Question: This question has two parts. A: B: Auerbach Inc, issued 6% bonds on October 1, 2018. The bonds have a maturity date of September 30,

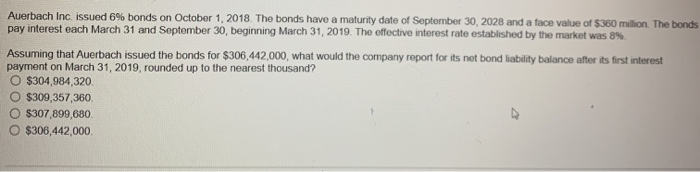

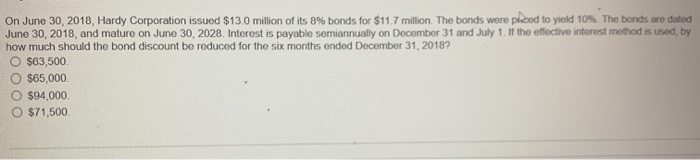

Auerbach Inc, issued 6% bonds on October 1, 2018. The bonds have a maturity date of September 30, 2028 and a face value of $360 million The bonds pay interest each March 31 and September 30, beginning March 31, 2019. The effective interest rate established by the market was Assuming that Auerbach issued the bonds for $306,442,000, what would the company report for its not bond liability balance after its first interest payment on March 31, 2019, rounded up to the nearest thousand? O $304,984,320 O $309,357,360 O $307,899,680 O $306,442,000 On June 30, 2018, Hardy Corporation issued $13.0 million of its 8% bonds for $11.7 million. The bonds were placed to yield 10%. The bonds are dated June 30, 2018, and mature on June 30, 2028. Interest is payable semiannually on December 31 and July 1. If the effective interest method is used by how much should the bond discount bo reduced for the six months ended December 31, 2018? O $63,500 O $65,000 O $94,000 O $71,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts