Question: this question has 3 parts. plz help What do I need to add? Im not really sure what you mean. Consider recent financials for Ellie's

this question has 3 parts. plz help

What do I need to add? Im not really sure what you mean.

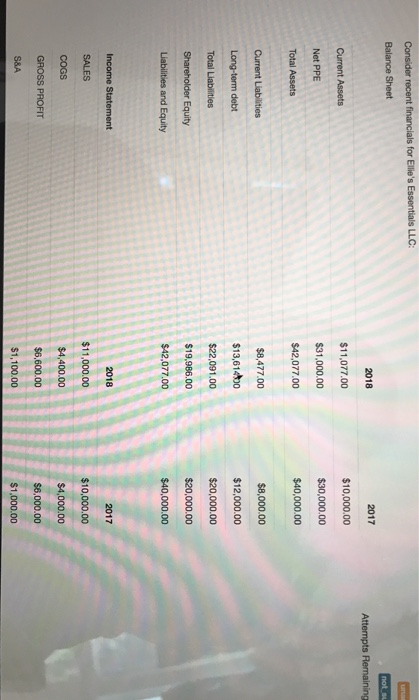

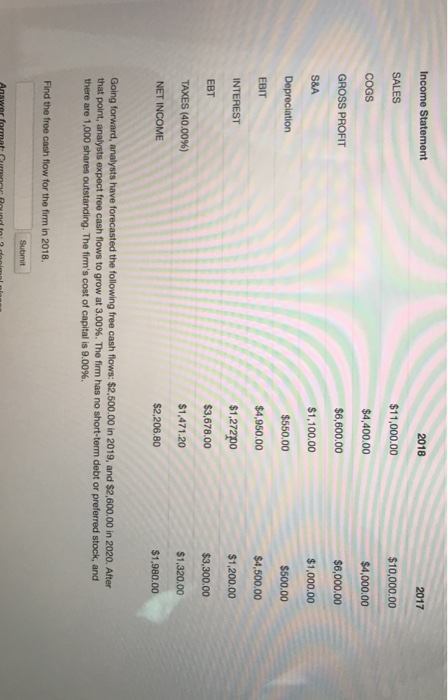

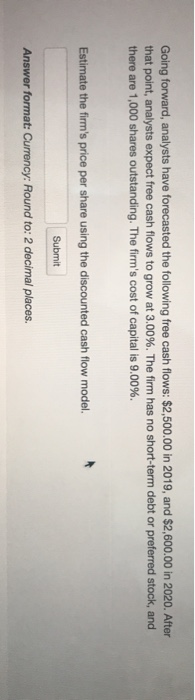

Consider recent financials for Ellie's Essentials LLC: Balance Sheet 2018 2017 not Attempts Remaining Current Assets $10,000.00 Net PPE $11,077.00 $31,000.00 $42,077.00 $30,000.00 Total Assets $40,000.00 Current Liabilities $8,477.00 $8,000.00 Long-term debt $13,61400 $12,000.00 Total Liabilities $22,091.00 $20,000.00 Shareholder Equity $19.986.00 $20,000.00 Liabilities and Equity $42,077.00 $40,000.00 Income Statement 2018 2017 SALES $10,000.00 $11,000.00 $4,400.00 COGS $4,000.00 GROSS PROFIT $6,600.00 $6,000.00 $1,000.00 S&A $1,100.00 Income Statement 2018 2017 SALES $11,000.00 $10,000.00 COGS $4,400.00 $4,000.00 GROSS PROFIT $6,600.00 $6,000.00 S&A $1,100.00 $1,000.00 Depreciation $550.00 $500.00 EBIT $4,950.00 $4,500.00 INTEREST $1,200.00 $1,272,00 $3,678.00 EBT $3,300.00 TAXES (40.00%) $1,471.20 $1,320.00 NET INCOME $2,206.80 $1.980.00 Going forward, analysts have forecasted the following free cash flows: $2,500.00 in 2019, and $2,600.00 in 2020. After that point, analysts expect free cash flows to grow at 3.00%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 9.00%. Find the free cash flow for the firm in 2018. Submit Answer format i Pino nimo Going forward, analysts have forecasted the following free cash flows: $2,500.00 in 2019, and $2,600.00 in 2020. After that point, analysts expect free cash flows to grow at 3.00%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 9.00%. Estimate the firm's price per share using the discounted cash flow model. Submit Answer format: Currency: Round to: 2 decimal places. Going forward, analysts have forecasted the following free cash flows: $2,500.00 in 2019, and $2,600.00 in 2020. After that point, analysts expect free cash flows to grow at 3.00%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 9.00%. You are trying to estimate the value of Doc McRuffins Incorporated. It is a rival firm to Ellie's Essentials, but not publicly traded. You do know that Doc McRuffins has an EBITDA of $4,750 for 2018. Using multiples, what is a rough estimate for the enterprise value of Doc McRuffins Submit Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts