Question: This question is a 5part with two problems with both. Please help filling this out. Required information [The foilowfng Information applies to the questions displayed

This question is a 5part with two problems with both. Please help filling this out.

![displayed below] Megamart, a retailer ofconsumer goods, provides the followmg information on](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/6736d6b3b89d8_1556736d6b3a44a8.jpg)

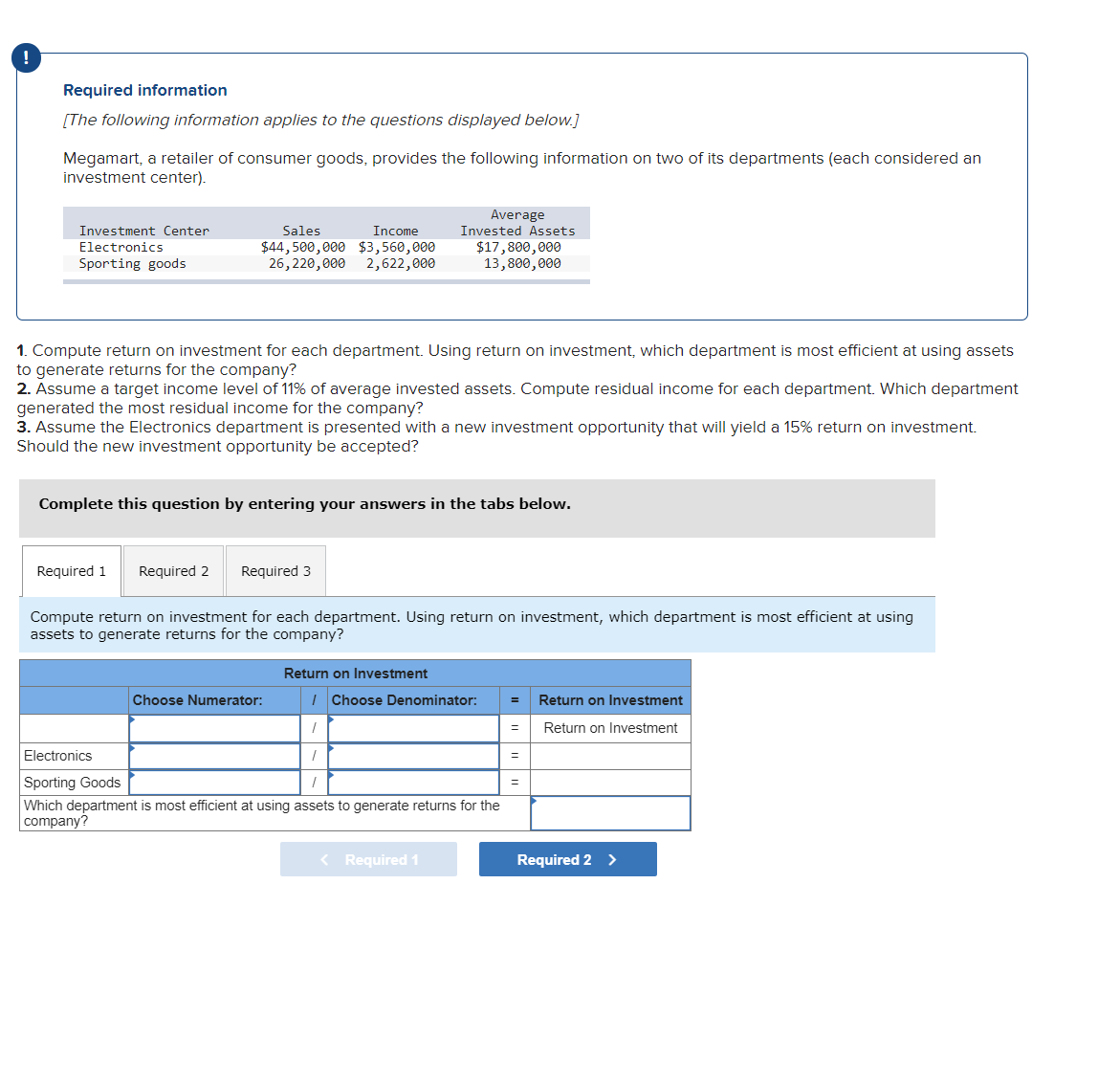

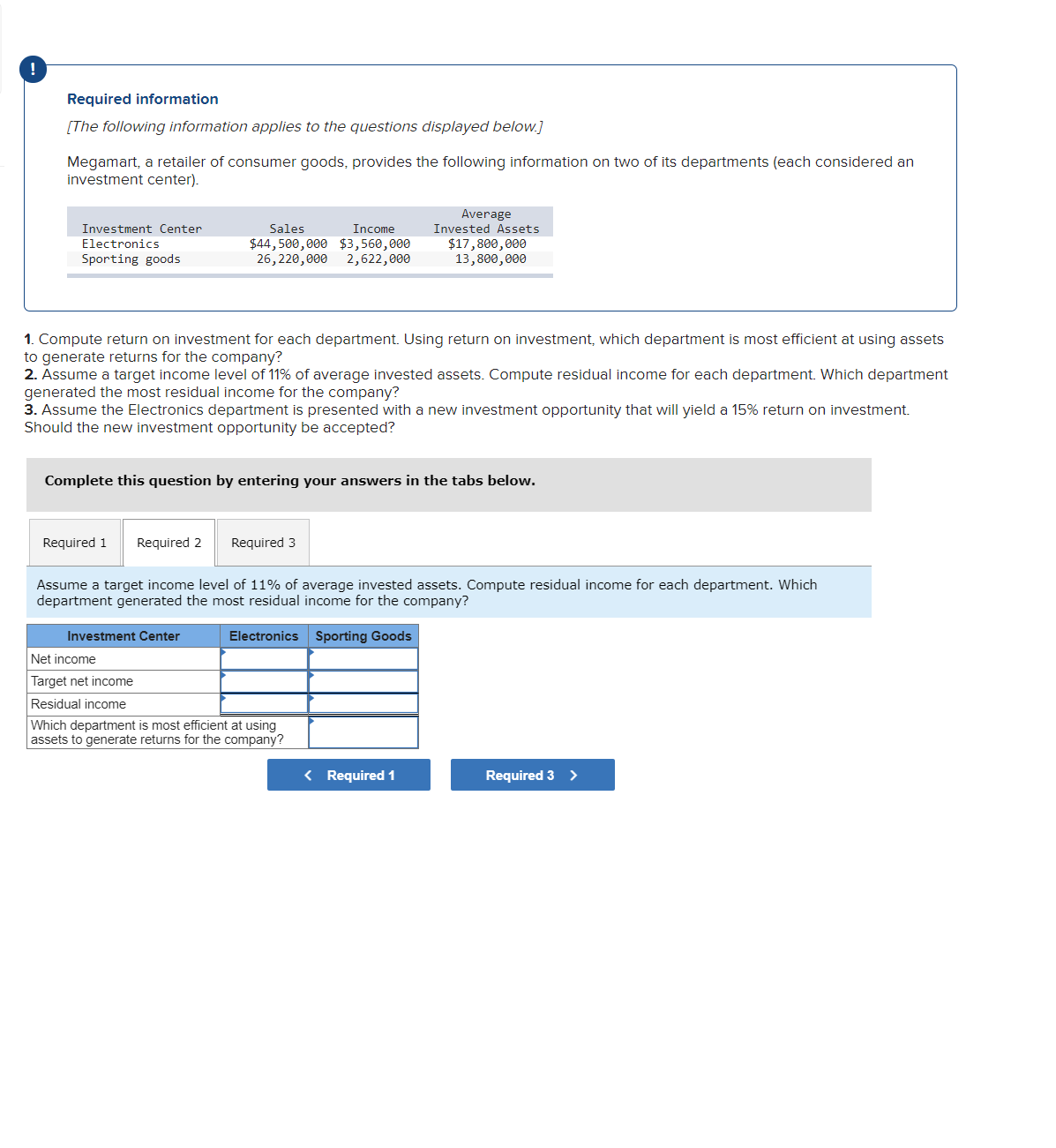

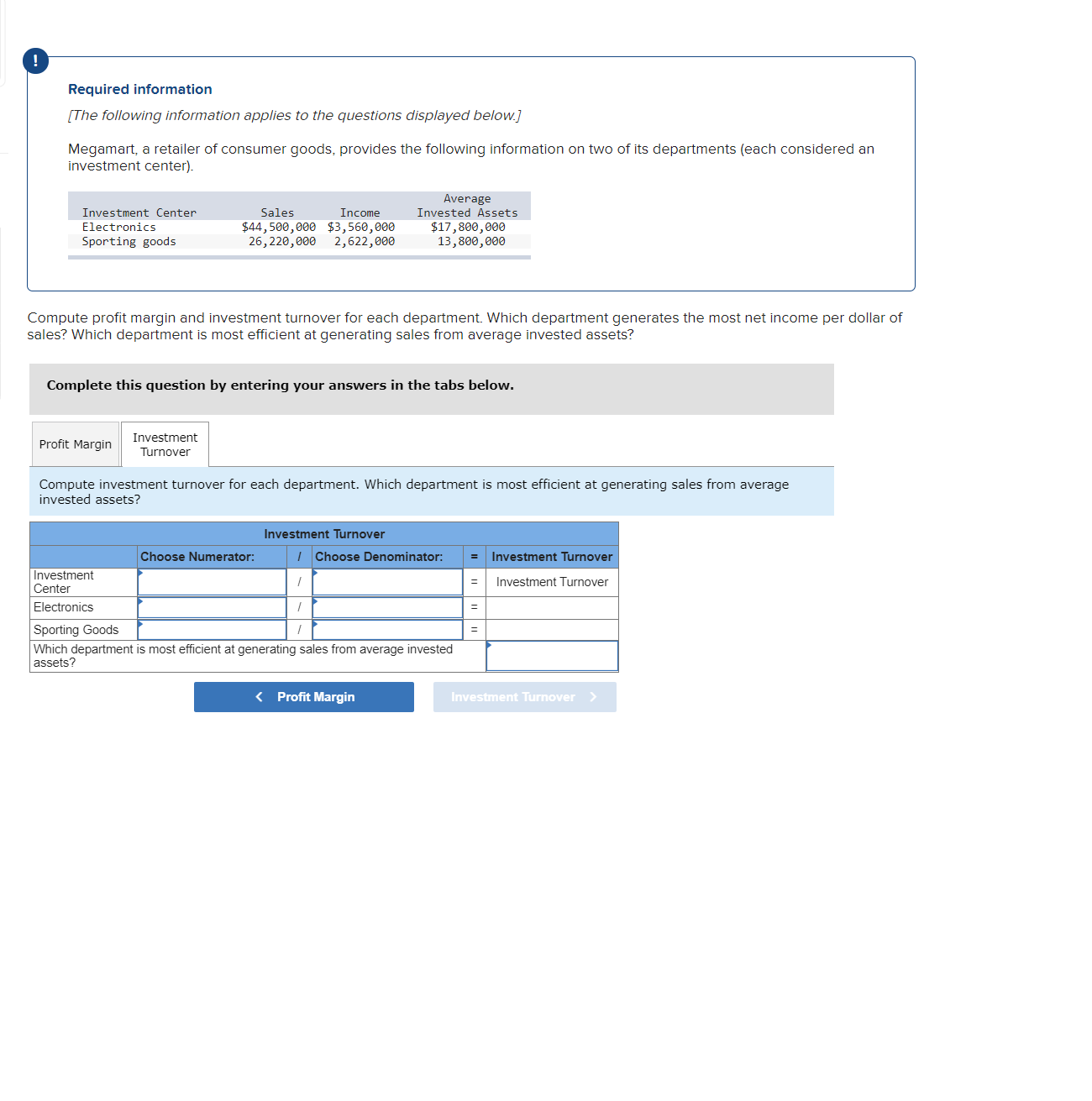

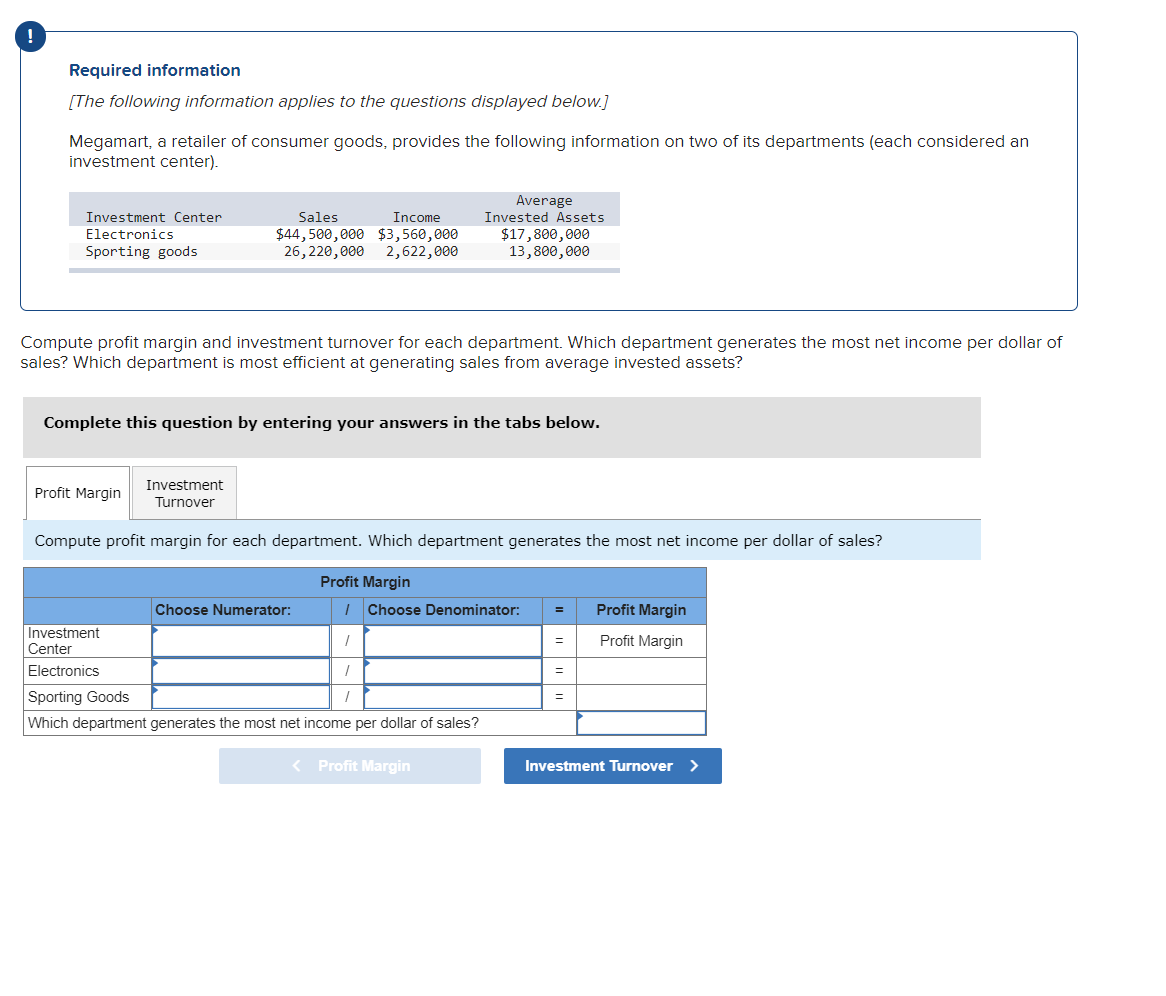

Required information [The foilowfng Information applies to the questions displayed below] Megamart, a retailer ofconsumer goods, provides the followmg information on two of its departments (each considered an Investment center), Average Investment Center- Sales Incone Invested Assets Electronics $44,533,333 $3,563,333 $17,333,333 Sporting goods 25,223,333 2,622,333 13,833,333 1, Compute return on investment for each department Using return on investment, which department is most eicient at using assets to generate returns for the company? 2. Assume a target income level ofi1% of average invested assets, Compute residual income for each department, Which department generated the most residual income for the company? 3. Assume the Electronics department is presented with a new investment opportunity that will yield a1596 return on investment, Should the new investment opportunity he accepted? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute return on invrem'nent for each department. Using return on investment, which department is most efcient at using assets to genemte returns for the company? Return an Investment Which department is most efcient at using assets to generate returns for the company? Required 2 > Required infurmet'ion [T he following Information applies to the questrorrs displayed below] Megamar't, a retailer ofconsumer goods, provides the following information on two of its departments (each considered an investment center). Average Investment Center Sales Incone Invested Assets Electronics $44,566,666 $3,556,666 $17,866,666 Sporting gonds 26,229,966 2,622,999 13,866,666 1, Compute return on investment for each department, Using return on investment which department is most efficient at usmg assets to generate returns for the company? 2. Assume a target income level of'l1% of average invested assets. Compute residual income for each department. Which depaitmeht generated the most residual income for the company? 3. Assume the Electronics department is presented with a new Investment opportunity that Will yield a15% return on investment. Should the new investment opportunity be accepted? Complete lis qu$tiun by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume a target income level of 11% of average invested asets. Compute residual income for ead1 department. which department generated the must r$idua| income for the company? Net incume Target net income Re5idual income mnslef enlatusing e mmpany? Required information [The following information applies to the questions displayed below] Megamart, a retailer ofconsumer goods, provides the following Information on two of its departments (each considered an investment center). Average Investment Center- Sales In

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts