Question: This question has 8 multiple choice questions. For each part, you are given five possible answers, labelled A, B, C, D, and E, only one

This question has 8 multiple choice questions. For each part, you are given five possible answers, labelled A, B, C, D, and E, only one of which is correct.

There is no penalty for selecting an incorrect answer. A correct answer gets one mark.

For each question, make your choice and then record it in the appropriate box at the end of the question.

| Qu. | A | B | C | D | E | |

| 13A | Which of these would NOT be used in a stress test for Basel capital adequacy? | A 3-year fall in world GDP of 20%. | A 30% reduction in house values | A rise in the UK unemployment rate from 4.1% to 8.9% | An increase in Eurozone inflation to 7.5%. | Heavy rain to cause 1/3 of Europes land to be under water. . |

| 13B | Which one of these is a possible reason for a bank to be removed from a stress testing review by the central bank? | The bank has been bought by a bank from another country | The bank has moved the location of its Head Office | The bank has stopped granting new credit | The bank is no longer a systemic bank | The bank reported a loss for the most recent financial year |

| 13C | According to the UK government guidelines, the assessment of affordability should be | Account-focussed | Borrower-focussed | Expenditure-focussed | Income-focussed | Lender-focussed |

| 13D | Regularisation is a process which | aims to have equal differences in wofe between attribute groupings | sets the cut-off to maximise profit | splits cases evenly across attribute groupings | spreads Bad cases across attribute groupings | tries to protect models from over-fitting |

| 13E | Hosmer-Lemeshow is used to assess if the | correlations among the characteristics are significant | estimates of PD are accurate | improvement in Gini is statistically significant | rating categories / buckets are appropriate | underlying economy has changed |

| 13F | See below. The total charge for D and E is | 10.6 | 12.2 | 16.7 | 17.8 | 28.4 |

| 13G | See below. The Log Odds to Score relationship that we might expect is | Cannot Tell | Line B | Line C | Line D | Line E |

| 13H | Reject Inference is a process where we | ask our applicants which bank rejected their applications before their current application | estimate how rejected applications would have performed if we had accepted them | estimate how the current applicants will perform if we reject them and they are then accepted by another lender | estimate which customers will reject our offer if we accept them but at a higher price | work out which rejected applications would also have been rejected by our competitors |

Ref: 13F

There are six aircraft using an airfield. The costs of building the runway lengths associated with each size of aircraft are 12, 20, 30, 30, 39, and 51, for aircraft A, B, C, D, E, and F, respectively. Calculate the Shapley Values which would correspond to a fair distribution of costs among the owners of the six aircrafts and then answer the question above.

Ref: 13G

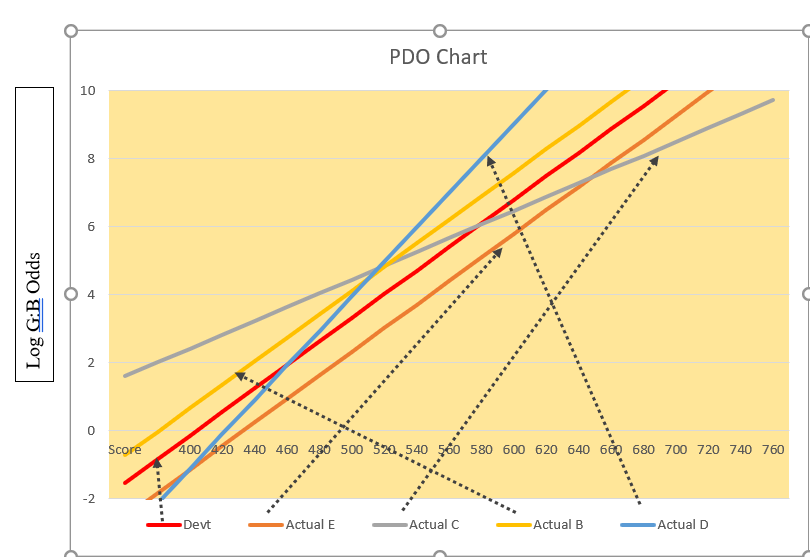

We built a scorecard using data from a period during which the economy was in a recession. WE are now monitoring the performance of this scorecard during a recent period in which the economy is doing much better. The scorecard continues to offer a high level of separation of Goods and Bads. The graph below shows the Log G:B odds for the development sample (Devt) and four possible relationships for actual performance.

-C PDO Chart 10 8 6 c Log G:B Odds N 0 Score 400 420 440 460 480 500 $20,540 560 580 600 620 640 680 680 700 720 740 760 -2 Devt Actual E -Actual C Actual B Actual D -C PDO Chart 10 8 6 c Log G:B Odds N 0 Score 400 420 440 460 480 500 $20,540 560 580 600 620 640 680 680 700 720 740 760 -2 Devt Actual E -Actual C Actual B Actual D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts