Question: This question is a tax problem question taken from Introduction to Federal Income Taxation in Canada. can you please help me solve showing steps to

This question is a tax problem question taken from Introduction to Federal Income Taxation in Canada. can you please help me solve showing steps to the solution. thanks in advance.

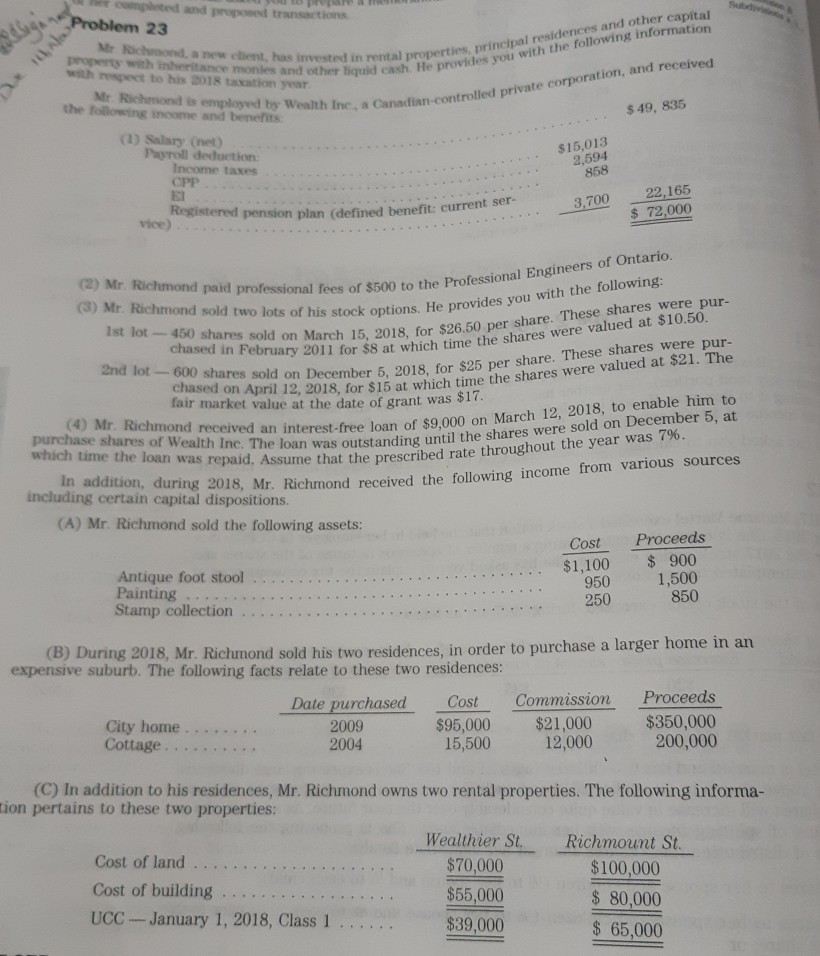

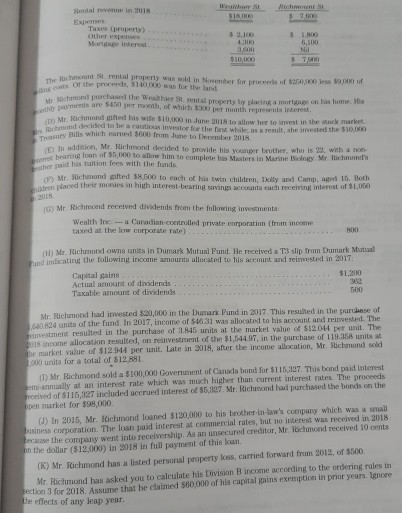

aret quid casdoperties, principal residences and other capital Wwalth Ine, a Canadian-controlled prvate 23 Mr Richmond, a new cient, has invested in rental Pr property with inheritance monles and other eash provides with respect to his 2018 taxation year the leslowting tno b n-controlled private corporation, and recei and benefits $49, 835 (1) Salary (net) $15,013 2,594 858 Payroll deduction Income taxes CPP El 700 22,165 $ 72,000 3, pension plan (defined benefit: current ser (2) Mr. Richmond paid professional fees of $500 to the Pro (3) Mr.Richmond sold two lots of his stock options. He prov lst lot- 450 shares sold on for $2 chased in Frch 15, 2018, for $26.50 per share. These shares were pur chased on cember 5, 2018, for $25 per share. These shares were pur- of Weath inteest-free loan of $9,000 on March 12, 2018, to enable him to during 2018, Mr. Richmond received the following income from various sources sold two lots 2011 for $8 at which time the shares were valued at $10.50 12, 2018, for $15 at which time the shares were valued at $21. The an was outstanding until the shares were sold on December 5, at 2nd lot-600 shares sold on fair market valu e at the date of grant was $1 (4) Mr. Richmond received an which time the loan was repaid. Assum e that the prescribed rate throughout the year was 7%. In addition, (A) Mr. Richmond sold the following assets: Cost Proceeds Antique foot stool Painting Stamp collection. $1,100 $900 950 1,500 850 .. 250 (B) During 2018, Mr. Rich umond sold his two residences, in order to purchase a larger home in an expensi ve suburb. The following facts relate to these two residences: Date purchased Cost Commission Proce $95,000 $21,000 12,000 eds $350,000 200,000 City home . 2009 2004 15,500 (C) In addition to his residences, Mr. Richmond owns two rental properties. The following informa- tion pertains to these two properties: Wealthier St Richmount St. Cost of land... Cost of building UCC-January 1, 2018, Class 1 $70,000 $55,000 $39,000 $100,000 $80,000 65,000 aret quid casdoperties, principal residences and other capital Wwalth Ine, a Canadian-controlled prvate 23 Mr Richmond, a new cient, has invested in rental Pr property with inheritance monles and other eash provides with respect to his 2018 taxation year the leslowting tno b n-controlled private corporation, and recei and benefits $49, 835 (1) Salary (net) $15,013 2,594 858 Payroll deduction Income taxes CPP El 700 22,165 $ 72,000 3, pension plan (defined benefit: current ser (2) Mr. Richmond paid professional fees of $500 to the Pro (3) Mr.Richmond sold two lots of his stock options. He prov lst lot- 450 shares sold on for $2 chased in Frch 15, 2018, for $26.50 per share. These shares were pur chased on cember 5, 2018, for $25 per share. These shares were pur- of Weath inteest-free loan of $9,000 on March 12, 2018, to enable him to during 2018, Mr. Richmond received the following income from various sources sold two lots 2011 for $8 at which time the shares were valued at $10.50 12, 2018, for $15 at which time the shares were valued at $21. The an was outstanding until the shares were sold on December 5, at 2nd lot-600 shares sold on fair market valu e at the date of grant was $1 (4) Mr. Richmond received an which time the loan was repaid. Assum e that the prescribed rate throughout the year was 7%. In addition, (A) Mr. Richmond sold the following assets: Cost Proceeds Antique foot stool Painting Stamp collection. $1,100 $900 950 1,500 850 .. 250 (B) During 2018, Mr. Rich umond sold his two residences, in order to purchase a larger home in an expensi ve suburb. The following facts relate to these two residences: Date purchased Cost Commission Proce $95,000 $21,000 12,000 eds $350,000 200,000 City home . 2009 2004 15,500 (C) In addition to his residences, Mr. Richmond owns two rental properties. The following informa- tion pertains to these two properties: Wealthier St Richmount St. Cost of land... Cost of building UCC-January 1, 2018, Class 1 $70,000 $55,000 $39,000 $100,000 $80,000 65,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts