Question: This question involves both concepts and some simple calculations. The CAPM implies that the market portfolio is the optimal risky portfolio, and thus is the

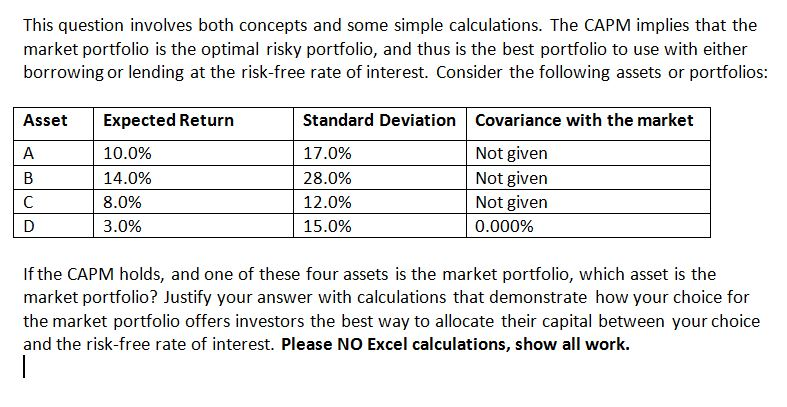

This question involves both concepts and some simple calculations. The CAPM implies that the market portfolio is the optimal risky portfolio, and thus is the best portfolio to use with either borrowing or lending at the risk-free rate of interest. Consider the following assets or portfolios Standard Deviation Covariance with the market 17.0% 28.0% 12.0% 15.0% Asset Expected Return 10.0% 14.0% 8.0% 3.0% Not given Not given Not given 0.000% If the CAPM holds, and one of these four assets is the market portfolio, which asset is the market portfolio? Justify your answer with calculations that demonstrate how your choice for the market portfolio offers investors the best way to allocate their capital between your choice and the risk-free rate of interest. Please NO Excel calculations, show all work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts