Question: This question has two parts: Problem 7.4 and 7.5. Thank you. Problem 7.4 Christoph Hoffeman trades currency for Kapinsk y Capital of Geneva. Christoph has

This question has two parts: Problem 7.4 and 7.5. Thank you.

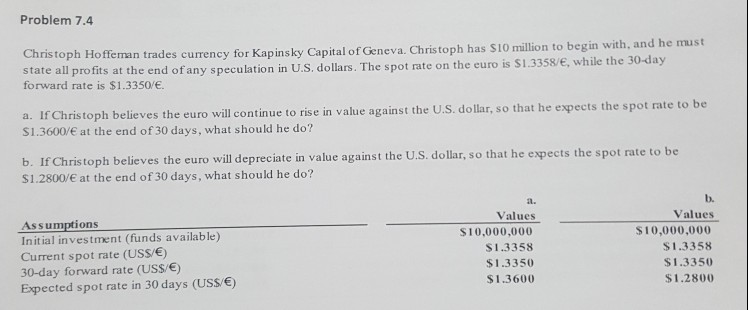

Problem 7.4 Christoph Hoffeman trades currency for Kapinsk y Capital of Geneva. Christoph has $10 million to begin with, and he must he euro is $1.3358/, while the 30-day state all profits at the end of any speculation in U.S. dollars. The spot rate on t forward rate is $1.3350VE n value against the U.S. dollar, so that he expects the spot rate to be a. If Christoph believes the euro will continue to rise i S1.3600/ at the end of 30 days, what should he do? will depreciate in value against the U.S. dollar, so that he expects the spot rate to be b. If Christoph believes the euro $1.2800/ at the end of 30 days, what should he do? Assumptions Init ial investment (funds available) Current spot rate (Uss/) 30-day forward rate (USS/E) Expected spot rate in 30 days (USS/) n. Values S10,000,000 $1.3358 $1.3350 $1.3600 b. Values $10,000,000 $1.3358 $1.3350 $1.2800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts