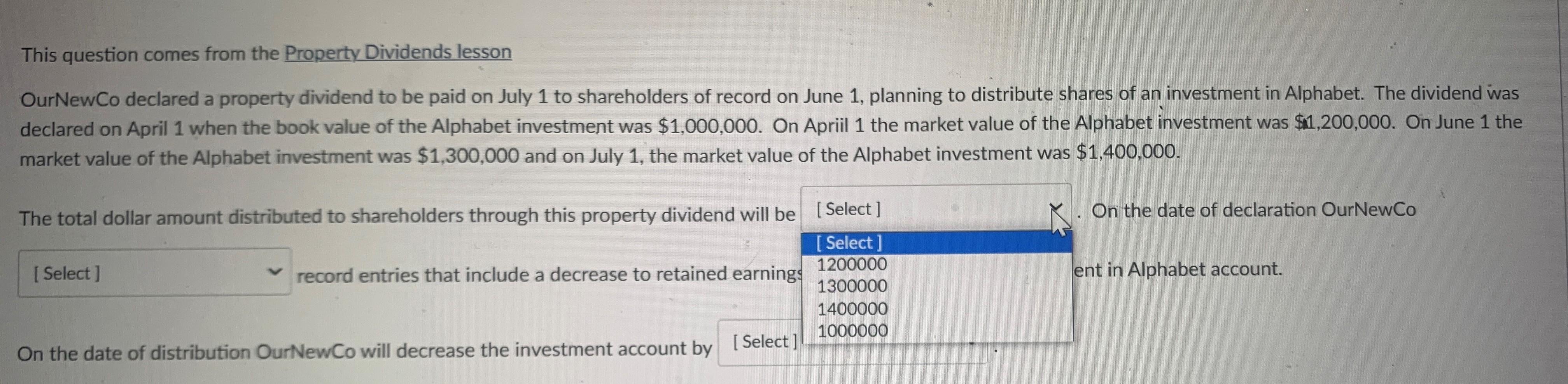

Question: This question comes from the Property Dividends lesson declared on April 1 when the book value of the Alphabet investment was $1,000,000. On Apriil 1

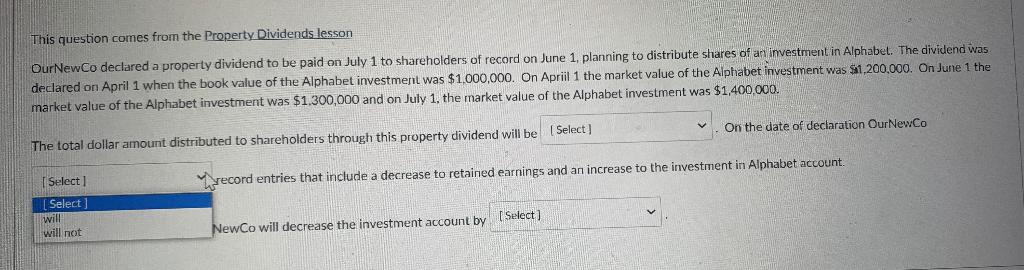

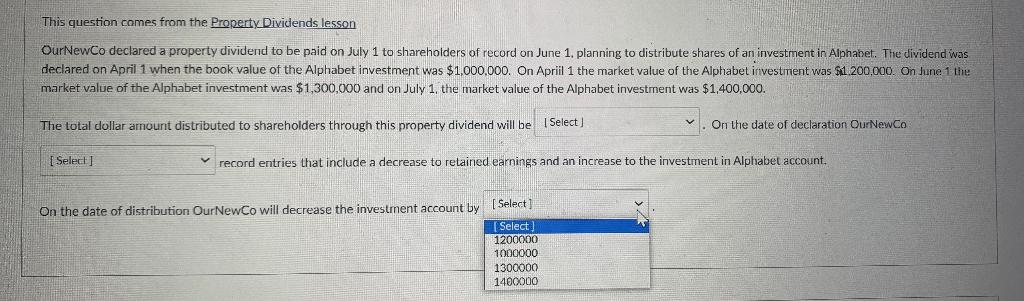

This question comes from the Property Dividends lesson declared on April 1 when the book value of the Alphabet investment was $1,000,000. On Apriil 1 the market value of the Alphabet investment was 1 the market value of the Alphabet investment was $1,300,000 and on July 1 , the market value of the Alphabet investment was $1,400,000. The total dollar amount distributed to shareholders through this property dividend will be recordentriesthatincludeadecreasetoretainedearning On the date of distribution OurNewCo will decrease the investment account by [Select] This question comes from the Property Dividends lesson OurNewCo declared a property dividend to be paid on July 1 to shareholders of record on June 1 , planning to distribute shares of an investment in Alphabet. The dividend was declared on April 1 when the book value of the Alphabet investment was $1,000,000. On Apriil 1 the market value of the Alphabet investment was $1,200,000. On June 1 the market value of the Alphabet investment was $1,300,000 and on July 1 , the market value of the Alphabet investment was $1,400,000. The total dollar amount distributed to shareholders through this property dividend will be On the date of declaration DurNewCo record entries that include a decrease to retained earnings and an increase to the investment in Alphabet account. NewCo will decrease the investment account by This question comes from the Property Dividends lesson OurNewCo declared a property dividend to be paid on July 1 to shareholders of record on June 1. planning to distribute shares of an investment in Alphahet. The dividend was declared on April 1 when the book value of the Alphabet investment was $1,000,000. On Apriil 1 the market value of the Alphabet irivestment was \$1,200,000. On June 1 the market value of the Alphabet investment was $1,300,000 and on July 1 , the market value of the Alphabet investment was $1,400,000. The total dollar amount distributed to shareholders through this property dividend will be On the date of declaration OurNewCo record entries that include a decrease to retained earnings and an increase to the investment in Alphabet account. On the date of distribution OurNewCo will decrease the investment account by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts