Question: This question is based off real economic data from General Electric. https://fred.stlouisfed.org/categories/116 Estimate the short run growth rate and the long run grow rate for

- Estimate the short run growth rate and the long run grow rate for the firm using historical dividend information, ROE and dividend payout ratio (Provide details on your calculation. Common practice is to estimate industry growth; for multi period DDM, you have to estimate the short run growth for the future five years and the long run growth from year 6 to infinity). Discuss the difference between the estimated short run growth rate and long run growth rate.

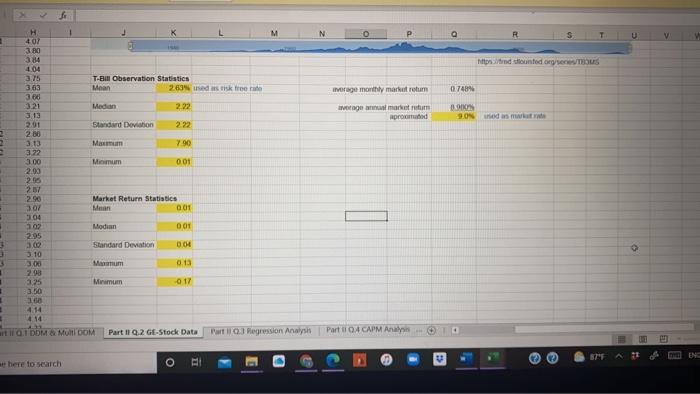

1 U sirdiounted on see Mean 07484 T-Bill Observation Statistics 263 used as risk fremte Median 2.22 407 3 384 404 15 363 3.00 3.21 313 2.00 2.36 3.13 322 3.00 2.00 2.05 237 2.90 go monthly market return e marrum proced 30 90 od sm Standard Deviction 2 222 7.90 Mom Minimum 001 Market Return Statistics 001 Mean Modian 001 Standard Devation 004 304 202 2.95 300 3.10 3.00 2.90 3.25 3.50 100 Mum 0.13 Mumum 017 3 . 4.14 art if a DDM Multi DOMA Part II 2 GE-Stock Data Part 1 O. Regression Analysis Part 4 CAPM Anal ATA ENG here to search 1 U sirdiounted on see Mean 07484 T-Bill Observation Statistics 263 used as risk fremte Median 2.22 407 3 384 404 15 363 3.00 3.21 313 2.00 2.36 3.13 322 3.00 2.00 2.05 237 2.90 go monthly market return e marrum proced 30 90 od sm Standard Deviction 2 222 7.90 Mom Minimum 001 Market Return Statistics 001 Mean Modian 001 Standard Devation 004 304 202 2.95 300 3.10 3.00 2.90 3.25 3.50 100 Mum 0.13 Mumum 017 3 . 4.14 art if a DDM Multi DOMA Part II 2 GE-Stock Data Part 1 O. Regression Analysis Part 4 CAPM Anal ATA ENG here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts