Question: This question is a slight variation of the above problem. It's the same set-up as before, but now we have an intermediary who charges a

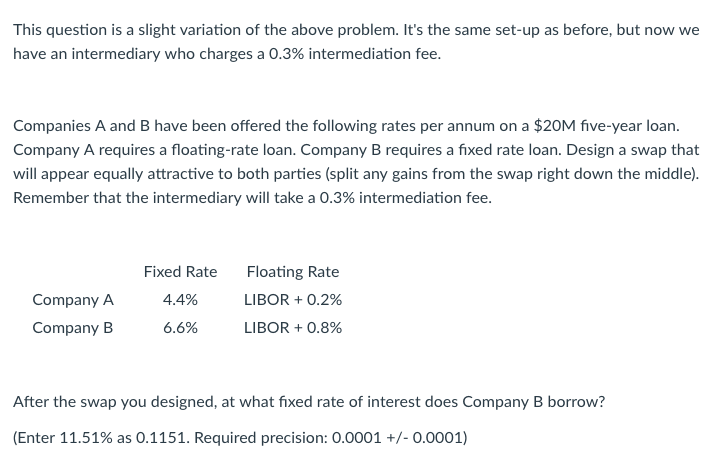

This question is a slight variation of the above problem. It's the same set-up as before, but now we have an intermediary who charges a 0.3% intermediation fee. Companies A and B have been offered the following rates per annum on a $20M five-year loan. Company A requires a floating-rate loan. Company B requires a fixed rate loan. Design a swap that will appear equally attractive to both parties (split any gains from the swap right down the middle). Remember that the intermediary will take a 0.3% intermediation fee. Company A Company B Fixed Rate 4.4% 6.6% Floating Rate LIBOR +0.2% LIBOR +0.8% rs y o (Enter 11.51% as 0.1151. Required precision: 0.0001 +/-0.0001)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts