Question: This question has already been asked multiple times, but I keep seeing spot answers of either 2 or 4. Which one is the actual answer?

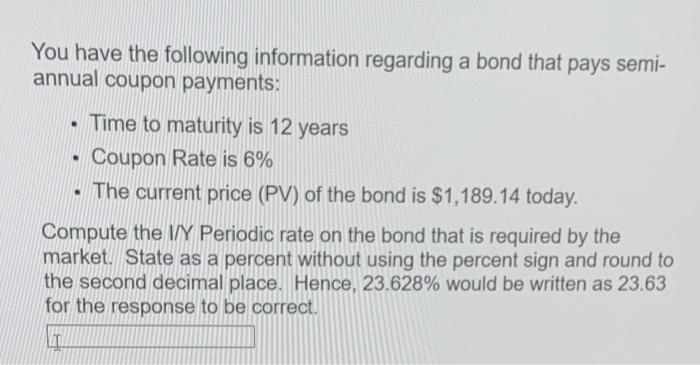

You have the following information regarding a bond that pays semiannual coupon payments: - Time to maturity is 12 years - Coupon Rate is 6% - The current price (PV) of the bond is $1,189.14 today. Compute the I/Y Periodic rate on the bond that is required by the market. State as a percent without using the percent sign and round to the second decimal place. Hence, 23.628% would be written as 23.63 for the response to be correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts