Question: This question is about risk management. I don't know how to deal with the question (c). Is it objective or subjective to answer the

This question is about risk management. I don't know how to deal with the question (c). Is it objective or subjective to answer the " how do you interpret this result"? (Objective means answering this question depends on whether you are a risk taking person or not) Can I use E(x) to compare them and choose the larger one? And there is another question not related to this exercise but I'm confused about it. The question is: if a person's ulitily function's first derivative is positive and the second derivative is negative, can I say he is risk averse, which means he will choose to avoid risk instead of taking it? Thanks!

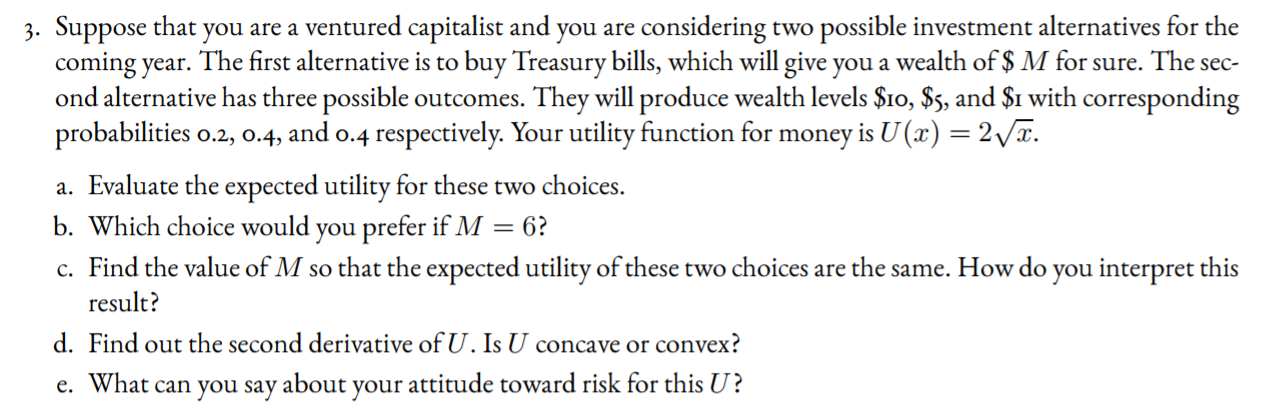

3. Suppose that you are a ventured capitalist and you are considering two possible investment alternatives for the coming year. The rst alternative is to buy Treasury bills, which will give you a wealth of $ M for sure. The sec- ond alternative has three possible outcomes. They will produce wealth levels $10, $5, and $1 with corresponding probabilities 0.2., 0.4, and 0.4 respectively. Your utility Function for money is U (3:) = 2J5. a. Evaluate the expected utility for these two choices. b. Which choice would you prefer if M = 6? c. Find the value of M so that the expected utility of these two choices are the same. How do you interpret this result? d. Find out the second derivative of U. Is U concave or convex? e. What can you say about your attitude toward risk for this U

3. Suppose that you are a ventured capitalist and you are considering two possible investment alternatives for the coming year. The rst alternative is to buy Treasury bills, which will give you a wealth of $ M for sure. The sec- ond alternative has three possible outcomes. They will produce wealth levels $10, $5, and $1 with corresponding probabilities 0.2., 0.4, and 0.4 respectively. Your utility Function for money is U (3:) = 2J5. a. Evaluate the expected utility for these two choices. b. Which choice would you prefer if M = 6? c. Find the value of M so that the expected utility of these two choices are the same. How do you interpret this result? d. Find out the second derivative of U. Is U concave or convex? e. What can you say about your attitude toward risk for this U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts