Question: This question is a Five part Question! please answer fully. The General Journal Requires 12 sections. Required information Problem 11-4A (Algo) Estimating warranty expense and

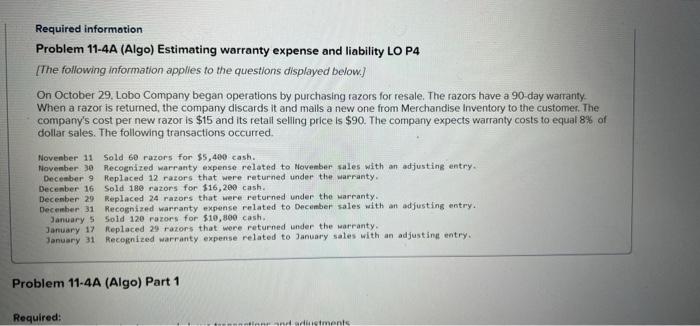

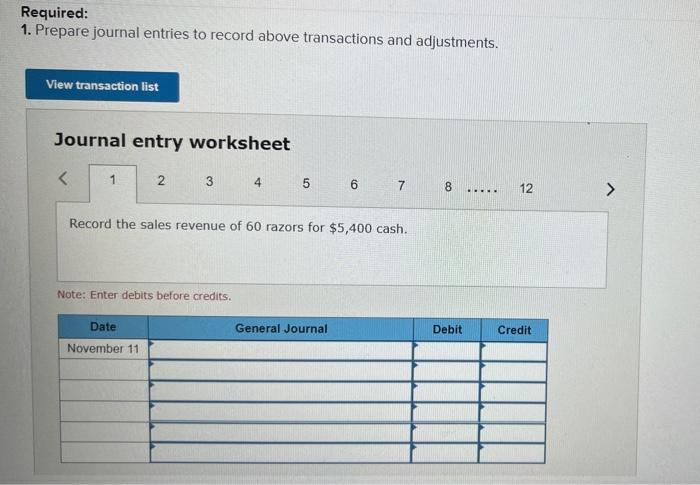

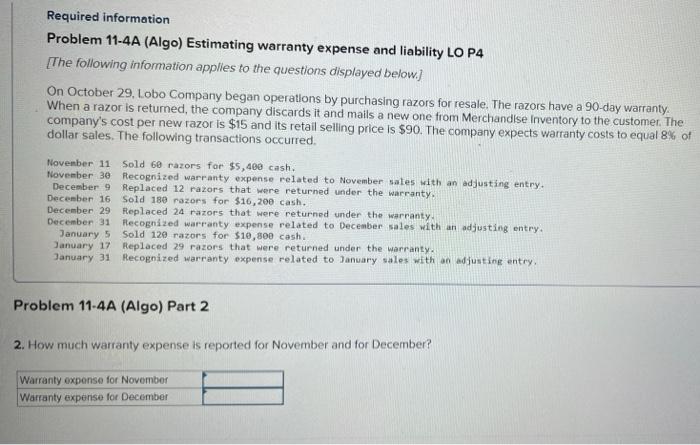

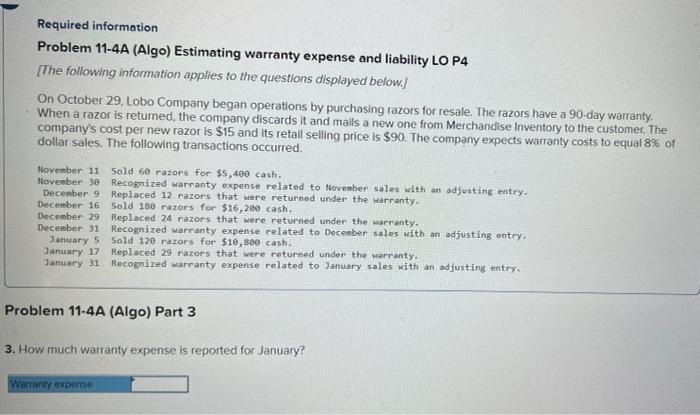

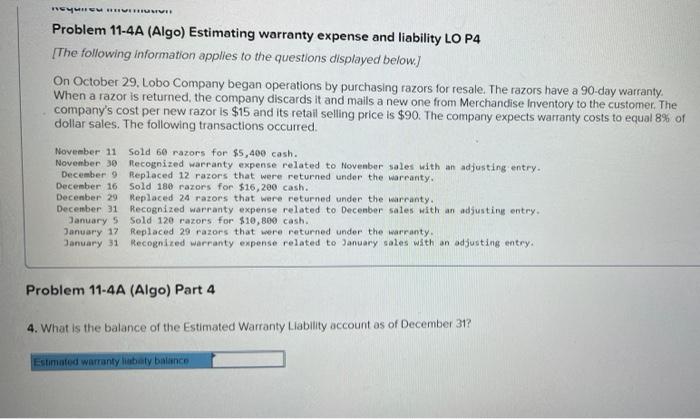

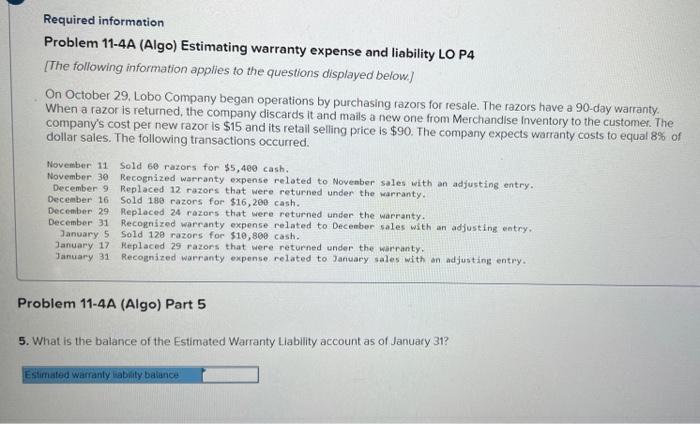

Required information Problem 11-4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below) On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 day warranty When a razor is returned, the company discards it and malls a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. Novenber 11 Sold 60 razors for $5,400 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 12 razors that were returned under the warranty. December 16 Sold 180 razors for $16,200 cash. December 29 Replaced 24 razors that were returned under the warranty. December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 Soid 120 rarors for $10,800 cash. January 17 Replaced 29 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Problem 11-4A (Algo) Part 1 Required: ustments Required: 1. Prepare journal entries to record above transactions and adjustments. View transaction list Journal entry worksheet Record the sales revenue of 60 razors for $5,400 cash. Note: Enter debits before credits Date General Journal Debit Credit November 11 Required information Problem 11-4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below.) On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail seling price is $90. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. November 11 Sold 60 razors for $5,400 cash. November 30 Recognized warranty expense related to November sates with an adjusting entry. December 9 Replaced 12 razors that were returned under the warranty. December 16 Sold 180 razors for $16,200 cash. December 29 Replaced 24 razors that were returned under the warranty: December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 Sold 120 razors for $10,800 cash January 17 Replaced 29 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Problem 11-4A (Algo) Part 2 2. How much warranty expense is reported for November and for December? Warranty exponse for November Warranty expense for December Required information Problem 11-4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below.) On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned the company discards it and malls a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. November 11 Sold 60 razors for $5,400 cash, November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 12 razors that were returned under the warranty. December 16 Sold 180 razors for $16,200 cash. December 29 Replaced 24 razors that were returned under the warranty. December 31 Recognized warranty expense rel to December sales with an adjusting entry. January 5 Sold 120 razors for $10,800 cash. January 17 Replaced 29 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Problem 11-4A (Algo) Part 3 3. How much warranty expense is reported for January? Warranty expense "MUHVERV Problem 11-4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below.) On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. November 11 Sold 60 razors for $5,400 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 12 razors that were returned under the warranty. December 16 Sold 180 razors for $16,200 cash. December 29 Replaced 24 razors that were returned under the warranty. December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 Sold 120 razors for $10,800 cash. January 17 Replaced 29 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Problem 11-4A (Algo) Part 4 4. What is the balance of the Estimated Warranty Liability account as of December 312 Estimated warranty labely balance Required information Problem 11-4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below.) On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. November 11 Sold 60 razors for $5,400 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 12 razors that were returned under the warranty. December 16 Sold 180 razors for $16,200 cash. December 29 Replaced 24 razors that were returned under the warranty. December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 Sold 120 razors for $10,800 cash. January 17 Replaced 29 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Problem 11-4A (Algo) Part 5 5. What is the balance of the Estimated Warranty Liability account as of January 31? Estimated warranty liably balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts