Question: This question has multiple parts. A farmer sows a certain crop. It costs $200.000 to buy the seed, prepare the ground, and sow the crop.

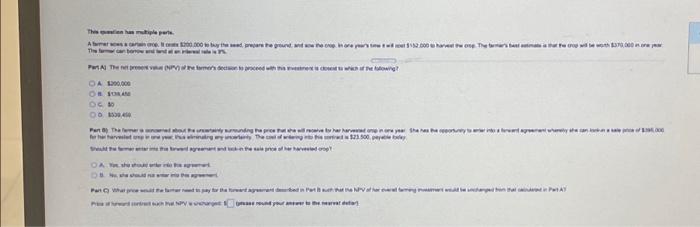

This question has multiple parts. A farmer sows a certain crop. It costs $200.000 to buy the seed, prepare the ground, and sow the crop. In one year's time it will cost $152.000 to harvest the crop. The farmer's best estimate is that the crop will be worth $370.000 in one year. The former can borrow and lend at an interest rate is 9%. Part A) The net present value (NPV) of the farmer's decision to proceed with this investment is closest to which of the following? OA $200,000 OB. $139,450 OC. SO OD. $539,450 Part B) The farmer is concerned about the uncertainty surrounding the price that she will receive for her harvested crop in one year. She has the opportunity to enter into a forward agreement whereby she can lock-in a sale price of $395,000 for her harvested crop in one year, thus eliminating any uncertainty. The cost of entering into this contract is $23.500 payable today. Should the farmer enter into this forward agreement and lock-in the sale price of her harvested crop? A Yos, she should unter into this agreemenl B. No, she should not enter into this agreement, Part C) What price would the farmer need to pay for the forward agreement described in Part B such that the NPV of her overall farming investment would be unchanged from that calculated in Part A? Price of forward contract such that NPV is unchanged: $ (please round your answer to the nearest dollar)

1200000 a. \\( 10 \\mathrm{are} \\) 5. 20 o. waselit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock