Question: This question has been deactivated. Please do not rely on the content/concept discussed in this question as it might be outdated or inaccurate. Due to

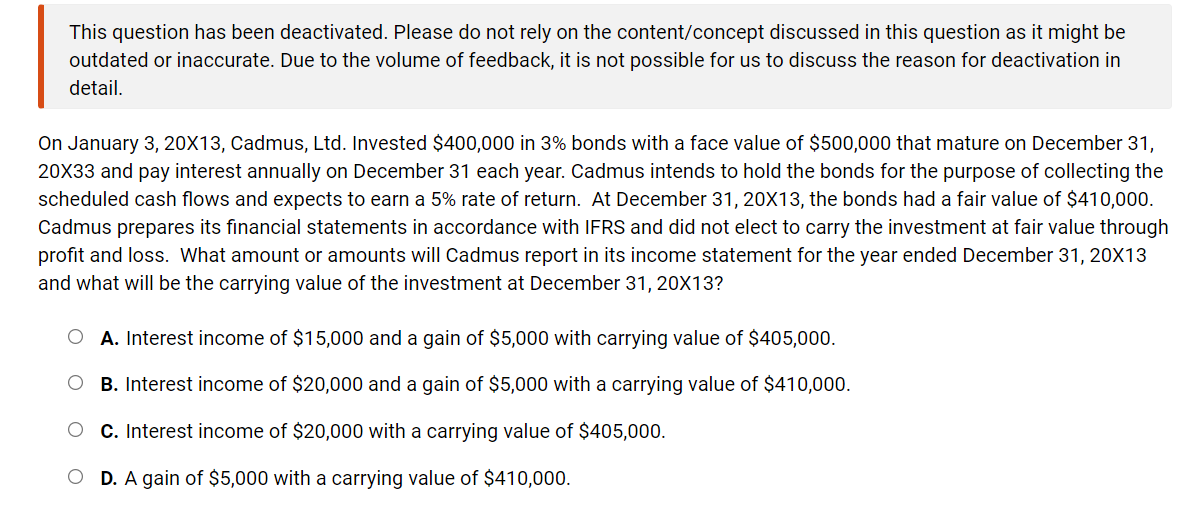

This question has been deactivated. Please do not rely on the content/concept discussed in this question as it might be outdated or inaccurate. Due to the volume of feedback, it is not possible for us to discuss the reason for deactivation in detail. On January 3, 20x13, Cadmus, Ltd. Invested $400,000 in 3% bonds with a face value of $500,000 that mature on December 31, 20x33 and pay interest annually on December 31 each year. Cadmus intends to hold the bonds for the purpose of collecting the scheduled cash flows and expects to earn a 5% rate of return. At December 31 , 20x1 3, the bonds had a fair value of $41 0,000. Cadmus prepares its nancial statements in accordance with IFRS and did not elect to carry the investment at fair value through prot and loss. What amount or amounts will Cadmus report in its income statement for the year ended December 31, 20x13 and what will be the carrying value of the investment at December 31, 20x13? 0 A. Interest income of $15,000 and a gain of $5,000 with carrying value of $405,000. 0 B. Interest income of $20,000 and a gain of $5,000 with a carrying value of $41 0,000. O C. Interest income of $20,000 with a carrying value of $405,000. 0 D. A gain of $5,000 with a carrying value of $410,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts