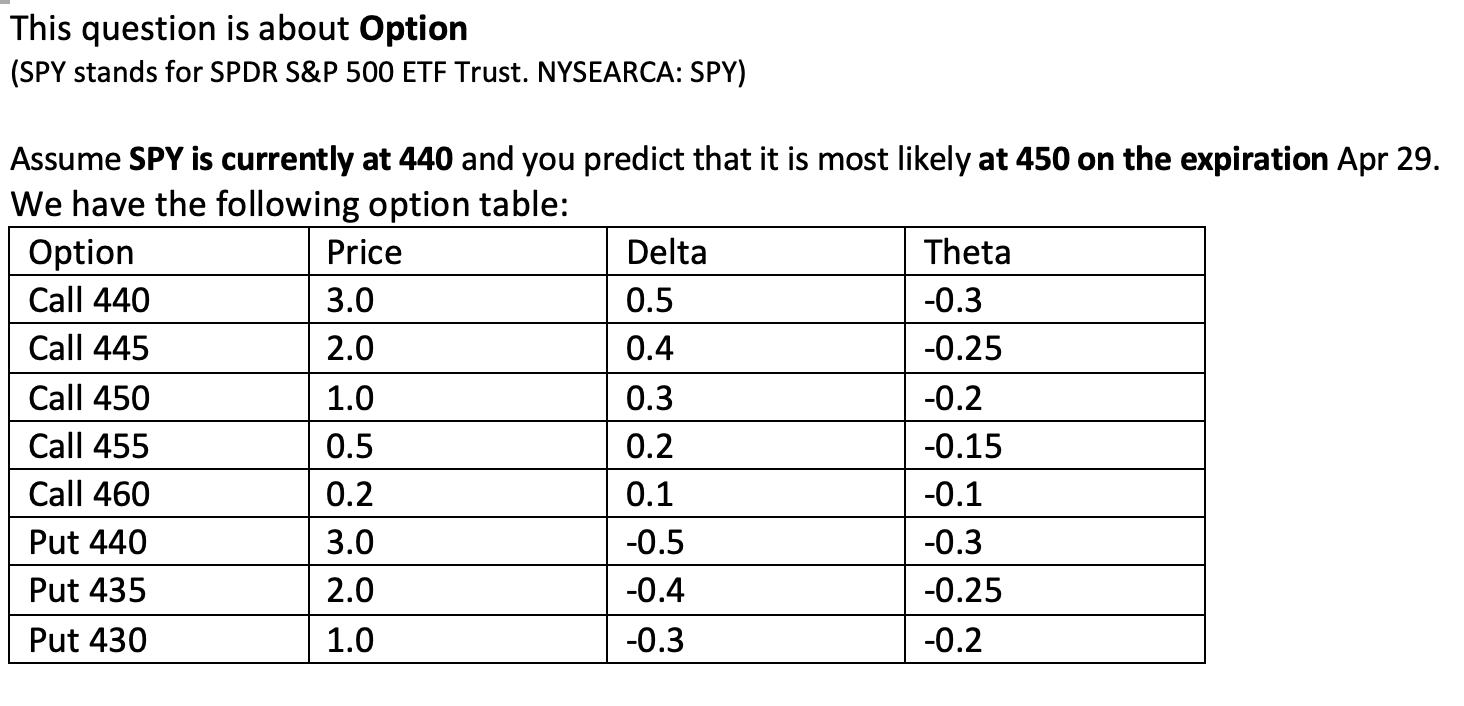

Question: This question is about Option (SPY stands for SPDR S&P 500 ETF Trust. NYSEARCA: SPY) Assume SPY is currently at 440 and you predict that

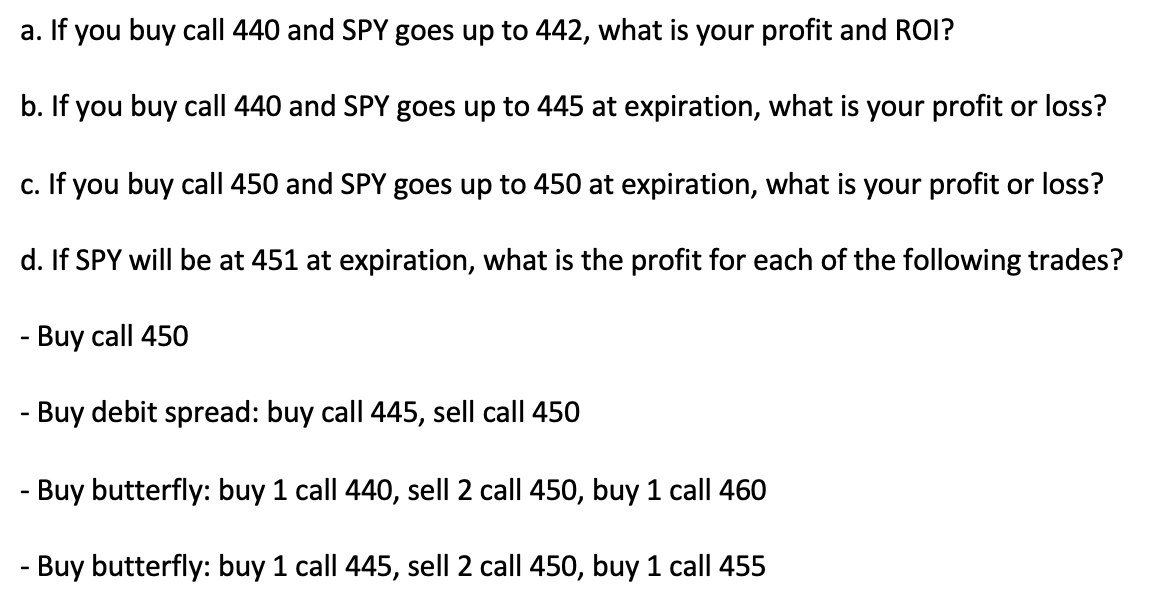

This question is about Option (SPY stands for SPDR S&P 500 ETF Trust. NYSEARCA: SPY) Assume SPY is currently at 440 and you predict that it is most likely at 450 on the expiration Apr 29. We have the following option table: Option Price Delta Theta Call 440 3.0 0.5 -0.3 Call 445 2.0 0.4 -0.25 Call 450 1.0 0.3 -0.2 Call 455 0.5 0.2 -0.15 Call 460 0.2 0.1 -0.1 Put 440 3.0 -0.5 -0.3 Put 435 2.0 -0.4 -0.25 Put 430 1.0 -0.3 -0.2 a. If you buy call 440 and SPY goes up to 442, what is your profit and ROI? b. If you buy call 440 and SPY goes up to 445 at expiration, what is your profit or loss? c. If you buy call 450 and SPY goes up to 450 at expiration, what is your profit or loss? d. If SPY will be at 451 at expiration, what is the profit for each of the following trades? - Buy call 450 - Buy debit spread: buy call 445, sell call 450 - Buy butterfly: buy 1 call 440, sell 2 call 450, buy 1 call 460 - Buy butterfly: buy 1 call 445, sell 2 call 450, buy 1 call 455

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts