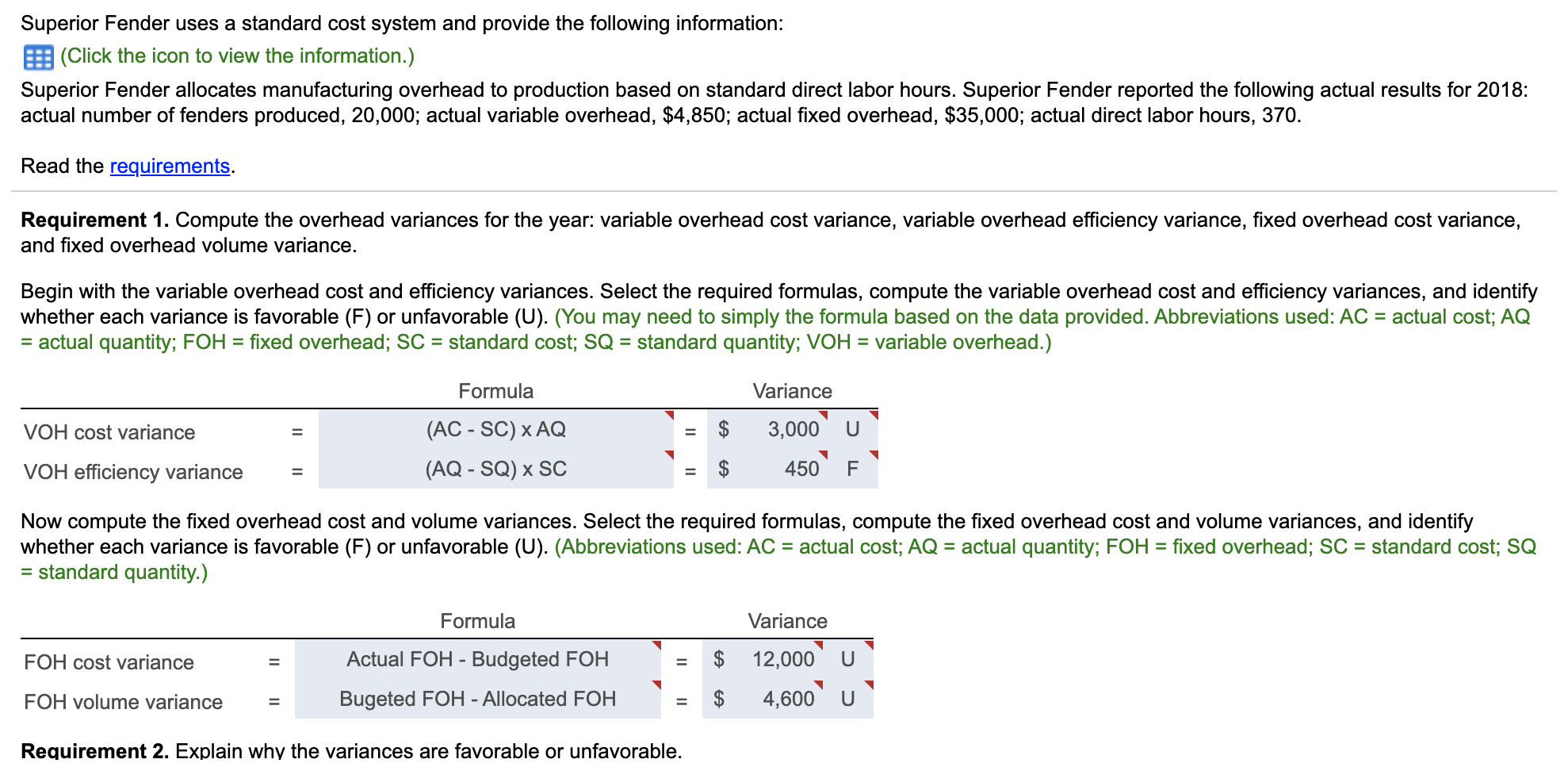

Best Fender uses a standard cost system and provide the following information: (Click the icon to view the information.) Best Fender allocates manufacturing overhead to production based on standard direct labor hours. Best Fender reported the following actual results for 2018: actual number of fenders produced, 20,000; actual variable overhead, $4,730; actual fixed overhead, $34,000; actual direct labor hours, 400. Read the requirements. Superior Fender uses a standard cost system and provide the following information: E: (Click the icon to view the information.) Superior Fender allocates manufacturing overhead to production based on standard direct labor hours. Superior Fender reported the following actual results for 2018: actual number of fenders produced, 20,000; actual variable overhead, $4,850; actual fixed overhead, $35,000; actual direct labor hours, 370. Read the requirements. Requirement 1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. Begin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (You may need to simply the formula based on the data provided. Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity; VOH = variable overhead.) Formula VOH cost variance VOH efficiency variance (AC-SC) XAQ (AQ - SQ)X SC = $ = $ Variance 3,000 UN 450' F' Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance FOH cost variance Actual FOH - Budgeted FOH FOH volume variance = Bugeted FOH - Allocated FOH = Requirement 2. Explain why the variances are favorable or unfavorable. $ 4,600 u Best Fender uses a standard cost system and provide the following information: (Click the icon to view the information.) Best Fender allocates manufacturing overhead to production based on standard direct labor hours. Best Fender reported the following actual results for 2018: actual number of fenders produced, 20,000; actual variable overhead, $4,730; actual fixed overhead, $34,000; actual direct labor hours, 400. Read the requirements. Superior Fender uses a standard cost system and provide the following information: E: (Click the icon to view the information.) Superior Fender allocates manufacturing overhead to production based on standard direct labor hours. Superior Fender reported the following actual results for 2018: actual number of fenders produced, 20,000; actual variable overhead, $4,850; actual fixed overhead, $35,000; actual direct labor hours, 370. Read the requirements. Requirement 1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. Begin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (You may need to simply the formula based on the data provided. Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity; VOH = variable overhead.) Formula VOH cost variance VOH efficiency variance (AC-SC) XAQ (AQ - SQ)X SC = $ = $ Variance 3,000 UN 450' F' Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance FOH cost variance Actual FOH - Budgeted FOH FOH volume variance = Bugeted FOH - Allocated FOH = Requirement 2. Explain why the variances are favorable or unfavorable. $ 4,600 u

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts