Question: THIS QUESTION HAS MULTIPLE PARTS. PLEASE SCROLL DOWN TO MAKE SURE YOU ADDRESS THE ENTIRE QUESTION. A commercial real estate developer is considering several options

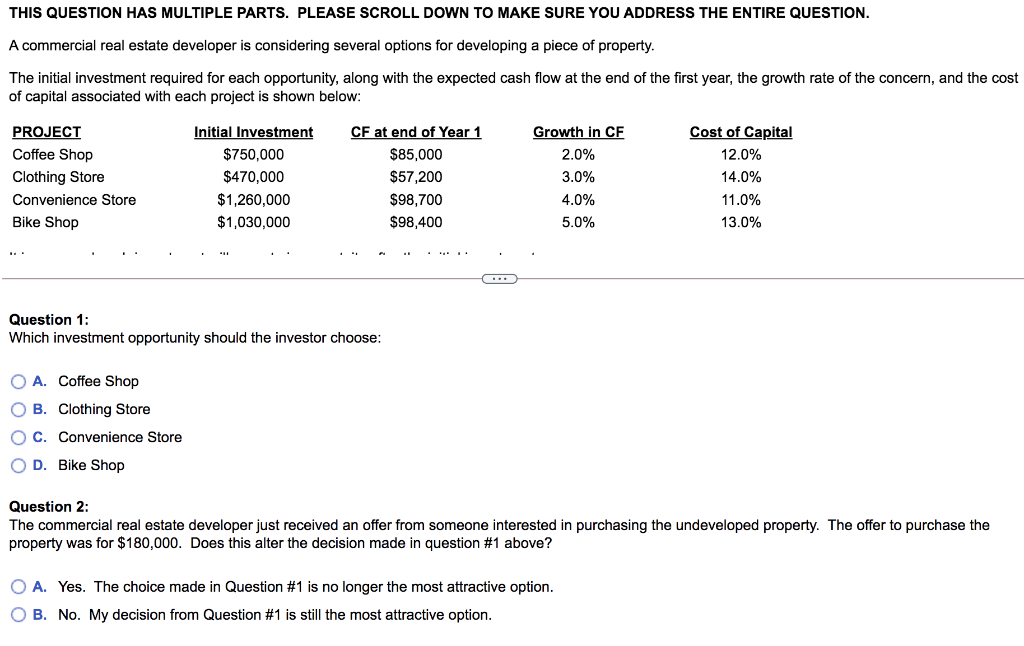

THIS QUESTION HAS MULTIPLE PARTS. PLEASE SCROLL DOWN TO MAKE SURE YOU ADDRESS THE ENTIRE QUESTION. A commercial real estate developer is considering several options for developing a piece of property. The initial investment required for each opportunity, along with the expected cash flow at the end of the first year, the growth rate of the concern, and the cost of capital associated with each project is shown below: PROJECT Coffee Shop Clothing Store Convenience Store Bike Shop Initial Investment $750,000 $470,000 $1,260,000 $1,030,000 CF at end of Year 1 $85,000 $57,200 $98,700 $98,400 Growth in CF 2.0% 3.0% 4.0% 5.0% Cost of Capital 12.0% 14.0% 11.0% 13.0% ... Question 1: Which investment opportunity should the investor choose: O A. Coffee Shop O B. Clothing Store OC. Convenience Store OD. Bike Shop Question 2: The commercial real estate developer just received an offer from someone interested in purchasing the undeveloped property. The offer to purchase the property was for $180,000. Does this alter the decision made in question #1 above? O A. Yes. The choice made in Question #1 is no longer the most attractive option. O B. No. My decision from Question #1 is still the most attractive option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts