Question: This question is all the same. There are section link togethers. Please answer all.I need this please. Required information [The following information applies to the

This question is all the same. There are section link togethers. Please answer all.I need this please.

![the questions displayed below.] Raner, Harris and Chan is a consulting firm](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67165f3d926e8_42167165f3d32210.jpg)

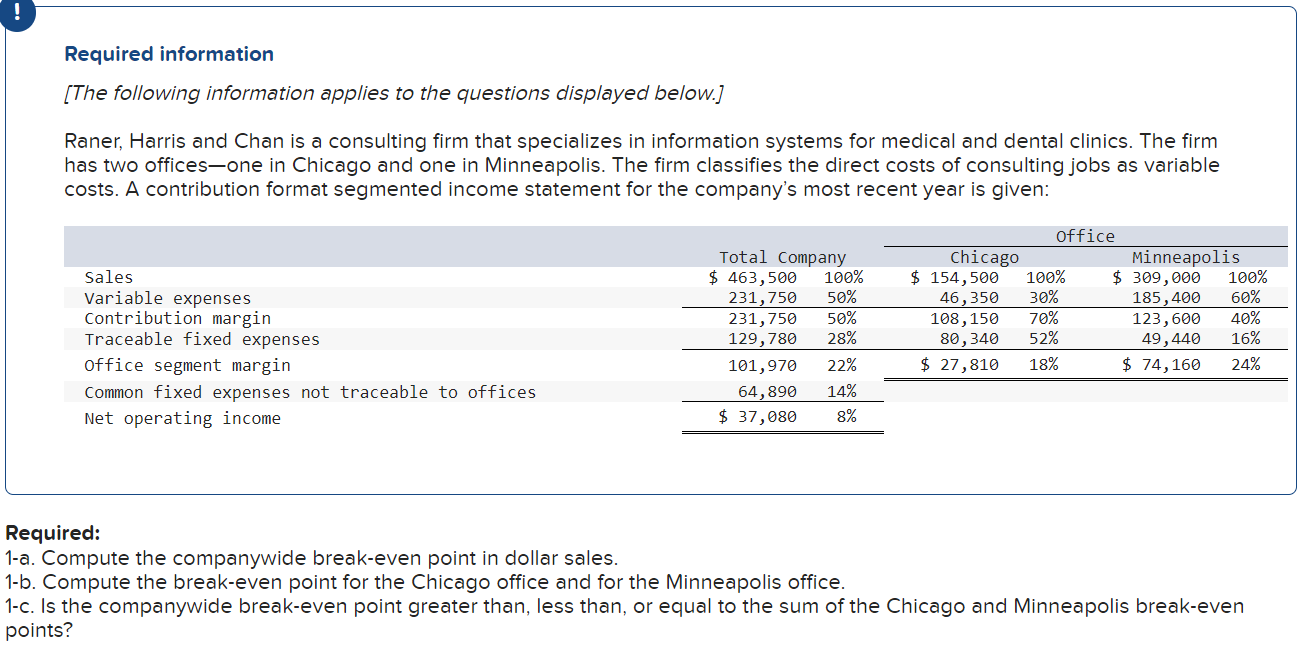

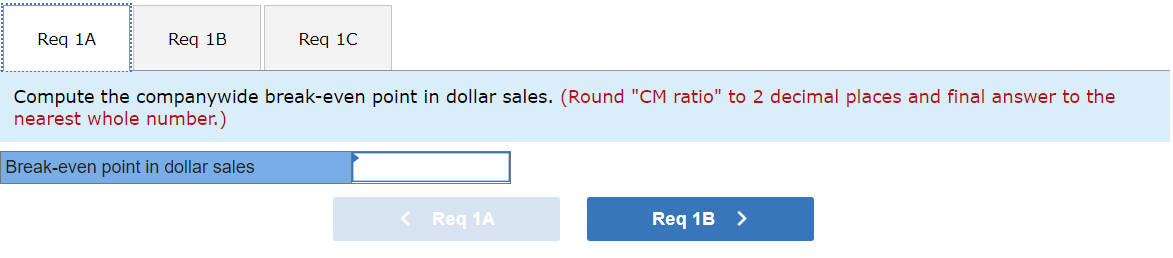

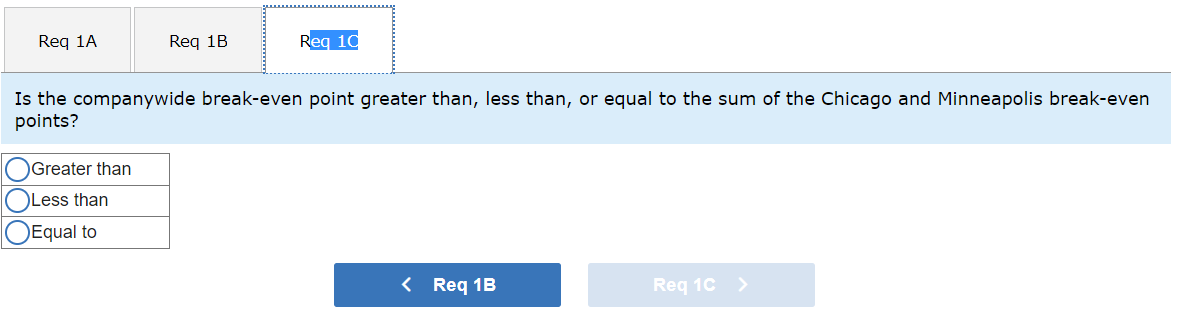

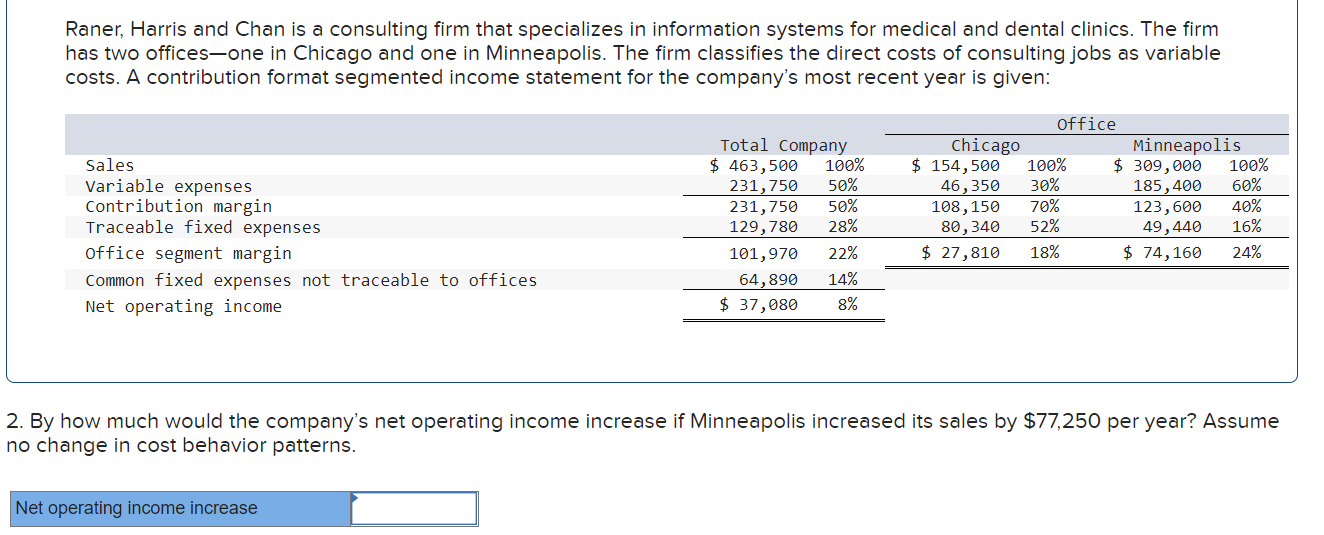

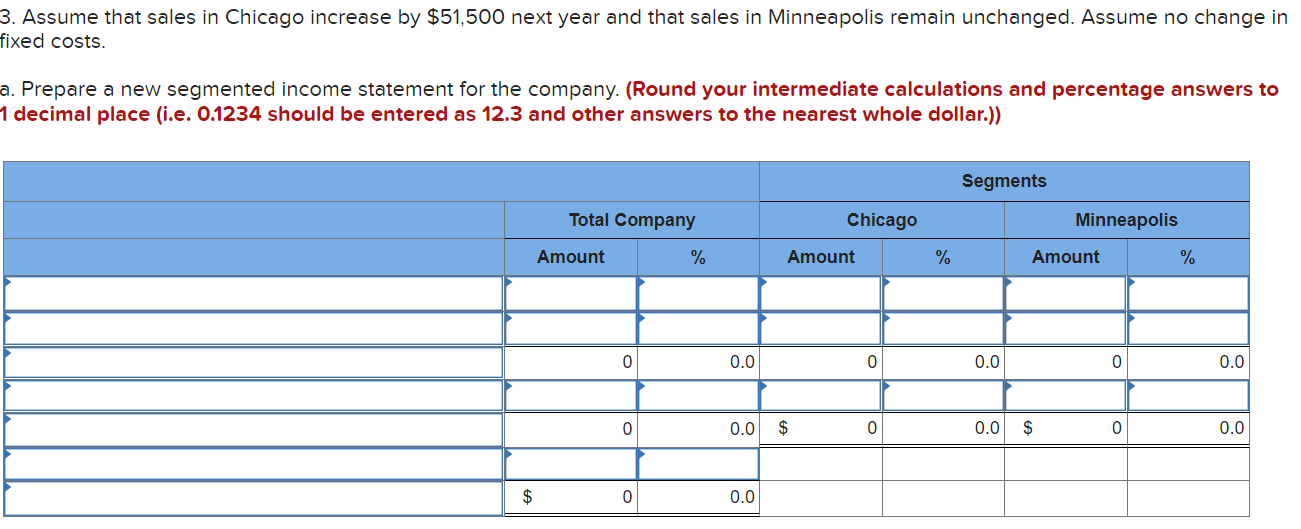

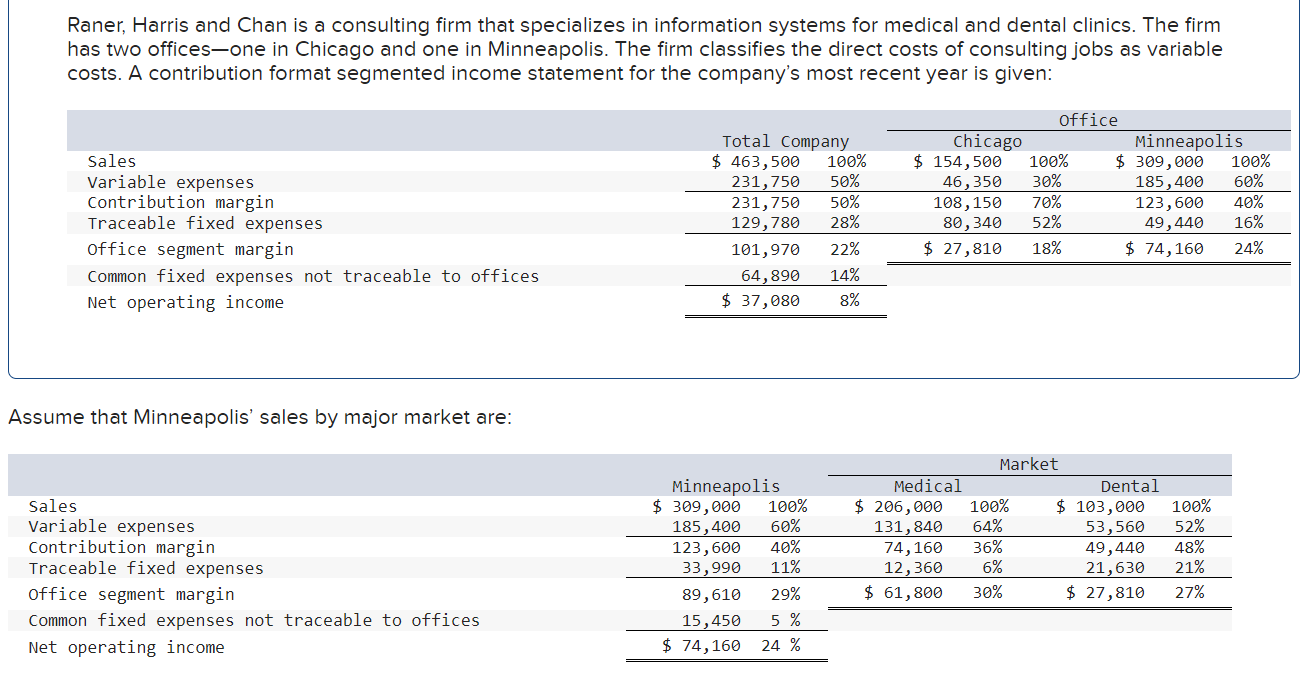

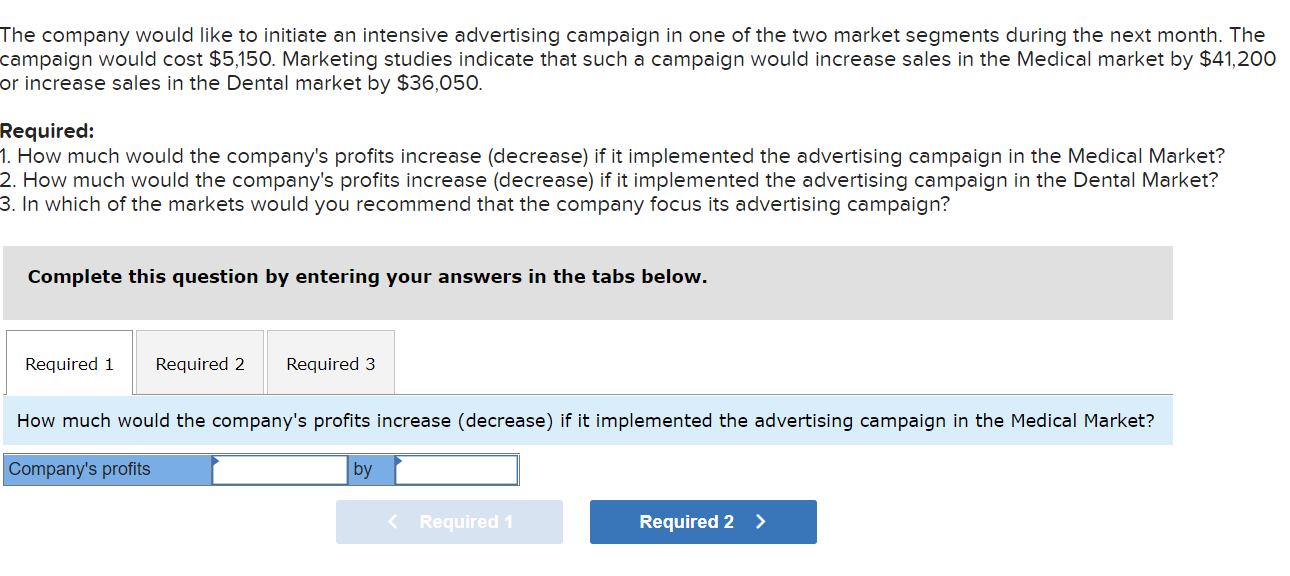

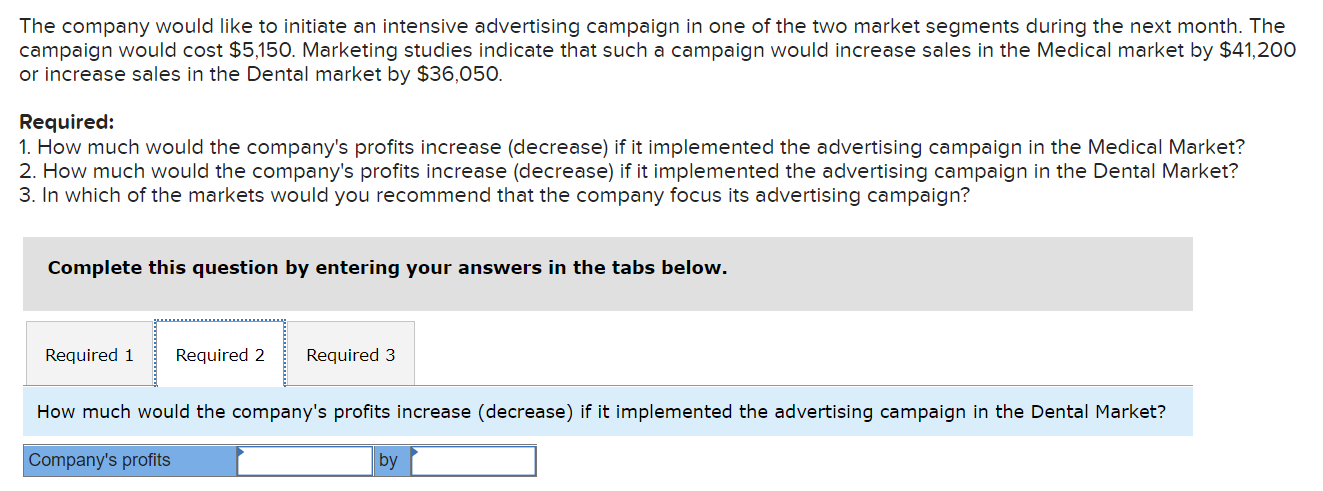

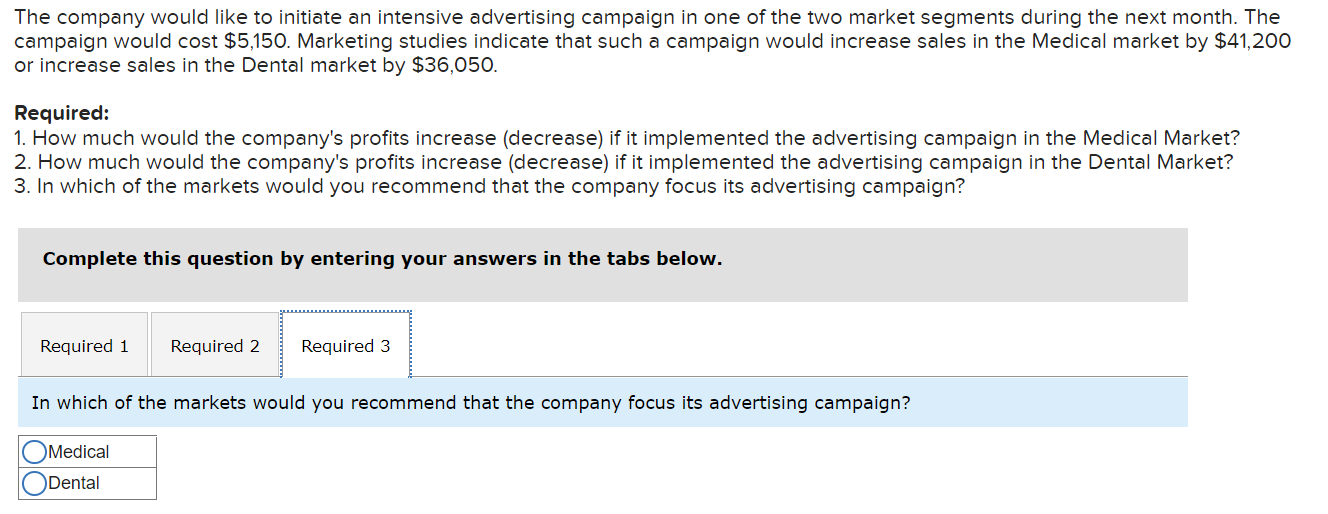

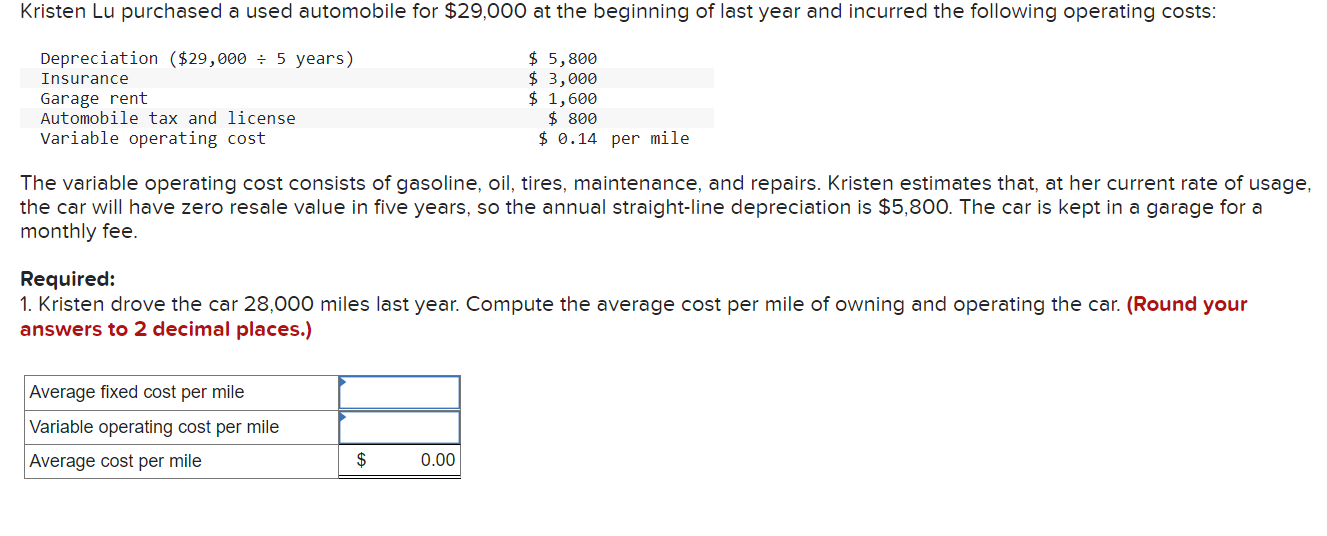

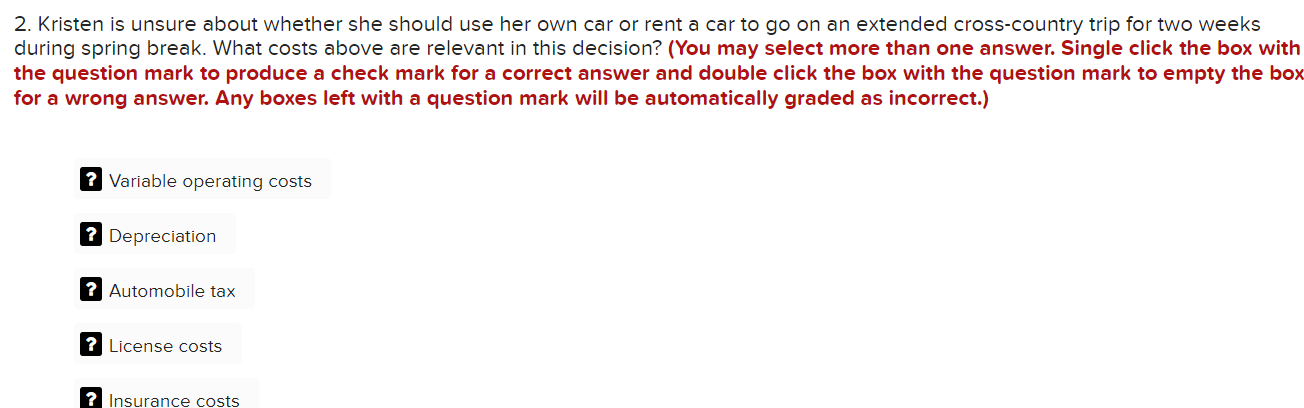

Required information [The following information applies to the questions displayed below.] Raner, Harris and Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: 50% Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not traceable to offices Net operating income Total Company $ 463,500 100% 231,750 231,750 50% 129,780 28% 101,970 22% 64,890 14% $ 37,080 8% office Chicago Minneapolis $ 154,500 100% $ 309,000 100% 46,350 30% 185,400 60% 108,150 70% 123,600 40% 80, 340 52% 49,440 16% $ 27,810 18% $ 74,160 24% Required: 1-a. Compute the companywide break-even point in dollar sales. 1-b. Compute the break-even point for the Chicago office and for the Minneapolis office. 1-c. Is the companywide break-even point greater than, less than, or equal to the sum of the Chicago and Minneapolis break-even points? Req 1A Reg 1B Req 10 Compute the companywide break-even point in dollar sales. (Round "CM ratio" to 2 decimal places and final answer to the nearest whole number.) Break-even point in dollar sales Req 1A Req 1B Req 1C Compute the break-even point for the Chicago office and for the Minneapolis office. (Round "CM ratio" to 2 decimal places and final answer to the nearest whole number.) Break-even Point Chicago office Minneapolis office Req 1A Req 1B Regid Is the companywide break-even point greater than, less than, or equal to the sum of the Chicago and Minneapolis break-even points? Greater than OLess than OEqual to The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,150. Marketing studies indicate that such a campaign would increase sales in the Medical market by $41,200 or increase sales in the Dental market by $36,050. Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? Company's profits by The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,150. Marketing studies indicate that such a campaign would increase sales in the Medical market by $41,200 or increase sales in the Dental market by $36,050. Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 In which of the markets would you recommend that the company focus its advertising campaign? Medical Dental Kristen Lu purchased a used automobile for $29,000 at the beginning of last year and incurred the following operating costs: Depreciation ($29,000 = 5 years) Insurance Garage rent Automobile tax and license Variable operating cost $ 5,800 $ 3,000 $ 1,600 $ 800 $ 0.14 per mile The variable operating cost consists of gasoline, oil, tires, maintenance, and repairs. Kristen estimates that, at her current rate of usage, the car will have zero resale value in five years, so the annual straight-line depreciation is $5,800. The car is kept in a garage for a monthly fee. Required: 1. Kristen drove the car 28,000 miles last year. Compute the average cost per mile of owning and operating the car. (Round your answers to 2 decimal places.) Average fixed cost per mile Variable operating cost per mile Average cost per mile $ 0.00 2. Kristen is unsure about whether she should use her own car or rent a car to go on an extended cross-country trip for two weeks during spring break. What costs above are relevant in this decision? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) ? Variable operating costs ? Depreciation ? Automobile tax ? License costs ? Insurance costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts