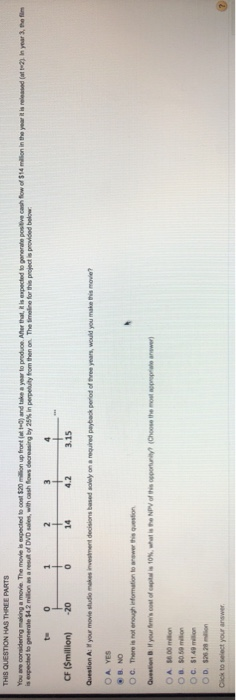

Question: THIS QUESTION HAS THREE PARTS You are considering making a movie. The movie is expected to cost $20 million up front is expected to generate

THIS QUESTION HAS THREE PARTS You are considering making a movie. The movie is expected to cost $20 million up front is expected to generate 54.2 million as a result of DVD s , with shows decreasing by20 and take a year to produce. After that is expected to generate positive cash flow of $14 m in perpetuty from then on the timeline for this project is provided below it is released in your 3. The film CF (Smillion) -20 3.15 Question A: your movie studime ve decisions based on a required payback period of twee years, would you make this OAFES NO OC. There is not enough information to newer this question Question: If your 's cost of capital is 10%what is the NPV of this party Choose the most propriate anwer OA 38 million OB. 80.5 million OC 5149 milion OD 52 Click to select your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts