Question: This question has been posted before but only #1 was answered. Please provide answers for all 3 of the following questions. #1. Rank the following

This question has been posted before but only #1 was answered. Please provide answers for all 3 of the following questions.

#1. Rank the following single taxpayers in order of magnitude of taxable income (from lowest to highest) and explain your results.

#2. Consider the differences between the standard deduction vs. the itemized deduction given the filing status.

#3. Compare and contrast deductions for AGI and deductions from AGI (itemized deductions).

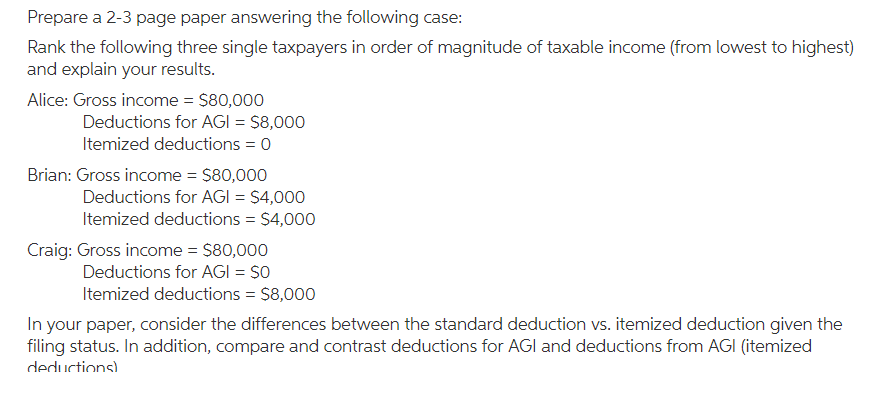

Prepare a 2-3 page paper answering the following case: Rank the following three single taxpayers in order of magnitude of taxable income (from lowest to highest) and explain your results. Alice: Gross income S80,000 Deductions for AG $8,000 Itemized deductions O Brian: Gross income-$80,000 Deductions for AGI-S4,000 Itemized deductions S4,000 Craig: Gross income $80,000 Deductions for AGI SO Itemized deductions-$8,000 In your paper, consider the differences between the standard deduction vs. itemized deduction given the filing status. In addition, compare and contrast deductions for AGI and deductions from AGI (itemized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts