Question: This question is about calculating an Annualized Return, which is different than calculating Return on 'Investment (ROI), but we need the ROI to solve this

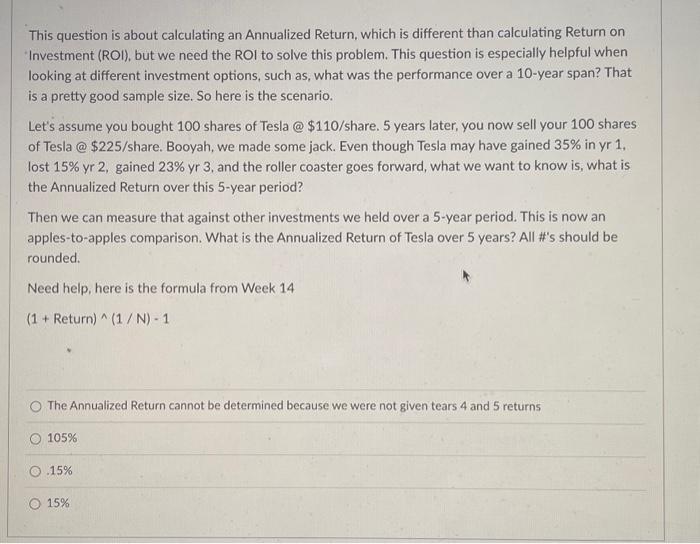

This question is about calculating an Annualized Return, which is different than calculating Return on 'Investment (ROI), but we need the ROI to solve this problem. This question is especially helpful when looking at different investment options, such as, what was the performance over a 10-year span? That is a pretty good sample size. So here is the scenario. Let's assume you bought 100 shares of Tesla @ \$110/share. 5 years later, you now sell your 100 shares of Tesla @ $225/ share. Booyah, we made some jack. Even though Tesla may have gained 35% in yr 1 . lost 15% yr 2 , gained 23% yr 3 , and the roller coaster goes forward, what we want to know is, what is the Annualized Return over this 5-year period? Then we can measure that against other investments we held over a 5-year period. This is now an apples-to-apples comparison. What is the Annualized Return of Tesla over 5 years? All \#'s should be rounded. Need help, here is the formula from Week 14 (1+Return)(1/N)1 The Annualized Return cannot be determined because we were not given tears 4 and 5 returns 105% .15% 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts