Question: This question has 2 parts, please answer both. a. b. Taxpayer owns a vacation home and personally uses it for 30 days of the year.

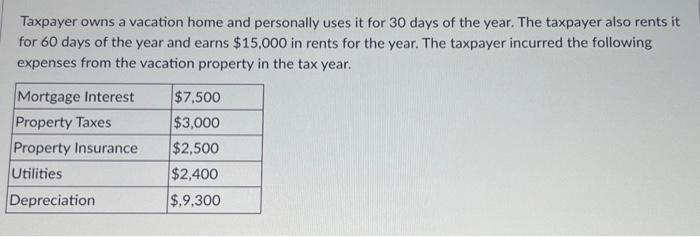

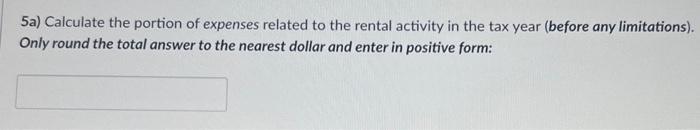

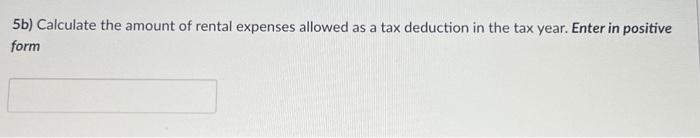

Taxpayer owns a vacation home and personally uses it for 30 days of the year. The taxpayer also rents it for 60 days of the year and earns $15,000 in rents for the year. The taxpayer incurred the following expenses from the vacation property in the tax year. 5a) Calculate the portion of expenses related to the rental activity in the tax year (before any limitations). Only round the total answer to the nearest dollar and enter in positive form: 5b) Calculate the amount of rental expenses allowed as a tax deduction in the tax year. Enter in positive form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts