Question: This question asks for information beginning 2016. The questions mentioned loss carryforwards but no mentions of loss carrybacks. Is there a way to handle this

This question asks for information beginning 2016. The questions mentioned "loss carryforwards" but no mentions of loss carrybacks. Is there a way to handle this question using just loss carryforward?

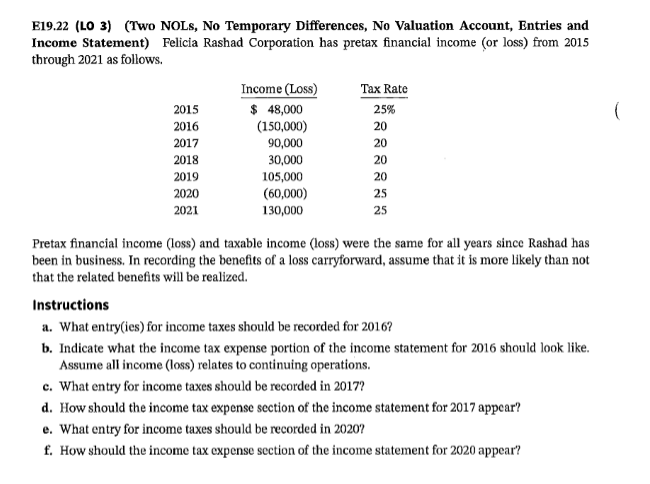

E19.22 (LO 3) (Two NOLs, No Temporary Differences, No Valuation Account, Entries and Income Statement) Felicia Rashad Corporation has pretax financial income (or loss) from 2015 through 2021 as follows. Income (Loss) Tax Rate 2015 $ 48,000 25% 2016 (150,000) 20 2017 90,000 20 2018 30,000 20 2019 105,000 20 2020 (60,000) 25 2021 130,000 25 Pretax financial income (loss) and taxable income (loss) were the same for all years since Rashad has been in business. In recording the benefits of a loss carryforward, assume that it is more likely than not that the related benefits will be realized. Instructions a. What entry(ies) for income taxes should be recorded for 2016? b. Indicate what the income tax expense portion of the income statement for 2016 should look like. Assume all income (loss) relates to continuing operations. c. What entry for income taxes should be recorded in 2017? d. How should the income tax expense section of the income statement for 2017 appear? e. What entry for income taxes should be recorded in 20207 f. How should the income tax expense section of the income statement for 2020 appear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts